What's Affecting Markets Today

Asian markets higher

Asia-Pacific stock markets rallied on Monday, driven by a private survey indicating that China’s manufacturing activity expanded at its fastest pace in nearly two years. The Caixin survey reported a manufacturing PMI increase to 51.7 in May from 51.4 in April, surpassing the Reuters forecast of 51.5 and marking the highest growth since June 2022. This follows official data from Friday showing an unexpected contraction in China’s manufacturing sector for May.

Hong Kong’s Hang Seng index surged 2%, and mainland China’s CSI 300 edged up 0.22%. Investors are also closely watching India’s markets, where exit polls suggest Prime Minister Narendra Modi’s Bharatiya Janata Party-led alliance is poised for a third consecutive term.

In Japan, the Nikkei 225 climbed approximately 1%, with the Topix index up 0.86%. South Korea’s Kospi advanced 1.80%, and the smaller-cap Kosdaq increased by 0.26%.

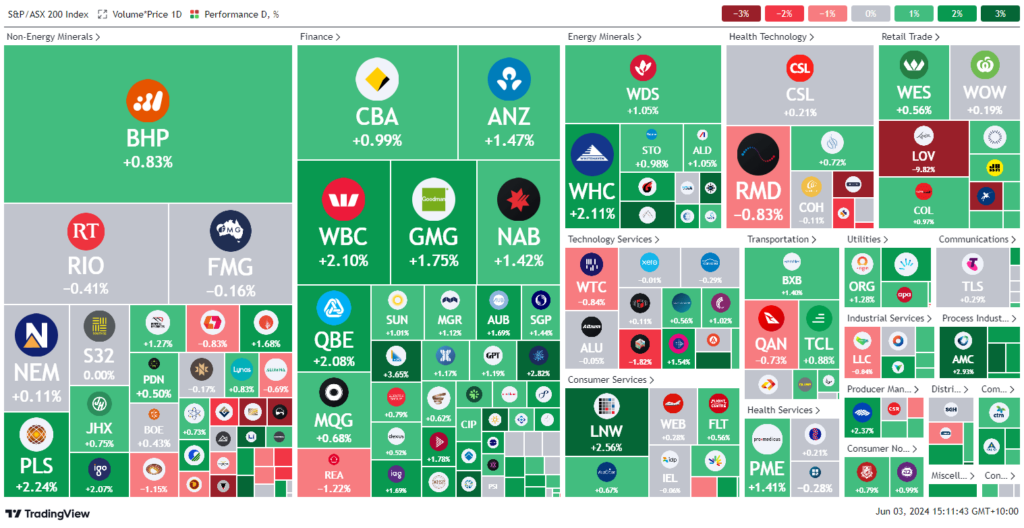

ASX Stocks

ASX 200 - 7,761.8 (+0.8%)

Key Highlights:

Australia’s sharemarket commenced June on a positive note, building on strong gains from the previous session. The S&P/ASX 200 rose by 55 points, or 0.7%, to 7757, following a 1% surge on Friday. This rebound came after a period of significant selling driven by a higher-than-expected inflation report, raising concerns about a potential rate hike from the Reserve Bank.

Energy stocks led the gains, climbing 1.3%, as OPEC+ extended production cuts while planning to reintroduce some oil later this year. Consequently, Brent crude prices fell 0.8% to below $81 USD. Woodside and Santos both saw increases of over 1%.

The Fair Work Commission announced a 3.75% minimum wage increase effective July 1.

Notable movements included Lovisa, which fell 9.1% to $30.82 following CEO changes, and Vulcan Energy Resources, which rose 4% to $4.93 after Gina Rinehart increased her stake. Galileo Mining surged 14.3% to 28¢ due to a joint venture with Mineral Resources, which gained 1% to $72.42.

Leaders

NGI Navigator Global 12.97%

APM APM Human Services Int 10.20%

DRO Droneshield Ltd 9.78%

VUL Vulcan Energy Resources 5.49%

SGF SG Fleet Group Ltd 4.92%

Laggards

WA1 WA1 Resources Ltd -13.02%

LOV Lovisa Holdings Ltd -9.67%

NEU Neuren Pharma Ltd -6.15%

SLR Silver Lake Resources Ltd -4.89%

RSG Resolute Mining Ltd -4.02%