What's Affecting Markets Today

Mineral Resources (MinRes) has agreed to sell its oil and gas assets in the Perth Basin to Gina Rinehart’s Hancock Prospecting in a $1.1 billion deal. This sale aligns with MinRes’s strategy to focus more on its core mining operations. Meanwhile, the company’s board is set to release findings from a long-running investigation into the tax affairs of managing director Chris Ellison, which has raised investor questions. Although the probe has been ongoing for over two years, MinRes maintains that it didn’t inform investors, citing no anticipated impact on share price.

In other ASX news, Corporate Travel Management’s (ASX: CTD) share price has risen by 9% to $12.89 after a positive market update at its annual general meeting. The company announced robust revenue growth in its “Rest of World” segment, with an expected 10% growth and an EBITDA margin increase from 23% to 27.5%. Given that this segment contributes 80% of the group’s revenue, the company forecasts strong profit growth for FY2025, setting a positive outlook for shareholders.

ASX Stocks

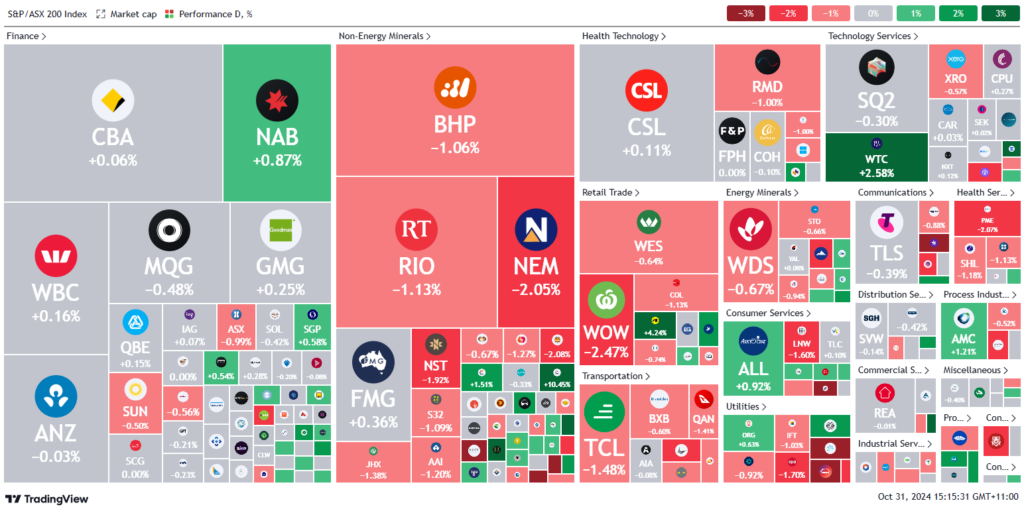

ASX 200 - 8,156.1 (-0.3%)

Key Highlights:

The S&P/ASX 200 Index fell 0.3% on Thursday, impacted by a decline in utilities and consumer staples. AGL Energy led losses in the utilities sector, dropping 5.3% after Barrenjoey downgraded its stock rating to underweight, citing the expiration of low-cost coal and gas contracts as a hit to future earnings. The consumer staples sector also struggled, with Woolworths down 2.3% and Coles slipping 1.1%. Coles reported a 2.9% sales increase in the September quarter, but this fell short of expectations.

Meanwhile, some consumer discretionary stocks performed well, including JB Hi-Fi, which rose 4.3% following strong third-quarter sales, particularly in New Zealand. Mineral Resources surged 10.6% after securing a $1.1 billion deal to sell its oil and gas assets to Hancock Prospecting. MinRes also announced it would soon conclude an investigation into the tax affairs of managing director Chris Ellison. Origin Energy saw a 0.6% increase in share price as it reported higher LNG revenue for the September quarter, despite a slight dip in production.

Leaders

MIN – Mineral Resources Ltd (+10.42%)

SYR – Syrah Resources Ltd (+9.82%)

STX – Strike Energy Ltd (+8.75%)

NXL – NUIX Ltd (+7.42%)

BRN – Brainchip Holdings Ltd (+6.67%)

Laggards

3PL – 3P Learning Ltd (-13.27%)

TBN – Tamboran Resources Corporation (-10.35%)

MEI – Meteoric Resources NL (-8.70%)

ASG – Autosports Group Ltd (-8.23%)

IMU – Imugene Ltd (-6.38%)