Overnight

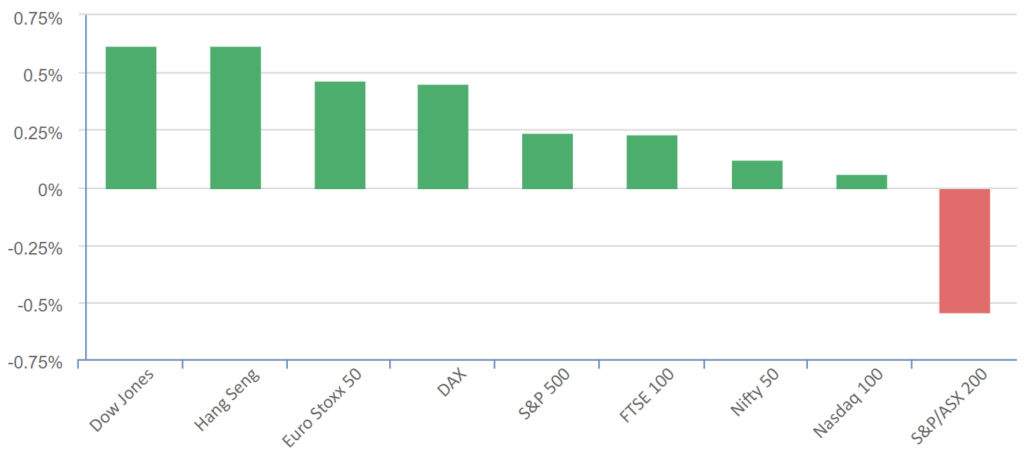

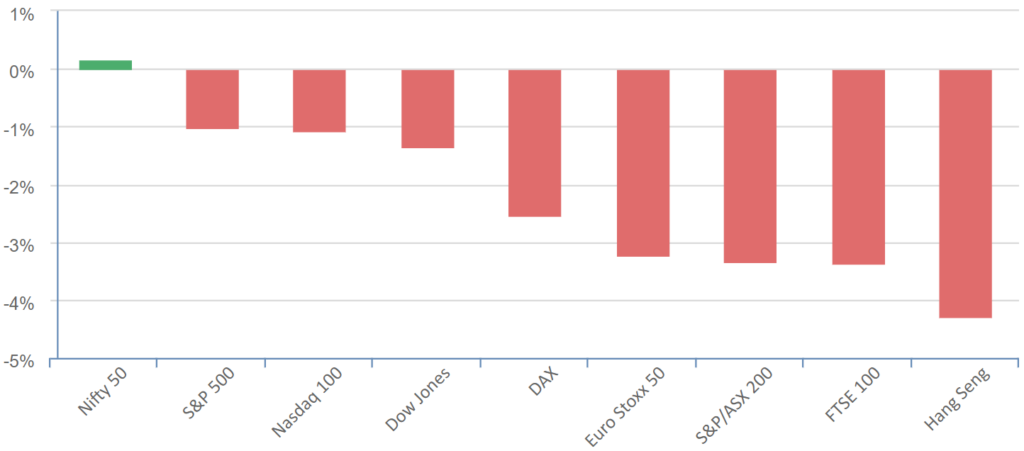

Market Summary

Equities rebounded on Monday, recovering from a slump last week as investors prepared for vital economic data expected later this week. The data, anticipated to indicate an inflation slowdown, will be released ahead of the Federal Reserve’s monetary policy meeting later this month.

Key points:

- Inflation in June is expected to slow down, but the Federal Reserve is likely to increase rates.

- The Consumer Price Index (CPI) and Producer Price Index (PPI) figures, expected on Wednesday and Thursday respectively, are likely to show that monthly price pressures increased in June but slowed on an annualized basis.

- Despite signs of inflation slowdown, the Federal Reserve is still expected to resume rate hikes later this month, as inflation continues to exceed its 2% target.

- Core CPI is expected to show a slowdown.

- About 92% of traders expect the Federal Reserve to increase rates later this month.

Tech stocks saw some fluctuation. Google experienced a dip of over 2%, and Microsoft saw a 1.6% drop. On a brighter note, Meta finished the day with a 1% gain. This was bolstered by its Threads app, a Twitter competitor, which has already exceeded 100 million sign-ups in just five days following its launch.

Moving forward, investor attention will be divided between the upcoming earnings season and the Federal Reserve’s implied further hikes due to inflation. This is likely to result in a mixed bag for the week.

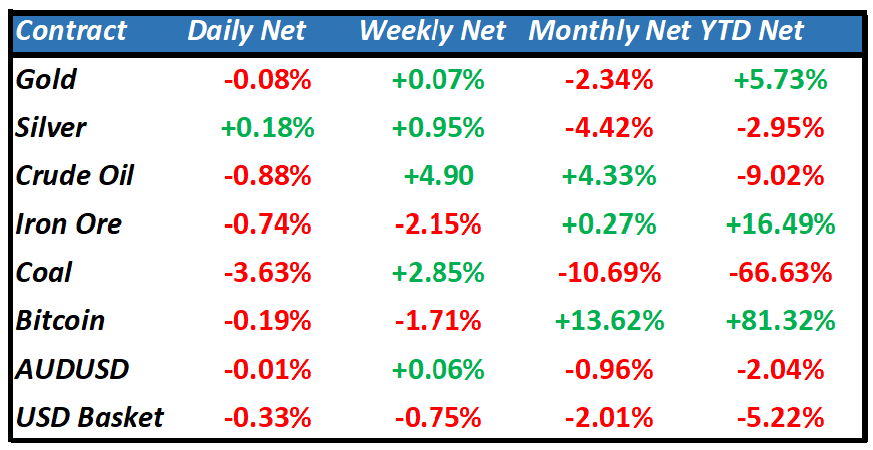

Commodities

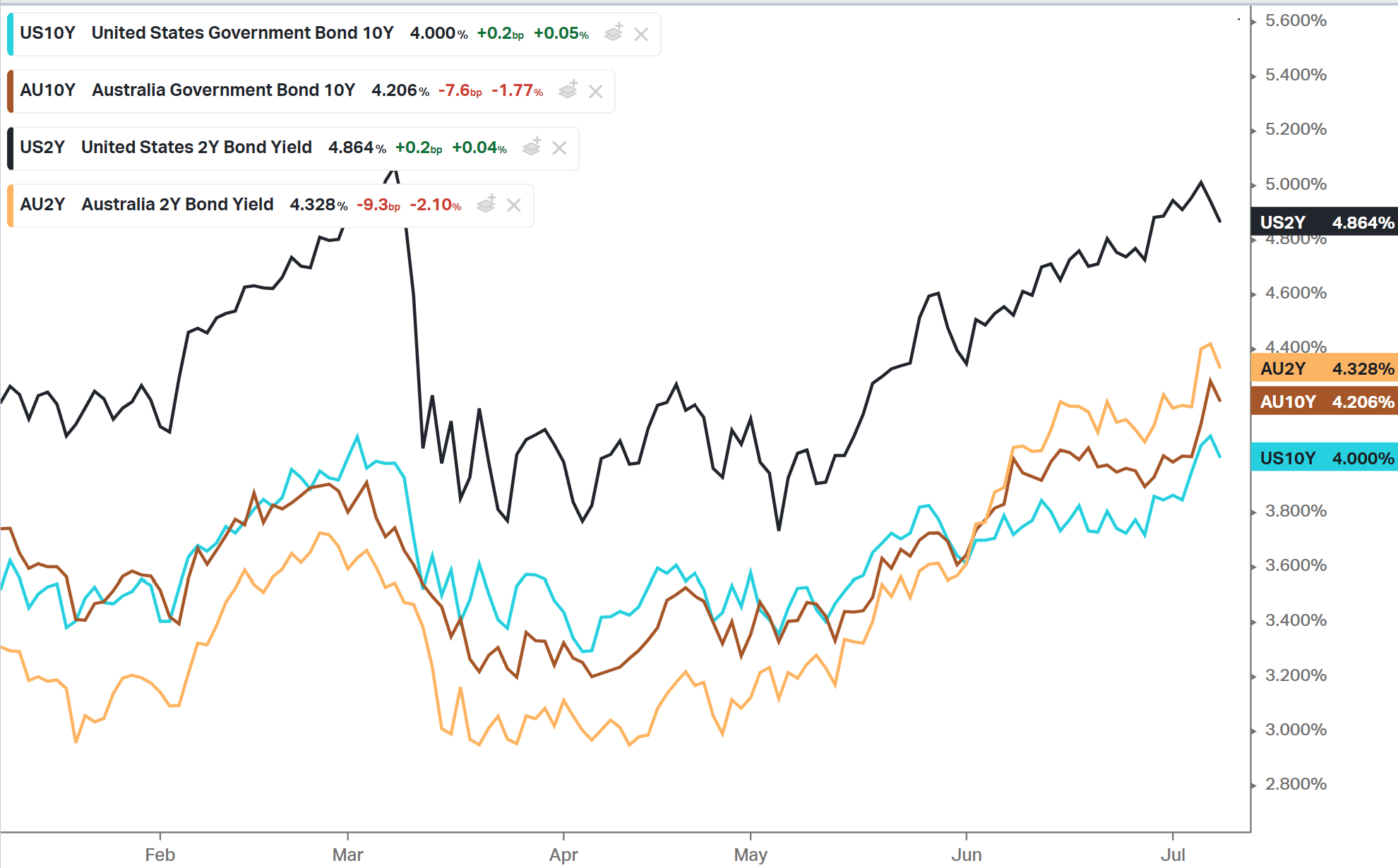

Bonds

The Day Ahead

The Australian Securities Exchange (ASX) is predicted to experience an early rise today, as the heavy selling influenced by China’s inflation data yesterday decreases.

Looking Ahead:

- There could be further consolidation in the lithium sector. Pilbara Minerals (PLS) is reportedly considering an acquisition of Piedmont Lithium (PMT), which might spark interest in other lithium stocks.

- However, the tech sector might lag, with AI-driven optimism potentially waning as we head into the earnings season.

- Mid-morning will see the release of Australian consumer and business sentiment numbers. This data may provide further insights into the impact of interest rate hikes on consumer and business spending and confidence.

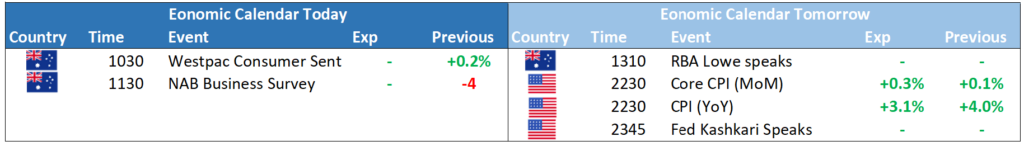

Calendar

Economic