What's Affecting Markets Today

Asian markets mostly weaker

Asia-Pacific markets largely declined on Friday. Japan’s Nikkei 225 saw a volatile session, initially crossing the 41,000 mark to hit fresh record highs before closing down 0.29%. The broad-based Topix also dropped 0.59% from its record highs. Japan’s household spending for May unexpectedly fell 1.8% year-on-year, against a forecasted 0.1% rise, impacting the Bank of Japan’s objective of achieving a “virtuous cycle” of rising wages and prices. Average household spending in May was 290,328 yen ($1,799.28), while monthly income increased 6.4% nominally and 3% in real terms to 500,231 yen.

South Korea’s Kospi rose 1.38%, with the small-cap Kosdaq up 0.91%, driven by Samsung Electronics’ estimated 15-fold surge in Q2 operating profit due to a rebound in semiconductor prices. Samsung shares climbed 2.25%, reaching their highest level since January 2021. Conversely, Hong Kong’s Hang Seng index dropped 1.09%, and mainland China’s CSI300 fell 0.96%. Investors are also awaiting retail sales data from Singapore.

ASX Stocks

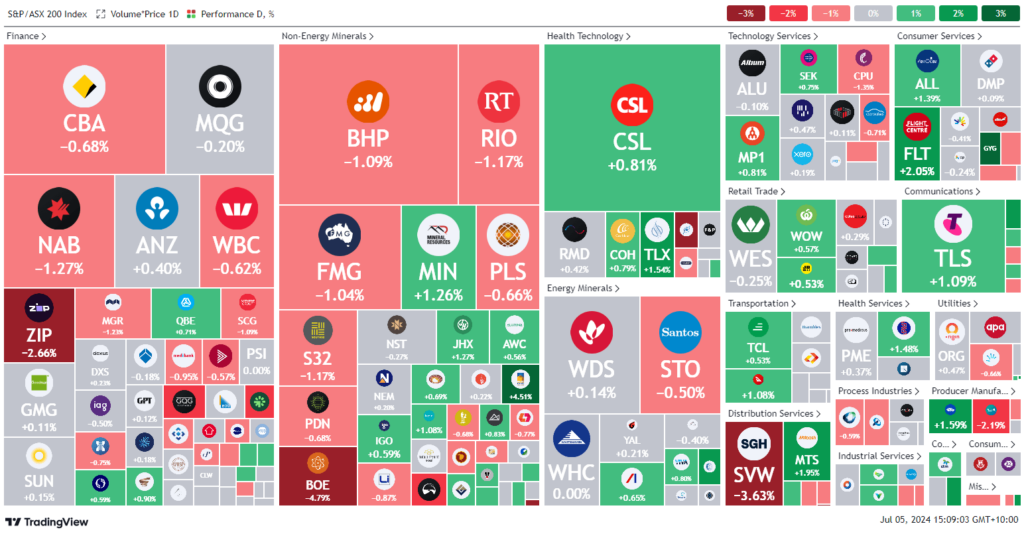

ASX 200 - 7,818.6 (-0.2%)

Key Highlights:

Australian shares edged down 0.1%, with mining and property stocks trimming recent gains. The healthcare sector outperformed, rising 0.5%, bolstered by gains in CSL, Cochlear, and ResMed. Bank shares declined, with CBA falling 0.5% and Westpac down 0.7%.

Saudi Aramco denied a Bloomberg report about a potential bid for gas giant Santos, stating, “such claims are inaccurate.” Consequently, Santos shares fell 0.8% to $7.93.

The Australian dollar reached its highest level since January 2, trading at 67.4 US cents, as traders speculated on a potential interest rate hike by the Reserve Bank of Australia in 2024. Iron ore futures surged to a nearly one-month high on optimism for increased demand from China.

GQG Partners hit a record high of $3.05, gaining 1.2% and up 77% in 2024, with a market value of around $8.9 billion. Magellan shares rose 5.8% to $9.54, building on a 6.1% gain from the previous day. Suncorp shares remained flat at $16.81 after confirming operating guidance for financial 2024 and announcing new reinsurance agreements for 2025.

Leaders

CUV – Clinuvel Pharmaceuticals Ltd (+14.90%)

VUL – Vulcan Energy Resources Ltd (+8.74%)

MSB – Mesoblast Ltd (+5.71%)

WAF – West African Resources Ltd (+4.91%)

MFG – Magellan Financial Group Ltd (+4.63%)

Laggards

CU6 – Clarity Pharmaceuticals Ltd (-4.81%)

BOE – Boss Energy Ltd (-4.67%)

SVW – Seven Group Holdings Ltd (-3.69%)

RDX – REDOX Ltd (-3.37%)

ZIM – Zimplats Holdings Ltd (-2.96%)