What's Affecting Markets Today

Asian markets extend losses

Asia-Pacific markets extended losses on Thursday, mirroring Wall Street’s declines ahead of key regional economic data releases on Friday. Japan’s Nikkei 225 fell 1.6%, and the Topix index dropped 0.8%. South Korea’s Kospi shed 0.72%, while the Kosdaq slipped 0.3%. Both Japan and South Korea are set to release industrial production figures, while China will publish its official May purchasing managers index. Additionally, Tokyo’s inflation data will be revealed.

Hong Kong’s Hang Seng index and mainland China’s CSI 300 index hovered near the flatline.

Overnight in the U.S., major indexes fell under pressure from rising Treasury yields. The 10-year Treasury note yield rose for the second consecutive day, trading above 4.6%. Higher yields can reduce stock valuations, increase borrowing costs, curb consumer spending, and enhance the appeal of T-bills and money market funds. The Dow Jones Industrial Average fell 1.06%, the S&P 500 dipped 0.74%, and the Nasdaq Composite slipped 0.58%, with Nvidia mitigating further tech sector losses.

ASX Stocks

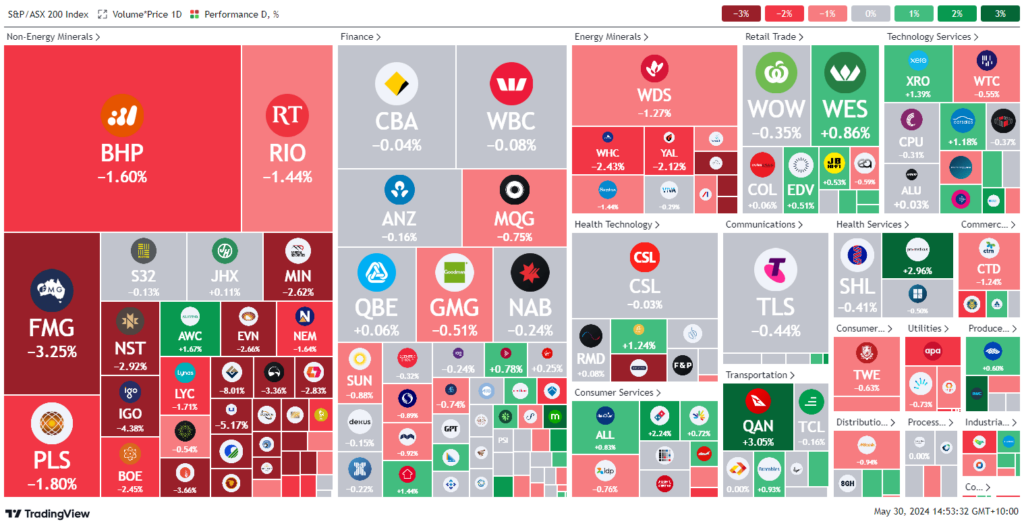

ASX 200 - 7,628.6 (-0.5%)

Key Highlights:

Australian shares have declined, mirroring New York’s downturn as concerns about interest rates dampen risk appetite. The S&P/ASX 200 fell 41 points, or 0.5%, to 7640, extending three-week lows after a hotter-than-expected inflation print. Shares have dropped over 2.5% in the past five sessions, with nine of the ASX’s 11 sectors falling, led by a 1.6% decline in mining stocks.

BHP Group shares fell 1.8% to $44.28 after deciding against a firm offer for Anglo American. Catapult Sports surged 12.9% to $1.75 following improved financial results, narrowing its net loss to $US19.1 million with an 18.5% increase in sales to $US100 million for the year ending March 31.

ASX-listed beef producers rose after China lifted its ban on Australian beef exports. Australian Agricultural Co climbed 1.8% to $1.34, while Elders gained 0.4% to $8.32. NRW Holdings jumped 4% to $3.02 after receiving a buy rating from Jarden analysts.

Leaders

APM APM Human Services Int 7.76%

WA1 WA1 Resources Ltd 3.81%

SGF SG Fleet Group Ltd 3.70%

NWH NRW Holdings Ltd 3.10%

CU6 Clarity Pharmaceuticals Ltd 3.04%

Laggards

MSB Mesoblast Ltd -8.13%

GMD Genesis Minerals Ltd -7.98%

RRL Regis Resources Ltd -5.73%

CMM Capricorn Metals Ltd -5.64%

LTR Liontown Resources Ltd -4.98%