What's Affecting Markets Today

Asian markets mixed

Asia-Pacific stocks showed mixed results on Friday as investors assessed economic data from China and Japan, along with the European Central Bank’s rate cut. China’s May exports exceeded expectations, rising 7.6% versus the anticipated 6%, and significantly higher than April’s 1.5% increase. However, imports grew only 1.8% year-on-year, falling short of the expected 4.2%.

Hong Kong’s Hang Seng index fell 0.63% after earlier gains, while the mainland Chinese CSI 300 saw a larger decline of 0.73%.

In Japan, household spending figures for April showed average monthly consumption expenditures per household at 313,300 yen, a 3.4% increase nominally and 0.5% rise in real terms, marking the first real spending increase since February 2023. April is critical for wage hikes, as it starts the financial year for Japanese companies.

Japan’s Nikkei 225 slipped 0.11%, and the Topix index declined marginally. South Korea’s Kospi rose 0.84% post-holiday, and the small-cap Kosdaq gained 1.31%.

ASX Stocks

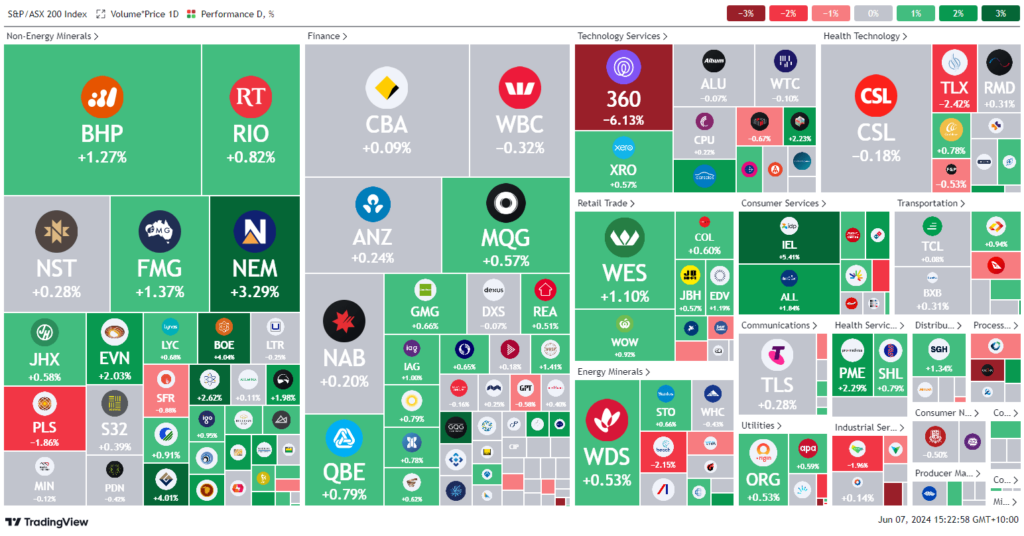

ASX 200 - 7,856.6 (+0.4%)

Key Highlights:

Shares booked their third consecutive day of gains on Friday, buoyed by rising commodity prices and optimism surrounding interest rate cuts by the Bank of Canada and European Central Bank. Fortescue rose 1.5% to $24.42, and BHP increased 1.1% to $44.55. Among gold miners, Regis jumped 3.2% to $1.90, and Bellevue Gold climbed 3% to $2.03, with gold prices firming around 1% to a two-week high of $US2377 per ounce.

The ASX will be closed for the King’s Birthday holiday on Monday.

GQG Partners reported a rise in total assets from $US142 billion on April 30 to $US150.1 billion on May 31, driven by $US9.1 billion in inflows and record-high global equity markets. Its stock rose 1.9% to a record $2.63.

Technology One shares climbed 0.7% to a record $18.37 as investors anticipate potential interest rate cuts. The company now has a $5.9 billion market cap, doubling in value over five years. Meanwhile, insurer QBE hit its highest level since 2011, rising 1% in early trade.

Leaders

RSG Resolute Mining Ltd 7.80%

IEL Idp Education Ltd 5.38%

WGX Westgold Resources Ltd 4.29%

CTT Cettire Ltd 3.98%

BOE Boss Energy Ltd 3.93%

Laggards

ERA Energy Resources of Australia Ltd -6.98%

360 LIFE360 Inc -6.67%

MEZ Meridian Energy Ltd -5.46%

NXL NUIX Ltd -4.01%

ORA Orora Ltd -2.97%