What's Affecting Markets Today

Asia markets mixed

Asia-Pacific markets experienced mixed trading on Thursday as investors digested key economic data and central bank decisions. The Reserve Bank of India held its interest rate steady at 6.5% for the ninth consecutive meeting, aligning with economists’ expectations. In Japan, the current account surplus for June fell short of forecasts, coming in at 1.533 trillion yen ($10.2 billion) versus the anticipated 1.789 trillion yen.

The Nikkei 225 and Topix fluctuated, closing down 0.3% and 0.6%, respectively. The Bank of Japan’s July meeting summary revealed discussions about potential rate hikes, though Deputy Governor Shinichi Uchida emphasized the need for continued monetary easing. SoftBank Group shares fell over 3.5% despite announcing a 500 billion yen ($3.4 billion) share buyback. Lasertec surged 22.6% on strong financial results, while Isuzu Motors led auto stocks higher, gaining 8%.

In China, the CSI 300 and Hong Kong’s Hang Seng index rebounded, gaining 0.4% and 0.7%, respectively. Cathay Pacific announced plans to purchase 30 Airbus A330-900 aircraft, with an option for 30 more, valued at $11 billion.

ASX Stocks

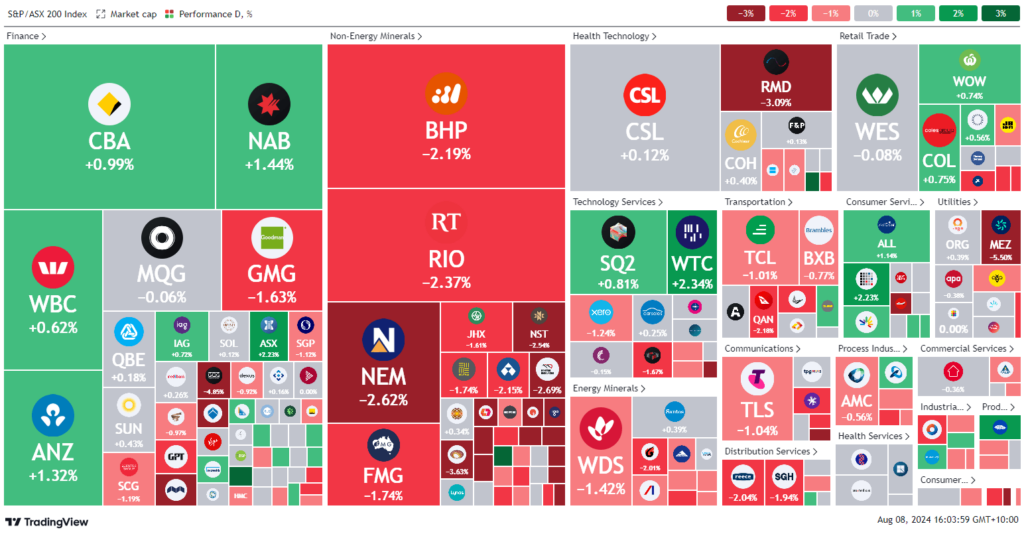

ASX 200 - 7,673.5 (-0.3%)

Key Highlights:

The Australian sharemarket retreated on Thursday afternoon, with the S&P/ASX 200 Index declining 0.3% or 23.4 points to 7676.4 by 2:32pm AEST. A sell-off in mining and property stocks, alongside a broader market pullback, weighed on the index. The materials sector dropped 1.5%, with BHP Group down 1.9%, Rio Tinto losing 1.8%, and Fortescue Metals falling 0.8% as Singapore iron ore futures slid 1.7% to $US99.2 per tonne. Property stocks were also hit, down 2.3%, as Goodman Group fell 2.5% and Scentre Group lost 1.5%. Mirvac shares plunged 9.5% after forecasting lower FY2025 earnings.

In contrast, AMP shares surged 11.5% on a 5.4% rise in half-year net profit and a 2¢ interim dividend. Qantas shares fell 1.9% as former CEO Alan Joyce faced a $9 million pay cut. Transurban dipped 1.3% despite strong profit growth, while Light & Wonder gained 2% on robust quarterly revenue.

Leaders

AMP AMP Ltd (+12.83%)

AD8 Audinate Group Ltd (+6.10%)

RED RED 5 Ltd (+3.73%)

SPR Spartan Resources Ltd (+3.23%)

HSN Hansen Technologies Ltd (+3.15%)

Laggards

ADT Adriatic Metals Plc (-10.69%)

WAF West African Resources Ltd (-10.39%)

MGR Mirvac Group (-8.53%)

CSC Capstone Copper Corp (-7.34%)

RSG Resolute Mining Ltd (-7.20%)