What's Affecting Markets Today

Asian markets positive

Asia-Pacific stocks surged as anticipation of rate cuts by the European Central Bank lifted market sentiment. The ECB is expected to reduce borrowing costs for the euro area for the first time since September 2019. Japan’s Nikkei 225 climbed 0.91%, nearing the 39,000 mark for the first time in two weeks, while the Topix index rose 0.61%. Hong Kong’s Hang Seng Index increased by 0.7%, trimming earlier gains, and China’s CSI 300 was slightly positive. South Korea’s markets were closed for a public holiday.

In the U.S., Nvidia led a rally in major tech stocks, with weak labor market data fueling hopes for potential Federal Reserve rate cuts later this year. The S&P 500 gained 1.18% to close at a record 5,354.03, while the Nasdaq Composite jumped 1.96% to a new high of 17,187.90. The Dow Jones Industrial Average lagged, adding just 0.25% as non-tech stocks underperformed.

ASX Stocks

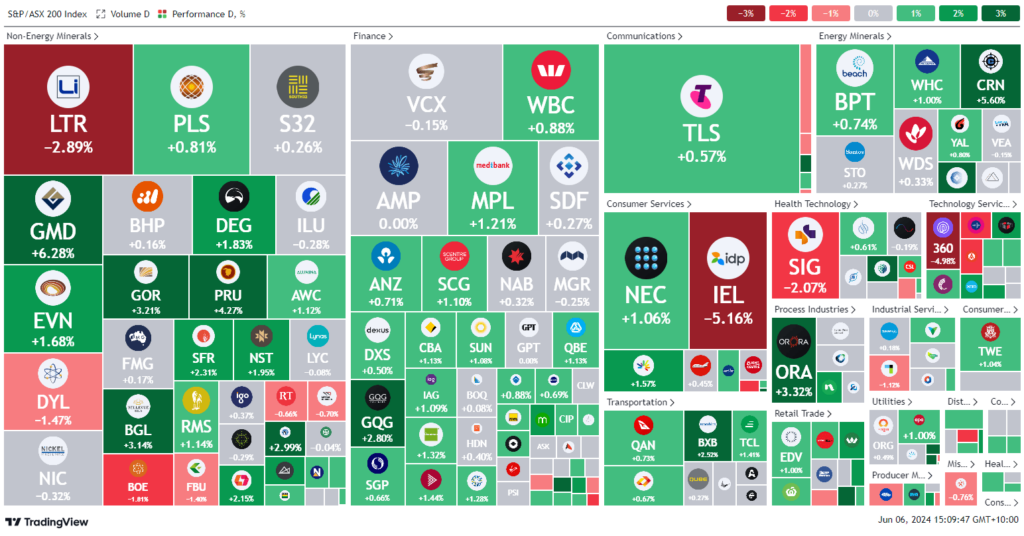

ASX 200 - 7,830.5 (+0.8%)

Key Highlights:

Australian shares rose 0.7% at midday, buoyed by a surge in U.S. tech stocks and Canada’s central bank cutting its cash rate, enhancing global rate cut expectations. All 11 sectors on the S&P/ASX 200 advanced, with Commonwealth Bank leading, climbing over 2% to a record $125.97. The local tech sector, inspired by AI enthusiasm on Wall Street, added 1.7%, with WiseTech, Xero, and Pro Medicus each gaining more than 1.8%.

In commodities, iron ore fell 0.3% to $107.10 per tonne amid uncertainty over Chinese demand, despite Beijing’s recent support measures.

Key stock movements included IDP Education, which plummeted 10.6% to $14.02 following warnings of significant business reductions due to restrictive international student policies. SkyCity Entertainment slashed its profit guidance, citing New Zealand’s recession and hotel project delays, causing shares to drop 18.4% to $1.31. Magellan Financial rose 1.3% to $8.45 as funds under management increased to $36.7 billion despite $100 million in net outflows.

Leaders

MCY Mercury NZ Ltd 6.42%

NAN Nanosonics Ltd 6.16%

GMD Genesis Minerals Ltd 5.87%

RPL Regal Partners Ltd 5.33%

ZIP ZIP Co Ltd 5.26%

Laggards

SKC Skycity Entertainment Group Ltd -14.64%

IEL Idp Education Ltd -5.23%

WA1 WA1 Resources Ltd -2.71%

MSB Mesoblast Ltd -2.58%

SEK Seek Ltd -2.57%