| Index | Code | Name | Sector | Entry Date | Entry Price | Profit Target | Stop Loss | Exit Date | Exit Price | Outcome | Trade Days | Total Return |

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 | SMR | Stanmore Resources | Coal | 19/09/2023 | 335,00 | 39,00 | 3,00 | 29/09/2023 | 376,00 | Profit | 10 | 12.24% |

| 2 | PDN | Paladin Energy Ltd | Uranium | 26/09/2023 | 1.045,00 | 128,00 | 93,00 | 29/09/2023 | 1.125,00 | Profit | 3 | 7.66% |

| 3 | PDN | Paladin Energy Ltd | Uranium | 26/09/2023 | 1.045,00 | 128,00 | 93,00 | 03/10/2023 | 105,00 | Loss | 7 | 0.48% |

| 4 | XJOQOA | XJO Index | Warrant | 05/10/2023 | 504,00 | 604,00 | 454,00 | 06/10/2023 | 526,00 | Profit | 1 | 4.37% |

| 5 | RMS | Ramelius Resources Limited | Gold | 09/10/2023 | 165,00 | 2,00 | 138,00 | 19/10/2023 | 173,00 | Profit | 10 | 4.85% |

| 6 | KAR | Karoon Energy Ltd | Crude Oil | 09/10/2023 | 257,00 | 3,00 | 235,00 | 12/10/2023 | 25.721,00 | Loss | 3 | 0.08% |

| 7 | PPK | PPK Group | Graphite | 17/10/2023 | 1.045,00 | 195,00 | 81,00 | 08/11/2023 | 95,00 | Loss | 22 | -9.09% |

| 8 | PDN | Paladin Energy Ltd | Uranium | 18/10/2023 | 95,00 | 12,00 | 85,00 | 21/11/2023 | 103,00 | Profit | 34 | 8.42% |

| 9 | PLS | Pilbara Minerals Ltd | Lithium | 25/10/2023 | 39,00 | 45,00 | 36,00 | 31/10/2023 | 37,00 | Loss | 6 | -5.13% |

| 10 | IVZ | Invictus Energy Ltd | Crude Oil | 25/10/2023 | 185,00 | 295,00 | 135,00 | 25/10/2023 | 295,00 | Profit | 0 | 59.46% |

| 11 | RMD | ResMed Inc | Healthcare | 26/10/2023 | 224,00 | 2.445,00 | 215,00 | 27/10/2023 | 215,00 | Loss | 1 | -4.02% |

| 12 | DYL | Deep Yellow | Uranium | 31/10/2023 | 1.295,00 | 1.635,00 | 1.145,00 | 27/12/2023 | 125,00 | Loss | 57 | -3.47% |

| 13 | FXUKCL | Australian Dollar | Currency | 06/11/2023 | 605,00 | 705,00 | 555,00 | 07/11/2023 | 53,00 | Loss | 1 | -12.40% |

| 14 | OOO | Crude Oil ETF | Crude Oil | 08/11/2023 | 561,00 | 651,00 | 515,00 | 21/11/2023 | 564,00 | Loss | 13 | 0.53% |

| 15 | SPFKCY | S&P500 short warrant | Warrant | 13/11/2023 | 342,00 | 382,00 | 322,00 | 15/11/2023 | 278,00 | Loss | 2 | -18.71% |

| 16 | CRN | Coronado Global Resources | Gold | 23/11/2023 | 161,00 | 189,00 | 146,00 | 04/12/2023 | 17,00 | Profit | 11 | 5.59% |

| 17 | DYL | Deep Yellow | Uranium | 04/12/2023 | 103,00 | 136,00 | 85,00 | 15/01/2024 | 14,00 | Profit | 42 | 35.92% |

| 18 | LTR | Liontown | Lithium | 08/12/2023 | 133,00 | 161,00 | 1.195,00 | 19/12/2023 | 161,00 | Profit | 11 | 21.05% |

| 19 | JDO | Judo Holdings | Financials | 14/12/2023 | 85,00 | 105,00 | 75,00 | 22/12/2023 | 95,00 | Profit | 8 | 11.76% |

| 20 | JDO | Judo Holdings | Financials | 21/12/2023 | 85,00 | 1.315,00 | 85,00 | 30/01/2024 | 115,00 | Profit | 40 | 35.29% |

| 21 | AGE | Alligator Energy | Uranium | 15/01/2024 | 75,00 | 1,00 | 58,00 | 10/05/2024 | 62,00 | Loss | 116 | -17.33% |

| 22 | PDN | Paladin Energy Ltd | Uranium | 24/01/2024 | 123,00 | 15,00 | 105,00 | 07/05/2024 | 1.685,00 | Profit | 104 | 36.99% |

| 23 | SMR | Stanmore Resources | Coal | 29/01/2024 | 39,00 | 42,00 | 365,00 | 06/02/2024 | 365,00 | Loss | 8 | -6.41% |

| 24 | LTR | Liontown | Lithium | 30/01/2024 | 1,00 | 12,00 | 87,00 | 06/02/2024 | 87,00 | Loss | 7 | -13.00% |

| 25 | BOE | Boss Energy | Uranium | 02/02/2024 | 57,00 | 69,00 | 51,00 | 04/03/2024 | 51,00 | Loss | 31 | -10.53% |

| 26 | PPE | PeopleIn | HR | 13/02/2024 | 135,00 | 185,00 | 11,00 | 26/02/2024 | 112,00 | Loss | 13 | -17.04% |

| 27 | JDO | Judo Holdings | Financials | 26/02/2024 | 119,00 | 15,00 | 105,00 | 08/03/2024 | 134,00 | Profit | 11 | 12.61% |

| 28 | DRO | DroneShield | Defense | 22/03/2024 | 73,00 | 93,00 | 58,00 | 17/04/2024 | 105,00 | Profit | 26 | 43.84% |

| 29 | EOS | Electro Optic Systems Holdings Ltd | Defense | 12/04/2024 | 174,00 | 21,00 | 14,00 | 24/06/2024 | 143,00 | Loss | 73 | -17.82% |

| 30 | WGX | Westgold Resources | Gold | 19/04/2024 | 24,00 | 28,00 | 215,00 | 15/07/2024 | 267,00 | Profit | 87 | 11.25% |

| 31 | OOO | Crude Oil ETF | Crude Oil | 19/04/2024 | 64,00 | 7,00 | 61,00 | 22/04/2024 | 61,00 | Loss | 3 | -4.69% |

| 32 | LTR | Liontown | Lithium | 30/04/2024 | 125,00 | 16,00 | 1,00 | 21/05/2024 | 1.475,00 | Profit | 21 | 18.00% |

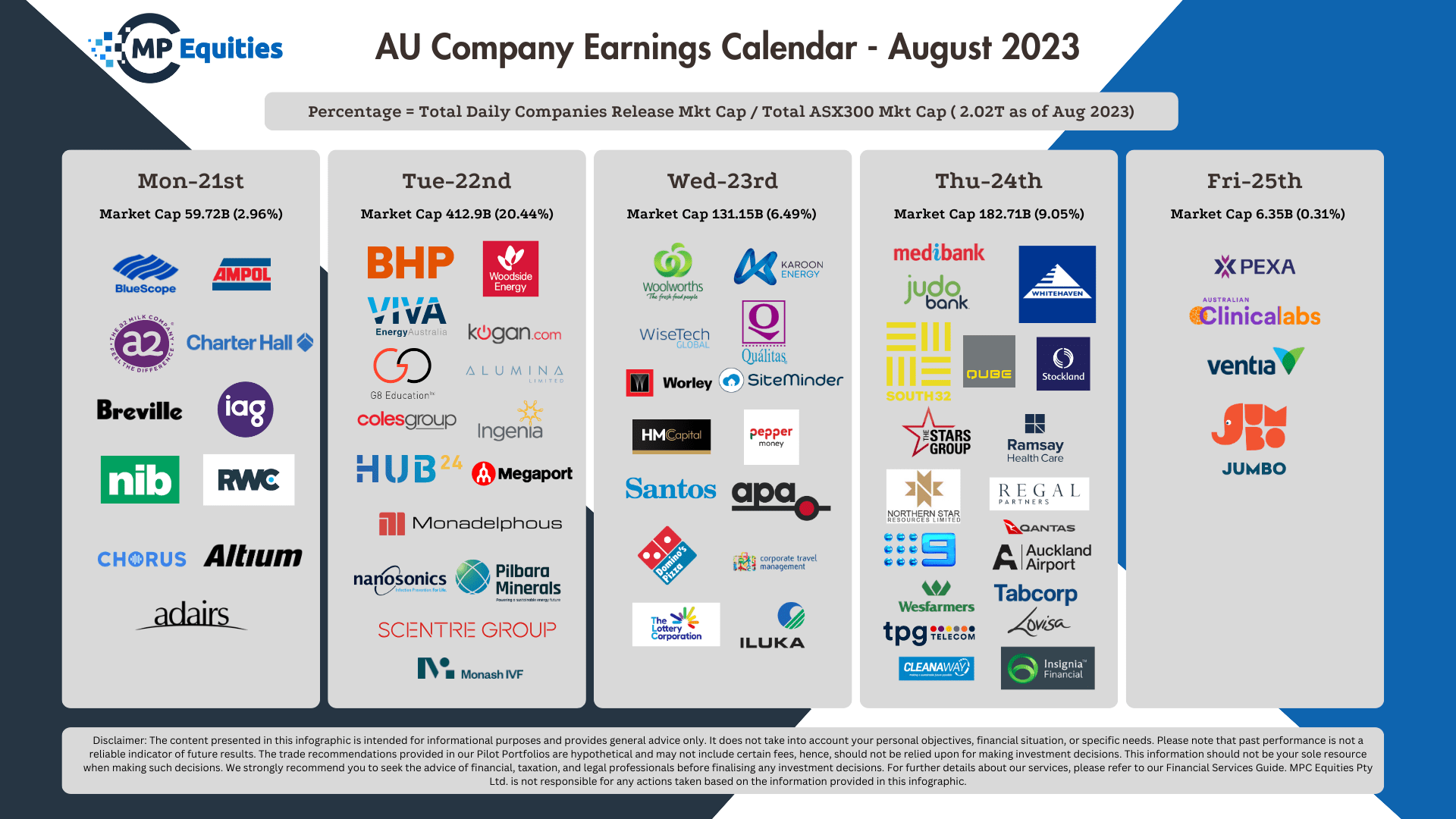

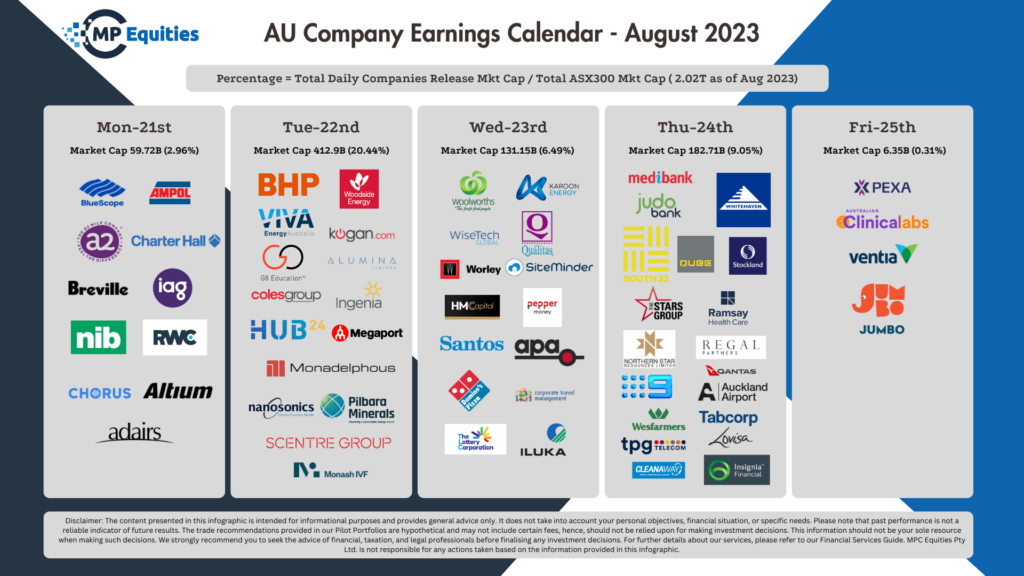

Release Summary

Ampol (ALD: ASX) – Experienced a 26% drop in first-half core profit due to an unexpected breakdown at their only oil refinery. Net operating profit declined to $329.6 million in the first half, down from $444.7 million the prior year. Statutory profit fell by 88% to $79.1 million. Dividend was reduced to 95¢ per share from $1.20 a year ago.

The a2 Milk Company (A2M: ASX) – Full-year sales grew 10.1% to $1.59 billion. Net profit after tax increased 26.2% to $NZ155.6 million. Infant formula sales up 8.4%, with strong performance in China. Liquid milk sales grew in both ANZ and USA markets. Group EBITDA rose by 11.8% to $NZ219.3 million.

Chorus (CNU: ASX) – Net profit dropped 61% to $NZ25 million primarily due to higher costs and natural disasters. The final dividend is NZ25.5¢ per share, bringing the total to NZ42.5¢ for the year. A dividend of NZ47.5¢ per share is projected for fiscal 2024.

Insurance Australia Group (IAG: ASX) – Profits surged to $832 million, up from $347 million, with factors such as favorable weather conditions in Australia and a turnaround from investment market losses. Gross written premium rose 10.6% to $14.7 billion. A final dividend of 9¢ was declared.

Reliance Worldwide (RWC: ASX) – Net profit after tax increased 2% to $US139.7 million, despite a 4% decline in sales in the Asia-Pacific region. Final dividend maintained at 9.5¢ per share. The Americas division experienced a 13% sales growth.

BlueScope Steel (BSL: ASX) – Reported a 64% decline in net profit after tax to $1.01 billion. Revenues were down by 4% at $18.2 billion. Dividend remained steady at 25¢ per share. EBIT for Australian operations decreased by 59% to $537 million.

Breville Group (BRG: ASX) – Net profit for the year increased by 4.2% to $110.2 million with revenues also rising by 4.2% to $1.48 billion. Profit margins improved to 11.6%.

Adairs (ADH: ASX) – Group sales for fiscal 2023 rose by 10.1% to $621.2 million. Gross profit surged by 5.8% to $285.5 million.

NIB Holdings (NIB: ASX) – Underlying operating profit grew by 11% to $263.2 million. The final dividend was raised nearly 40% to 15¢ per share. Premium revenues for Australian resident health insurance increased by 6.1%.

Charter Hall Group (CHC: ASX) – Operating earnings for fiscal 2023 were $441.2 million, down from the previous year. Statutory profit after tax was $196.1 million, a significant decrease from the $911.1 million the prior year. Full-year distributions amounted to 42.5¢ per security. The company projects a decline in 2024 operating earnings to around 75¢ per security.

- AKE Allkem (AKE: ASX) – Recorded over $US1.2 billion in group revenue from its Mt Cattlin and Olaroz operations. Announcing a merger with New York-listed Livent to target a position as the third largest global lithium entity.

- BHP Group Limited (BHP: ASX) – Full-year underlying profit decreased by 37% to $US13.4 billion due to commodity price weaknesses and reduced sales. Seeking to divest from certain coking coal mines in Queensland.

- Woodside Energy Group Limited (WPL: ASX) – Saw a 6% first-half profit increase post-BHP petroleum merger. Interim dividend declined from the previous year, with notable investment for Scarborough LNG project amidst looming union disputes.

- Coles Group Limited (COL: ASX) – Reported a 5.2% growth in annual revenue, driven mainly by food price hikes. Liquor sales met market expectations closely. EBIT grew by 6.4%, with consistent dividend. Anticipated challenges with its Victoria-based Ocado centre.

- Scentre Group (SCG: ASX) – Significant decline in interim statutory profit due to a mall portfolio writedown. Without the writedown, profit grew by 3.2% alongside a 6.3% revenue increase. The company reiterated its full-year 2023 guidance.

- Viva Energy Group Limited (VEA: ASX) – H1 net profit slumped by over 50% due to Geelong refinery issues. Retail sector reported a 40% EBITDA growth due to price and demand hikes. Fuel sales rose by 11% YoY, with a dividend declaration of 8.5 cents/share.

- Hub24 Limited (HUB: ASX) – Net profit skyrocketed by 160% to reach $38.2 million in FY23. Declared a share buyback worth $50 million, with funds under administration rising 23% to $80.3 billion.

- Megaport Limited (MP1: ASX) – Reported 40% revenue growth and reduced net loss. Achieved positive cash flow for the first time and forecasted an EBITDA growth between 152% and 182% for FY24.

- Ingenia Communities Group (INA: ASX) – A 4% YoY decrease in underlying profit. Statutory profit fell 33% due to revaluation, despite a 17% rise in group revenue.

- Nanosonics Limited (NAN: ASX) – 38% revenue growth with a notable after-tax profit hike. Transitioned to US direct sales, with the CORIS product release pushed to Q3 FY24.

- Monadelphous Group Limited (MND: ASX) – Achieved $1.83 billion sales revenue. EBITDA margin improved year-on-year, declaring a 25¢/share final dividend.

- Kogan.Com Limited (KGN: ASX) – Gross sales and revenue declined by 28.4% and 31.9%, respectively. Addressed an inventory concern.

- Monash Ivf Group Limited (MVF: ASX) – Expecting positive growth in the next financial year after service price increments in Australia. Foreseeing revenue and underlying net profit growth in FY24, but currently battling a class-action lawsuit tied to its genetic screening tech.

- Woolworths Group Limited (WOW: ASX) – Sales rose by 5.7% to $64.29 billion with Australian food sales at $48 billion. Warned of potential inflation and consumer challenges; net profit after tax decreased by 79.6%.

- WiseTech Global Limited (WTC: ASX) – 9% rise in full-year profit, 29% increase in revenue. Acquired Blume Global and Envase Technologies with an anticipated 27-34% revenue growth in FY24.

- Pepper Money Limited (PPM: ASX) – 28% decline in H1 profits to $52 million, dividends reduced by one-third. Pivoting focus towards auto and equipment lending.

- Santos Limited (STO: ASX) – First-half profit dropped 32% due to decreased production and prices. However, interim dividend increased by 14%.

- Lottery Corporation Limited (TLC: ASX) – Despite a 23.6% fall in net profit, they reported a 7.2% growth in revenue and a significant 16.3% rise in Keno turnover.

- Apa Group (APA: ASX) – Successfully acquired Alinta’s remote power assets for roughly $1.8 billion.

- Worley Limited (WOR: ASX) – Experienced a sharp 78% fall in annual net profit following a loss from a sale but saw a 17% growth in global group revenues.

- Domino’s Pizza Enterprises Limited (DMP: ASX) – Encountered a 74% dip in net profit. CEO, Don Meij, has committed not to transfer inflationary costs onto customers.

- Iluka Resources Limited (ILU: ASX) – Half-year profit declined by 45%. They also reduced their interim dividend from 25¢ to 3¢.

- Corporate Travel Management Limited (CTD: ASX) – Revenue rebounded to over 90% of pre-COVID levels in Q4 with an increased unfranked final dividend of 22¢ per share.

- Hmc Capital Limited (HMC: ASX) – Steadily progressing towards a milestone of $10 billion in assets under management.

- South32 Limited (S32: ASX) reported a $US173 million loss after tax, with underlying earnings down 65%. They declared a US3.2¢ fully franked dividend.

- Ramsay Health Care Limited (RHC: ASX) experienced a 3.6% drop in net profit, ending at $365.5 million, with a 48% reduced dividend.

- Northern Star Resources Limited (NST: ASX) will pay a 15.5¢ full-year dividend, following a 30% increase in net profits due to rising gold prices.

- Auckland International Airport Limited (AIA: ASX) saw net profit decrease to $NZ43.2 million from $NZ191.6 million, but passenger numbers nearly doubled.

- Qantas Airways Limited (QAN: ASX) reported a record $2.5 billion underlying profit before tax, emphasizing a leaner structure post-COVID.

- TPG Telecom Limited (TPG: ASX) faced a 71% decline in interim profit to $48 million and is in talks to sell fibre assets for $6.3 billion.

- Stockland (SGP: ASX) reported a net after-tax profit of $440 million, impacted by a $256 million loss in investment property value.

- Medibank Private Limited (MPL: ASX) revealed a $46.4 million hit from a cyberattack but saw after-tax profits rise by 30% to $511.1 million.

- Whitehaven Coal Limited (WHC: ASX) posted a record $2.66 billion full-year profit and declared a 42¢ final dividend.

- Cleanaway Waste Management Limited (CWY: ASX) reported a 71% slide in net profit after a $74 million write-off, but revenues rose by 13.9% to $2.97 billion.

- Qube Holdings Limited (QUB: ASX): Qube’s net profit rose by 32% to $167.9 million, despite a decline in imported container goods volumes. Earnings in its logistics and infrastructure business surged by 54%, but earnings in the ports and bulk goods division dropped by 3%. Qube will pay a final dividend of 4.35¢ a share.

- Nine Entertainment Co. Holdings Limited (NEC: ASX): Nine cut its full-year dividend by 21% following declines in earnings and profits. The company reported a revenue of $2.69 billion and a net profit of $262.1 million. The final dividend is set at 5 cents.

- Tabcorp Holdings Limited (TAH: ASX): Tabcorp reported a net profit of $66.5 million after its lotteries and Keno business demerger. The company’s revenue increased by 2.6% to $2.4 billion, and its EBITDA rose by 88% to $407.4 million.

- Lovisa Holdings Limited (LOV: ASX): Lovisa’s sales rose by 30% to $596.4 million, and its net profit increased by 16.7% to $68.2 million. The company declared a final dividend of 31¢, down from the previous year’s 37¢.

- Insignia Financial Limited (IFL: ASX): Insignia’s annual net profit fell by 15% to $191 million. The company’s funds under management and administration increased by 1.5% to $295 billion. Insignia will pay a final dividend of 9.3¢ per share.

- Judo Capital Holdings Limited (JDO: ASX): Judo Bank’s net profit for the year was $73.4 million, a significant increase from the previous year’s $9.1 million. The bank plans to continue its growth in lending to small businesses.

- Regal Partners Limited (RPL: ASX): Regal Partners reported an underlying interim net profit of $13.1 million, nearly double from the previous half-year. The company attracted $400 million of inflows, raising its full-year fund to $1.1 billion.

- Wesfarmers Limited (WES: ASX): Reported a 4.8% rise in NPAT to $2.465 million for the year. Declared a total dividend of $1.91 per share, up 6.1%. Sales surged 18.2% to $43.55 billion, driven by Bunnings, Kmart Group, and WesCEF.

- Ventia Services Group Limited (VNT: ASX): Posted a 16% decline in interim net profit to $88.3 million. Group revenues increased by 11% to $2.8 billion. Declared an interim dividend of 8.3¢.

- Pexa Group Limited (PXA: ASX): Revised its UK market estimate from $719 million to $500 million. Reported a net loss of $21.8 million, with a 6% decline in core Australia-based PEXA Exchange operation revenue.

- Jumbo Interactive Limited (JIN: ASX): Announced a 13.9% revenue increase to $118.7 million and a 7.6% rise in earnings to $58.1 million. Declared a final dividend of 20¢ per share.

- Pilbara Minerals (PLS: ASX): Reported a full-year NPAT of $2.4 billion. Announced a 35% increase in ore reserves to 214 million tonnes. Revenue reached $4.1 billion, up from $1.2 billion last year. Declared a final dividend of 14¢ per share.

Previous Weeks

No posts found!