What's Affecting Markets Today

Asian markets advance

Asia-Pacific markets advanced on Friday as investors analyzed economic data from key regional economies. Japan’s industrial output unexpectedly declined by 0.1% in April, contrary to a Reuters poll forecast of a 0.9% rise. Core inflation in Tokyo met expectations, increasing by 1.9% in May. South Korea’s industrial production index outperformed, rising 2.2% month-on-month in April, surpassing the anticipated 1.1% increase.

In China, the manufacturing sector contracted in May, with the official purchasing managers index falling to 49.5 from 50.4 in April. Despite this, mainland China’s CSI 300 index rose by 0.4%, and Hong Kong’s Hang Seng index climbed 1.3%.

Japan’s Nikkei 225 increased by 0.41%, and the broader Topix index saw a gain of nearly 0.9%. South Korea’s Kospi also rose by 0.4%, although the smaller-cap Kosdaq dipped 0.22% after reversing earlier gains. The mixed data did not dampen overall market optimism in the region.

ASX Stocks

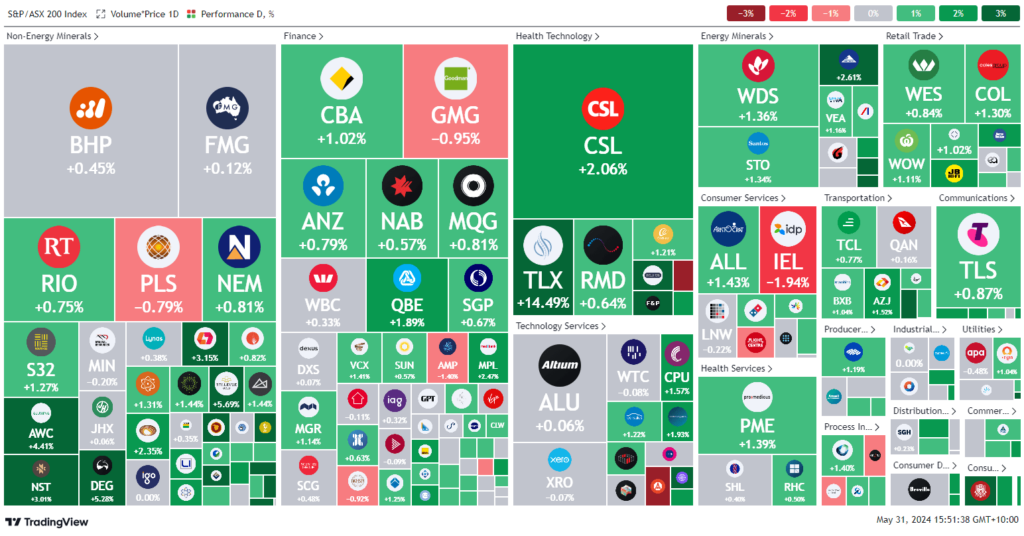

ASX 200 - 7,691.8 (+0.8%)

Key Highlights:

Australian shares rose 0.5% at lunchtime, buoyed by broad buying after a three-day sell-off triggered by hotter-than-expected April inflation data. Burritos chain Guzman y Gomez announced plans to list on the ASX in June with an enterprise valuation of 32.5 times its forecast FY25 EBITDA of $59.9 million.

All ASX sectors were higher, except for the interest rate-sensitive tech and property sectors. Tech shares tumbled following a sales miss from Salesforce on Wall Street. Gold miners performed strongly as gold prices increased to $US2343 an ounce, with Northern Star up 1.9% to $14.24 and Newmont rising 1.7% to $63.05.

The yield on one-year Australian bonds increased by 4 basis points to 4.42%, while the US 10-year note yield fell by 7 basis points to 4.55%.

Telix Pharmaceuticals surged 14.2% to $17.98 after a positive broker note from Wilsons. CRH received approval for its $2.1 billion buyout of Adbri, and Pro Medicus shares jumped 3.7% to a record $124.50. Namoi Cotton traded flat at 70¢ as Louis Dreyfus extended its bid deadline.

Leaders

TLX TELIX Pharmaceuticals Ltd 14.04%

CU6 Clarity Pharmaceuticals Ltd 8.78%

BGA Bega Cheese Ltd 7.74%

NXL NUIX Ltd 6.57%

MEZ Meridian Energy Ltd 6.07%

Laggards

EBO Ebos Group Ltd -5.24%

ERA Energy Resources of Australia Ltd -4.35%

MP1 Megaport Ltd -4.27%

VUL Vulcan Energy Resources Ltd -4.21%

OML Ooh!Media Ltd -3.62%