What's Affecting Markets Today

Asian markets weaker despite stronger Nasdaq

The Asia-Pacific markets mostly fell on Tuesday, diverging from Wall Street where the Nasdaq Composite reached a new record, driven by gains in major tech stocks like Microsoft, Apple, and Nvidia. The Nasdaq advanced by 0.83% to end at 17,879.3.

Traders in Asia were closely watching South Korea’s inflation rate, which was reported at 2.4% for June, falling short of the expected 2.7% forecasted by economists polled by Reuters. This influenced South Korea’s Kospi, which declined by 0.84%, and the small-cap Kosdaq, which fell by 1.77%.

In Japan, the Nikkei 225 rose by 0.38%, and the Topix index increased by 0.78%. However, the Japanese yen weakened further to 161.67 against the dollar, a 38-year low. Mitsubishi Heavy Industries saw a significant gain of 4.87%, hitting a fresh all-time high and continuing a six-day winning streak.

Hong Kong’s Hang Seng index experienced a modest increase of 0.37%, while Mainland China’s CSI 300 was marginally lower.

ASX Stocks

ASX 200 - 7,720.0 (-0.3%)

Key Highlights:

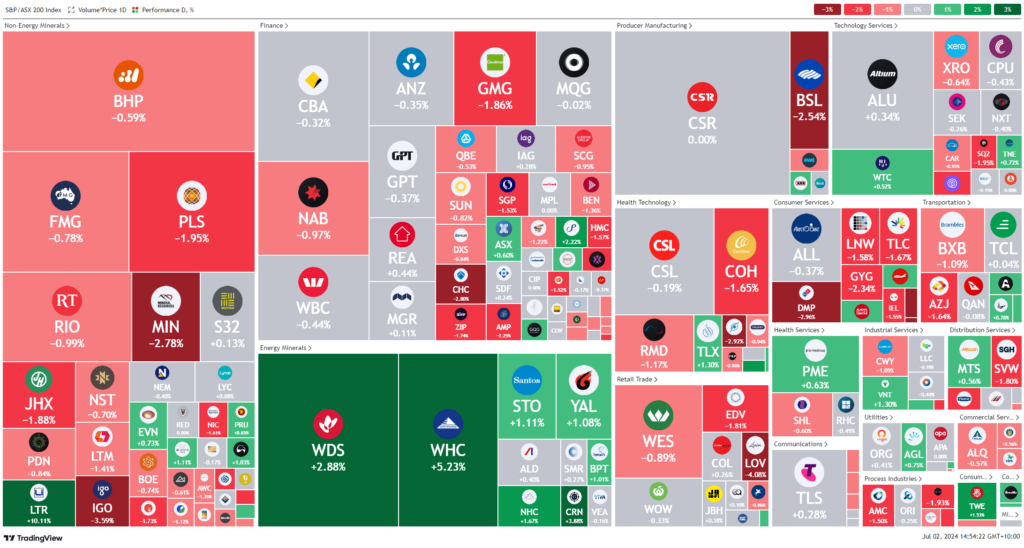

The ASX turned lower late in trading, with the S&P/ASX 200 down 0.1% to 7743.7 by 1:30 pm. Losses in banking and mining sectors offset gains from oil and coal producers. Major banks, including National Australia Bank and Commonwealth Bank, declined by 0.8% and 0.5% respectively. Real estate stocks fell 1.7%, with Goodman Group dropping 2.5%. Mining stocks decreased by 0.9%, led by iron ore and lithium miners.

Energy stocks gained 1.5% as oil prices remained near a two-month high amid geopolitical concerns. Woodside rose 2.3%, while coal stocks remained strong due to supply constraints.

The Reserve Bank of Australia discussed a potential rate hike, with a 70% chance of an increase by year-end according to ANZ.

Bendigo and Adelaide Bank dropped 1.6% as CEO Marnie Baker announced her departure. Ramelius Resources increased its stake in Spartan Resources, while Superloop’s shares rose 4.2% on strong earnings expectations. Liontown Resources surged 14.6% after securing $250 million in funding from LG Energy Solutions.

Leaders

LTR Liontown Resources Ltd 12.08%

DRO Droneshield Ltd 5.95%

WHC Whitehaven Coal Ltd 5.66%

CRN Coronado Global 5.04%

RSG Resolute Mining Ltd 4.81%

Laggards

MSB Mesoblast Ltd -5.25%

LOV Lovisa Holdings Ltd -4.08%

ABB Aussie Broadband Ltd -4.07%

SGR The Star Ent Group Ltd -3.54%

IGO IGO Ltd -3.42%