What's Affecting Markets Today

Asian markets stronger

Asia-Pacific markets largely rose Thursday, highlighted by Japan’s Topix hitting an all-time high of 2,886.50, surpassing its December 1989 record. The Topix increased by 0.37%, while the Nikkei 225 climbed 0.2%, nearing its peak of 40,888.43. SoftBank Group shares surged 2.5%, marking a seven-day record streak. Japanese firms implemented the largest wage hikes in three decades, with average monthly pay for union workers rising 5.1% this fiscal year, driven by Rengo’s survey. Larger firms increased wages by 5.19%, smaller firms by 4.45%. This wage growth is expected to foster a “virtuous cycle” of rising prices and wages, enabling the Bank of Japan to adjust interest rates.

Taiwan’s Weighted Index reached a new high, powered by chip stocks, with Foxconn up 5% and TSMC gaining 2.66%. In contrast, Hong Kong’s PMI fell to 48.2 in June, its fastest contraction in over two years. The Hang Seng index rose 0.23%, while Mainland China’s CSI 300 remained flat.

ASX Stocks

ASX 200 - 7,830.5 (+1.2%)

Key Highlights:

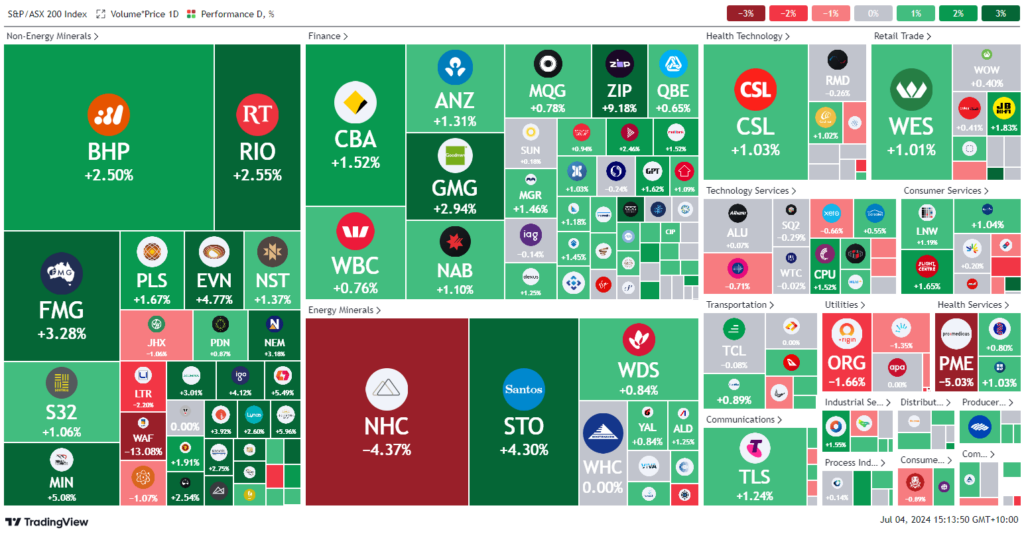

Australian shares rose 1% on Thursday afternoon, supported by an ongoing bull market in New York ahead of the Independence Day holiday. Santos shares increased 4% to $8 following reports from Bloomberg that Saudi Aramco and Abu Dhabi National Oil Co are exploring bids for Santos to expand their overseas gas investments. Analysts highlighted potential challenges, including the need for FIRB clearance and control complexities.

Materials led sector gains, up 1.8%, while energy added 1.3%. Arcadium Lithium rebounded 6.1% to $5.22 after earlier losses in 2024. Bitcoin fell another 5% to $US58,540, extending a monthly decline of over 18%.

Fund manager Magellan saw shares jump 5.8% after announcing $19 million in performance fees and stable inflows for June, with shares rising to $9.15. Gold miners Newmont and Evolution Mining gained over 3% each, driven by gold prices reaching $US2357 an ounce. Lendlease shares remained flat at $5.68 amid ACCC opposition to a Stockland deal.

Leaders

WA1 WA1 Resources Ltd 12.68%

ZIP ZIP Co Ltd 8.85%

NXL NUIX Ltd 8.56%

MSB Mesoblast Ltd 7.73%

MFG Magellan Financial Group Ltd 6.43%

Laggards

WAF West African Resources Ltd -13.05%

ERA Energy Resources of Australia Ltd -5.26%

TPW Temple & Webster Group Ltd -4.63%

PME Pro Medicus Ltd -4.34%

NHC New Hope Corporation Ltd -4.09%