Consequences of the Spiraling US Debt

The spiraling U.S. debt poses substantial economic and financial risks that warrant close scrutiny from economic analysts and policymakers. Elevated debt levels can lead to increased borrowing costs as investors demand higher yields on government bonds to compensate for perceived risks. Consequently, the cost of servicing the debt rises, diverting funds from critical public services and investments. Over time, this excessive debt can undermine economic growth, reduce the government’s fiscal flexibility, and heighten the risk of a fiscal crisis.

When a significant portion of tax revenue is directed toward debt service, the government’s ability to fund essential services and invest in growth-promoting activities is severely constrained. This fiscal strain can lead to a deterioration in public services and infrastructure, as well as a diminished capacity to respond to economic downturns. Furthermore, a high debt service burden increases the risk of default, as a large share of revenue is already committed to interest payments, leaving less flexibility to address other financial obligations or unexpected expenses.

High debt service costs can also create concerns about the long-term sustainability of the government’s fiscal policies. Investors may worry about the government’s ability to manage its finances effectively, leading to increased borrowing costs and reduced investor confidence. Additionally, reliance on foreign creditors can compromise national security and sovereignty, adding another layer of complexity to the debt issue.

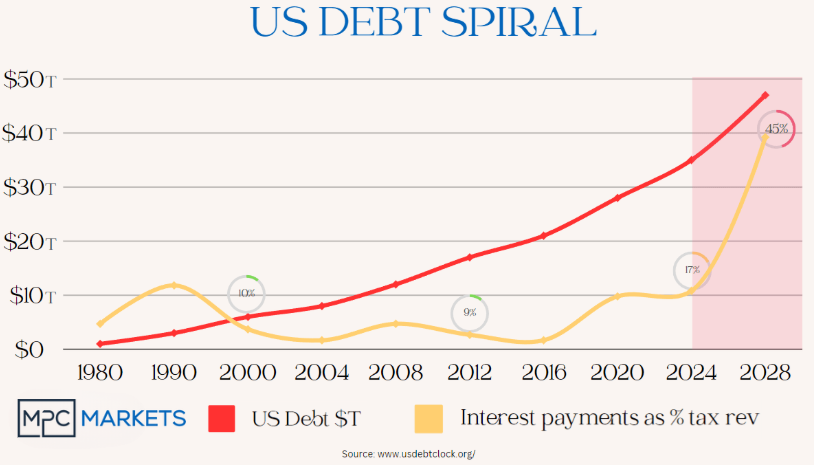

One critical consequence of the spiraling U.S. debt is the potential for a downgrade in the country’s credit rating. Credit rating agencies, such as Fitch, consider various factors, including fiscal health, economic conditions, and debt levels. When interest payments on the national debt are predicted to constitute 45% of the USA’s tax revenue, it likely signals severe fiscal strain, prompting a reassessment of the country’s creditworthiness.

A lower credit rating would typically result in higher borrowing costs for the government, as investors demand higher yields to compensate for the increased risk. This creates a vicious cycle, where higher interest rates further exacerbate the debt service burden, making it increasingly challenging for the government to manage its finances. A downgrade from the top-tier AAA rating could potentially move the rating down several notches, depending on factors such as the overall debt level, economic growth prospects, and political stability.

If the U.S. credit rating were downgraded, the impact on borrowing costs would be significant. The government would face higher interest rates, further straining its fiscal resources and potentially leading to cuts in essential services and investments. Persistent debt growth can also devalue the currency, potentially leading to inflation and eroding public trust in the government’s financial management.

In summary, the spiraling U.S. debt poses significant economic and financial risks, including increased borrowing costs, reduced fiscal flexibility, and the potential for a credit rating downgrade. These factors collectively threaten the long-term economic stability and fiscal health of the country, necessitating urgent and strategic policy responses to mitigate these risks.