What's Affecting Markets Today

Asian markets mixed

Asia-Pacific markets showed mixed performance on Wednesday as investors awaited the Bank of Japan’s rate decision and evaluated China’s business activity data. The Bank of Japan is anticipated to raise rates to 0.1%, with some analysts predicting a larger hike. If raised, it will be the first time since 2010 that the rate exceeds 0.1%.

China’s factory activity contracted slightly in July, with the manufacturing PMI at 49.4, down from 49.5 in June but above the Reuters forecast of 49.3.

Japan’s Nikkei 225 fell 0.94% ahead of the BOJ decision, and the Topix declined 0.4%. Retail sales in Japan increased by 3.7% year-on-year in June, surpassing the expected 3.2% rise.

South Korea’s Kospi rose 0.17%, boosted by Samsung Electronics’ 1,458.2% year-on-year increase in Q2 operating profit. The Kosdaq remained nearly flat.

Hong Kong’s Hang Seng index gained 0.42%, while the mainland Chinese CSI 300 edged slightly lower.

Additionally, China’s securities regulatory commission replaced vice chairman Fang Xinghai with Li Ming, citing Fang’s retirement.

ASX Stocks

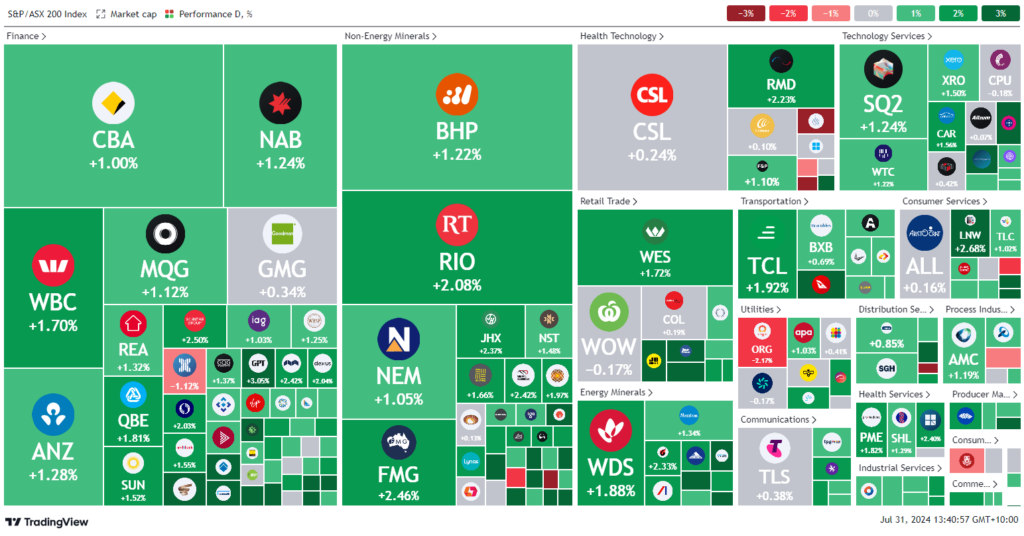

ASX 200 - 8,071.4 (+1.5%)

Key Highlights:

The Australian sharemarket extended its gains at midday as the quarterly inflation gauge met expectations, indicating that rising inflation had returned to predictable territory. The S&P/ASX 200 Index climbed 1.5%, or 119.7 points, to 8072.6, despite a mixed session on Wall Street where the Dow Jones closed higher, but the S&P 500 fell 0.5% and the Nasdaq dropped 1.3%.

The Australian Bureau of Statistics reported the consumer price index remained steady at 1% for the June quarter, matching the March quarter. Year-on-year, CPI increased to 3.8% from 3.6%, aligning with market forecasts.

Betashares chief economist David Bassanese noted the June quarter inflation data was “good enough” to rule out a rate hike by the Reserve Bank at its next meeting. However, he cautioned that the RBA might still raise rates later this year if inflation doesn’t decline further.

Meanwhile, Regional Express entered voluntary administration, grounding its domestic fleet of Boeing 737 aircraft and canceling flights between major airports.

Leaders

VUL Vulcan Energy Resources Ltd (+7.57%)

DYL Deep Yellow Ltd (+5.53%)

CRN Coronado Global Resources Inc (+4.98%)

NIC Nickel Industries Ltd (+4.66%)

TNE Technology One Ltd (+4.65%)

Laggards

RDX Redox Ltd (-3.69%)

GOR Gold Road Resources Ltd (-3.36%)

CU6 Clarity Pharmaceuticals Ltd (-3.14%)

TLX Telix Pharmaceuticals Ltd (-2.80%)

CCP Credit Corp Group Ltd (-2.17%)