What's Affecting Markets Today

Asian markets fall after strong inflation in Australia

Asia-Pacific markets mostly declined on Wednesday as investors digested Australia’s April inflation figures and anticipated data from Japan. Australia’s weighted CPI rose 3.6% year-on-year in April, surpassing the 3.4% forecast by a Reuters poll and the 3.5% reported in March.

ING analysts noted, “One more bad inflation report from Australia, and we will consider removing the final cut pencilled in by the RBA for Q4. Two more, and we may consider adding a rate hike.”

Following the CPI announcement, the Australian S&P/ASX 200 fell nearly 1%.

Japan’s Nikkei 225 dropped 0.41%, and the Topix declined 0.48%, reversing gains from the market open. South Korea’s Kospi decreased by 0.9%, and the Kosdaq fell 0.75%.

Hong Kong’s Hang Seng index slid 1.35%, while mainland China’s CSI 300 gained 0.35%.

ASX Stocks

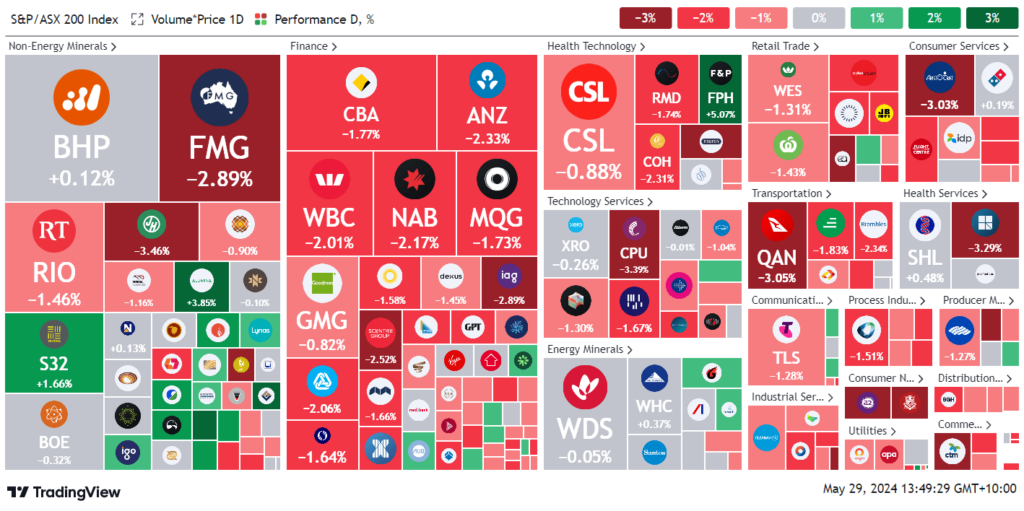

ASX 200 - 7,662.5 (-1.3%)

Key Highlights:

Australian shares slumped 1% to a three-week low as April’s CPI unexpectedly accelerated to 3.6% year-on-year, from 3.5% in March, surpassing economists’ expectations of 3.4%. This reinforced expectations that the cash rate won’t be cut soon.

The S&P/ASX 200 dropped 79.2 points to 7687.5, following a 0.3% fall on Tuesday. The All Ords also fell 1%. All 11 sectors declined, led by consumer staples and industrials. Mining giants weakened, with iron ore futures falling 1.2% to $US117.90 a tonne. Fortescue dropped 2.1%, Rio Tinto shed 1.3%, while BHP edged up 0.1% ahead of a potential deal with Anglo American.

Lendlease eased 0.4% after announcing a $4.5 billion plan to focus on Australian operations. Major banks faltered, and insurance giant IAG fell 2.3% due to a class-action lawsuit over home insurance policy discounts.

Data#3 surged 4% after Morgan Stanley upgraded the stock to “overweight” citing AI benefits. The Australian dollar and bond yields rose after the inflation report, with the $A briefly hitting US66.65¢. Traders increased the probability of the Reserve Bank lifting the cash rate to 4.6% this year.

Notable movers included Fisher & Paykel, up 4.7%, and Fonterra, up 4%. Ramelius fell 2.9% amidst a dispute involving Westgold Resources, which rose 7%.

Leaders

FPH Fisher & Paykel Healthcare Corp 5.15%

WGX Westgold Resources Ltd 4.88%

APM APM Human Services Int 4.53%

GMD Genesis Minerals Ltd 4.32%

RSG Resolute Mining Ltd 4.25%

Laggards

NEU Neuren Pharmaceuticals Ltd -11.03%

RMS Ramelius Resources Ltd -4.98%

CTT Cettire Ltd -4.73%

CNI Centuria Capital Group -4.60%

ADT Adriatic Metals Plc -4.55%