What's Affecting Markets Today

Neuren’s Sales Forecast Despite Royalty Dip

Shares of Neuren Pharmaceuticals tumbled 7.6% to $18.57 after revealing modest royalty earnings of $11.6 million for the March quarter. Despite the dip, the company remains optimistic about its flagship product, Daybue, a treatment for the neurodegenerative disorder Rett Syndrome in children. Neuren projects 2024 royalty earnings to range from $61 million to $70 million. Moreover, the company anticipates a significant jump in Daybue’s total sales in the US, estimating a target between $370 million and $420 million for the year.

Aussie Broadband’s Strategic Move in Singapore

Aussie Broadband has secured a regulatory green light from Singapore’s Infocommunications Media Development Authority to hold up to a 19.9% stake in Superloop. This approval follows a contentious phase where Aussie Broadband, after an initial acquisition of nearly 20% in Superloop, had to reduce its share due to regulatory non-compliance. The subsequent legal battle underscores Aussie Broadband’s commitment to its expansion strategy despite Superloop’s resistance to the takeover. This development marks a significant regulatory win for Aussie Broadband in its international business strategy.

UBS Downgrades CBA Amidst Falling Loan Quality

UBS has issued a sell rating on Commonwealth Bank of Australia (CBA) shares following a 5% decrease in cash profit for the March quarter, which totaled $2.4 billion. The brokerage highlighted a noticeable deterioration in CBA’s asset quality, although it anticipates potential upgrades in consensus for the bank’s second half 2024 earnings due to today’s credit impairment charges. Despite these challenges, CBA is actively leveraging its distribution network to maintain and boost its mortgage business, a critical focus area for sustaining profitability amidst market shifts. UBS’s current valuation of CBA stands at $105, significantly below its market price of $119.74.

ASX Stocks

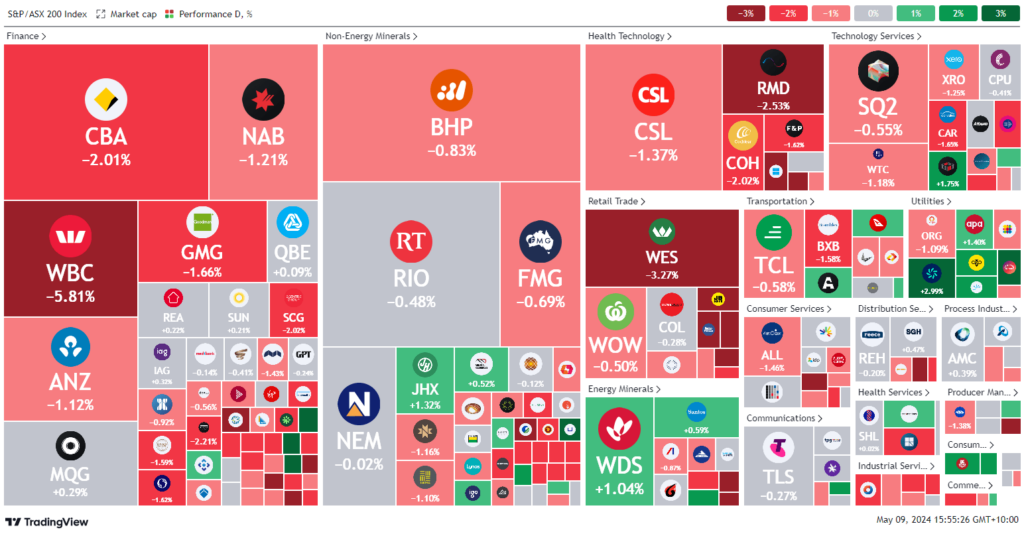

ASX 200 - 7,717.3 (-1.10%)

Key Highlights:

Australian shares continued their downward trend as rising living costs and dim retail updates spurred a sell-off. The S&P/ASX 200 index dropped by 0.9%, with significant losses seen across the retail sector. The Commonwealth Bank’s shares fell 1.5% as it reported a drop in March cash profits, contributing to the broader market decline. In retail, JB Hi-Fi saw a 5% decrease in share price after announcing flat sales for the March quarter, while Baby Bunting’s shares plummeted 21% following warnings of decreased sales due to financial pressures on families. Super Retail Group also reported a 4.9% decline in shares post its sales update.

Furniture retailers like Nick Scali, Harvey Norman, and Temple & Webster experienced over 4% drops in their stock values, coinciding with the Australian Bureau of Statistics’ report of a sustained downturn in retail sales. Adding to sector woes, financial institutions like National Australia Bank, ANZ, and Westpac saw shares decline due to growing concerns about loan arrears amid tightening economic conditions. Meanwhile, Orica managed a 1.3% gain after a favorable earnings report, contrasting the general market sentiment. Internationally, the market remained tepid with Wall Street closing nearly flat and iron ore prices affecting resource giants BHP and Rio Tinto, alongside an unexpected rate cut by Sweden’s central bank.

Leaders

HTA (Hutchison Telecom.): +29.31%

TBN (Tamboran Res.): +15.63%

COE (Cooper Energy): +11.25%

CHN (Chalice Mining): +10.65%

STX (Strike Energy): +7.96%

Laggards

BBN (Baby Bunting): -22.90%

TPW (Temple & Webster): -17.12%

AGI (Ainsworth Game Tech.): -16.31%

NXG (Nexgen Energy): -9.32%

PEN (Peninsula Energy): -8.33%