What's Affecting Markets Today

Fisher & Paykel Disappoints with Flat Guidance

Fisher & Paykel Healthcare reported half-year profits and revenues at the lower end of expectations, disappointing investors anticipating an upgrade due to strong demand for its respiratory care products. The company maintained its FY2025 net profit guidance of $NZ320-$NZ370 million and revenue forecasts, triggering a 4% drop in its New Zealand-listed shares. While growth was supported by recovering hospital patient numbers, analysts noted that the results fell short of earnings per share forecasts. Wilsons Advisory expressed frustration over the lack of a guidance upgrade, highlighting the company’s missed opportunity to exceed market expectations.

Pro Medicus Surges on $330M Contract

Healthcare imaging software developer Pro Medicus saw its shares jump 9.4% to $249.94 after announcing a $330 million, 10-year deal with Trinity Health, a major U.S. not-for-profit organization. The contract, managed through its subsidiary Visage Imaging, will migrate Trinity’s legacy systems to the Visage 7 platform. Trinity Health, Pro Medicus’ largest client to date, operates 93 hospitals, 107 continuing care locations, and 142 urgent care sites across 26 states. CEO Dr. Sam Hupert emphasized the importance of the partnership, which solidifies Pro Medicus’ presence in the U.S. healthcare market and positions it as a leader in imaging solutions.

ASX Stocks

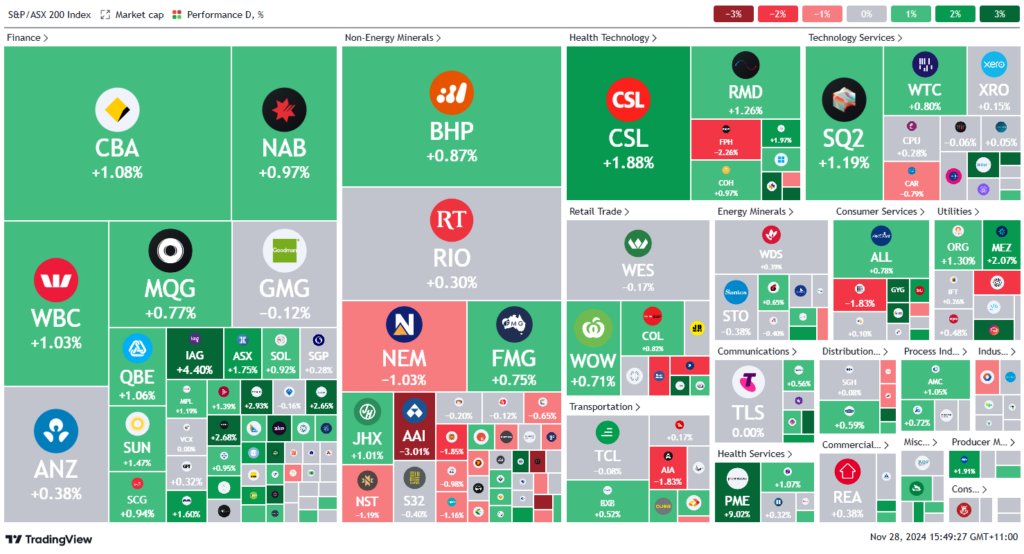

ASX 200 - 8,469.7 (+0.7%)

Key Highlights:

The S&P/ASX 200 Index hit a record high, rising 0.7% to 8466.7, led by strength in banking and healthcare stocks. Commonwealth Bank climbed 0.7% to $158.87, while CSL, Pro Medicus, and ResMed gained over 1% each. This occurred despite a weak lead from Wall Street, where the Dow Jones, S&P 500, and Nasdaq fell 0.3%, 0.4%, and 0.6%, respectively, following disappointing earnings from Dell and HP, which both dropped 12%. US inflation data exceeded expectations for the second month, raising the possibility of the Federal Reserve maintaining interest rates, although markets still anticipate a potential quarter-point hike. Bitcoin rebounded above $US97,000, driving crypto stocks higher, with Sydney-based miner Iren surging 32%.

Among individual stocks, IAG rose 3.8% to $8.49 after announcing an $855 million acquisition of RACQ’s insurance underwriting business. AVJennings nearly doubled to 65¢ after receiving a $370 million buyout offer from Proprium Capital and Avid Property Group. Dexus advanced 1.3% following the $443.2 million sale of two office properties, while Star Entertainment slid 2.4% after reporting a $27 million loss.

Leaders

ERA – Energy Resources of Australia Ltd (+50.00%)

IMR – Imricor Medical Systems Inc (+14.02%)

CEN – Contact Energy Ltd (+9.04%)

PME – Pro Medicus Ltd (+9.04%)

AQZ – Alliance Aviation Services Ltd (+7.66%)

Laggards

HUM – Humm Group Ltd (-12.90%)

TTT – Titomic Ltd (-8.51%)

NVX – Novonix Ltd (-7.95%)

PYC – PYC Therapeutics Ltd (-7.75%)

RHI – Red Hill Minerals Ltd (-7.03%)