What's Affecting Markets Today

Nikkei rebounds after Mondays falls

Japan’s stock market rebounded sharply on Tuesday, with the Nikkei 225 and Topix indices recovering more than 7% after suffering a steep 12% decline in the previous session. The rally followed the Bank of Japan’s recent rate hike, which had driven the yen to a seven-month high, exerting pressure on equities. Global market jitters, fueled by U.S. recession fears due to weak jobs data, also weighed on sentiment.

Leading the recovery, Japan’s major trading houses surged over 6%, with Mitsui up more than 9% and Softbank Group gaining over 8%. Japanese automakers and semiconductor suppliers, including Honda and Renesas Electronics, saw notable gains of 13% and 17%, respectively.

Elsewhere in Asia, South Korea’s Kospi climbed over 3%, and the Kosdaq rose more than 5%, following a temporary halt on Monday due to an 8% drop. Mainland China’s CSI 300 remained flat, while Hong Kong’s Hang Seng index increased by 0.9%.

ASX Stocks

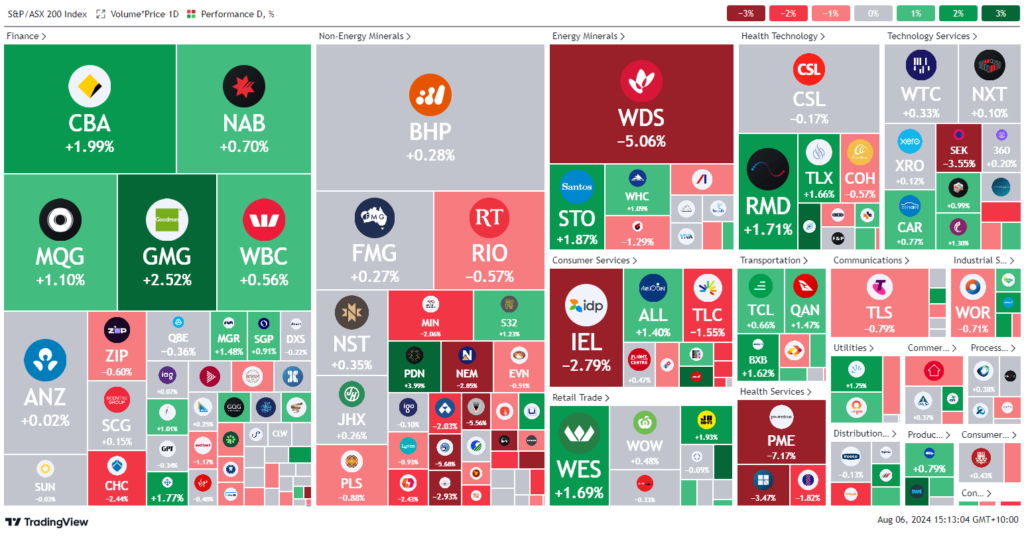

ASX 200 - 7,708.5 (+0.8%)

Key Highlights:

The Australian sharemarket maintained its gains despite the Reserve Bank holding the cash rate steady at 4.35%, citing persistent inflation concerns. The S&P/ASX 200 Index was up 0.4%, trading at 7677.7 points by 3:06pm AEST, with six of 11 sectors in positive territory. The Australian dollar remained stable at US65.1¢. The RBA’s decision to keep rates unchanged at a 12-year high was expected, with the board highlighting that inflation remains above target and cautioning that policy will remain restrictive.

Global markets showed mixed performance, with Japanese equities recovering from Monday’s losses, while US equity futures signaled a potential rebound. Commodities, including copper, gold, and oil, declined amid economic concerns, though oil prices saw a slight recovery. Notably, Woodside shares dropped 5.1%, and Audinate Group saw a sharp 36% fall after a weak FY25 outlook. Treasury Wine Estates gained 0.4% amid a strategic review of its brand portfolio.

Leaders

CU6: Clarity Pharmaceuticals Ltd (+6.10%)

OBM: Ora Banda Mining Ltd (+5.13%)

DYL: Deep Yellow Ltd (+4.23%)

RWC: Reliance Worldwide Corp Ltd (+4.23%)

PDN: Paladin Energy Ltd (+3.99%)

Laggards

AD8: Audinate Group Ltd (-36.19%)

PME: Pro Medicus Ltd (-7.17%)

EMR: Emerald Resources NL (-5.68%)

RED: RED 5 Ltd (-5.56%)

WDS: Woodside Energy Group Ltd (-5.04%)