What's Affecting Markets Today

Asian markets plummet

Japan’s benchmark indexes plummeted up to 5% on Friday, leading declines across Asia-Pacific markets following a Wall Street sell-off fueled by recession concerns. The Nikkei, extending Thursday’s 2.62% drop, hit its lowest level since February before paring losses to trade down 4.56%. The Topix index also trimmed its losses, ending 4.47% lower.

Major Japanese stocks were hit hard, with Softbank Group falling over 5%, trading giants Mitsui and Marubeni down more than 8% and 6%, respectively, and semiconductor firm Tokyo Electron dropping over 9%. Meanwhile, Japanese government bond yields declined, with the 10-year JGB yield falling below 1%.

In South Korea, the Kospi slid 3.19%, primarily due to weakness in banking stocks, while the Kosdaq fell 3.46%. However, K-pop stocks outperformed, led by Hybe, which surged after unveiling a new business strategy. Elsewhere, Hong Kong’s Hang Seng index fell 2%, and China’s CSI 300 saw a more modest decline of 0.66%.

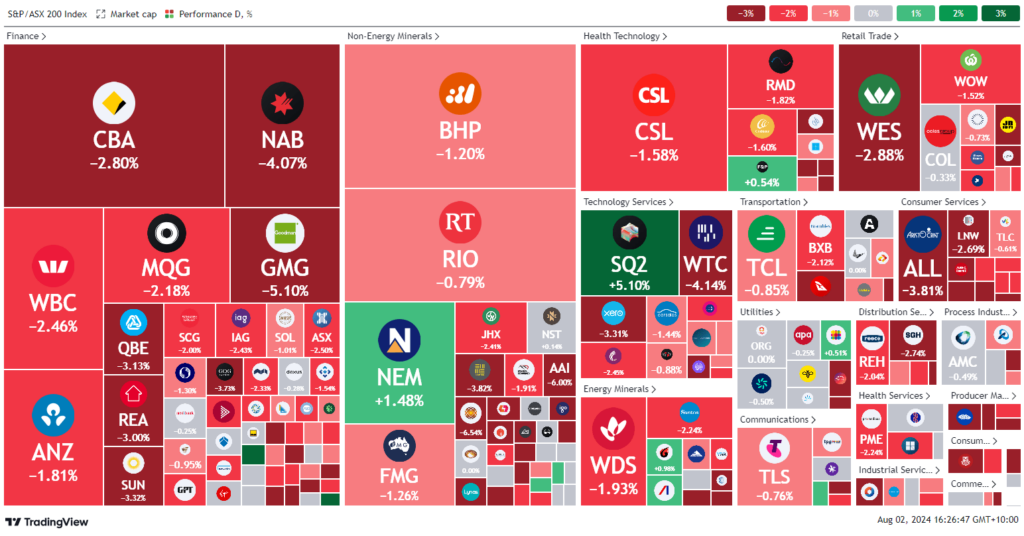

ASX Stocks

ASX 200 - 7,943.2 (-2.1%)

Key Highlights:

Australian shares experienced their largest one-day drop in 16 months, with the S&P/ASX 200 plummeting 2.1% or 171.1 points to 7943.60, following a sharp decline on Wall Street amid concerns that the Federal Reserve may be behind on cutting interest rates. This fall comes after the index reached a record high of 8114.7 just a day earlier. Despite the drop, the index remains on track for a 0.3% weekly gain, following a 4.2% rise last month.

All 11 sectors of the benchmark index ended in the red, with consumer and energy stocks leading the decline. Boss Energy was the biggest loser, down over 14%, while major banks and miners also faced significant losses. Woodside Energy and Santos both fell 1.7%, despite a slight recovery in oil prices. Block Inc. was a rare bright spot, gaining 5% after raising its full-year guidance and announcing a $US3 billion share buyback.

Leaders

SQ2 Block Inc (+4.94%)

WGX Westgold Resources Ltd (+4.91%)

PNI Pinnacle Investment Management Group Ltd (+4.74%)

LFG Liberty Financial Group (+4.14%)

SLC Superloop Ltd (+2.58%)

Laggards

DYL Deep Yellow Ltd (-18.85%)

NXG Nexgen Energy (Canada) Ltd (-13.34%)

BOE Boss Energy Ltd (-12.88%)

PDN Paladin Energy Ltd (-11.28%)

DMP Domino’s Pizza Enterprises Ltd (-9.17%)