What's Affecting Markets Today

Rex Enters Trading Halt

Regional Express, known as Rex, has paused trading after weekend reports indicated that the airline engaged Deloitte’s restructuring services. This development follows Rex’s recent decision to remove its executive chairman and major shareholder, Lim Kim Hai. In response, Lim has threatened to overthrow the board, with allies reportedly holding more than 50% of the airline’s shares. The turmoil has placed Rex under intense scrutiny, as the company navigates through significant internal conflict and potential restructuring to stabilize its operations and governance.

Pacific Smiles Gets Revised Offer from Genesis

Pacific Smiles Group has received a revised acquisition proposal from Genesis Capital, offering $1.90 per share via a scheme of arrangement. The new proposal allows Pacific Smiles shareholders the option to receive all or part of the consideration in scrip. The board, along with its advisers, is currently evaluating the offer. Previously, in April, Pacific Smiles had agreed to a deal with NDC BidCo for $1.911 per share, pending certain conditions. Despite the new offer from Genesis, the board continues to unanimously recommend the NDC Scheme, maintaining their initial agreement stance.

Oil Posts Largest Weekly Decline Since Beginning of May

Oil prices dropped significantly as algorithmic traders capitalized on market uncertainty, juxtaposed with mixed signals regarding Chinese demand and US stockpiles. West Texas Intermediate settled near $US77 a barrel, marking the steepest weekly decline since early May. The market has been under pressure from trend-following commodity trading advisers and a broader equity market retreat. Concerns over Chinese economic growth, despite Beijing’s rate cuts, have also contributed to the decline. Meanwhile, US inventories fell for the fourth consecutive week, but this expected drawdown has not been enough to stimulate buying, leaving futures in a narrow trading band.

ASX Stocks

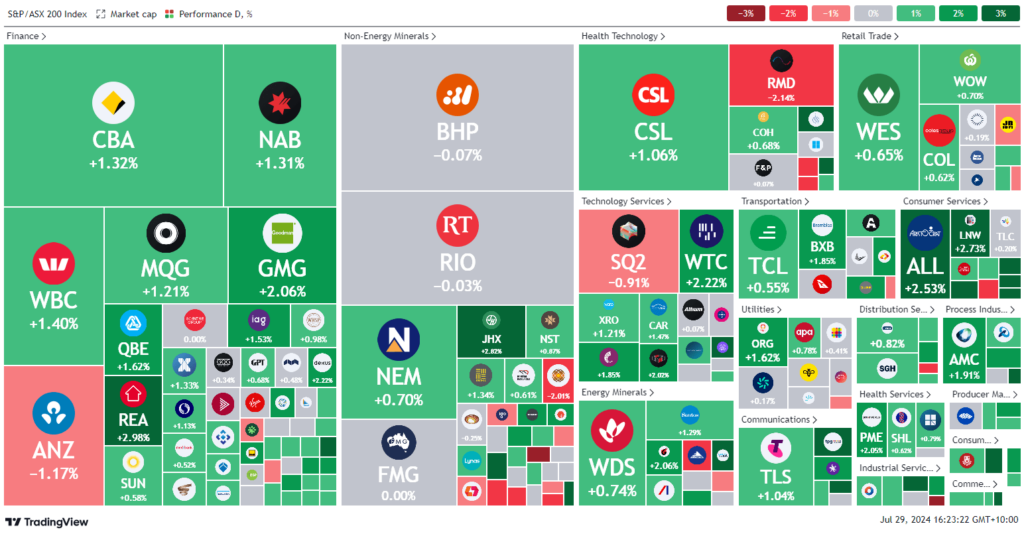

ASX 200 - 7,989.6 (+0.9%)

Key Highlights:

The Australian sharemarket experienced broad gains, driven by a positive rebound on Wall Street following inflation data, suggesting the US Federal Reserve may lower interest rates. The S&P/ASX 200 Index rose by 0.8%, or 63.8 points, reaching 7985.1, with all 11 sectors posting gains. Technology and energy stocks led the advance, with WiseTech and Xero notably rising. Property stocks also performed well, including Goodman Group and Vicinity Centres.

Monday’s stable session is likely to precede increased volatility as investors await crucial quarterly inflation data, which could influence the Reserve Bank’s interest rate decisions. June quarter inflation data, set for release on Wednesday, is anticipated to show a 1% quarterly increase and a 4% year-on-year rise. A higher figure could pressure the RBA to raise the cash rate beyond 4.35%.

In focus, Fletcher Building dropped 6% due to anticipated operational issues impacting FY2025 earnings. Pacific Smiles Group gained 2.2% following a revised acquisition proposal from Genesis Capital. Adore Beauty rose 1.1% after appointing Sacha Laing as CEO. Kogan fell 2% after earlier gains, reporting a slight decline in gross sales but a rise in gross profit. Additionally, Lark Distilling Co and Regional Express halted trading for company-specific reasons.

Leaders

SGR – The Star Enter. Ltd (+14.22%)

ERA – Energy Resou. Ltd (+9.38%)

OPT – Opthea Ltd (+7.32%)

ENR – Encounter Resources Ltd (+6.56%)

CU6 – Clarity Pharmaceuticals Ltd (+5.87%)

Laggards

SKO – Serko Ltd (-8.01%)

ONE – Oneview Healthcare Plc (-7.50%)

HTA – Hutchison Telecommunications (Australia) Ltd (-6.67%)

FBU – Fletcher Building Ltd (-5.81%)

MSB – Mesoblast Ltd (-4.89%)