What's Affecting Markets Today

Copper and Base Metals Retreat

Copper and other base metals experienced a decline on Tuesday as the US dollar strengthened following President-elect Donald Trump’s announcement of additional tariffs. Trump’s posts on Truth Social, indicating plans for a 10% tariff on Chinese goods and 25% levies on imports from Mexico and Canada, led to a 0.7% increase in the Bloomberg Dollar Spot Index and a drop in Asian shares. This development has added to the existing pressure on base metals since Trump’s election victory, which had already sparked a dollar rally. The stronger dollar makes metals more expensive for many buyers, while concerns over potential trade disputes and weak demand from China, the top consumer of metals, have further weighed on prices. As a result, copper fell 0.6% to $8993.5 per ton on the London Metal Exchange, with aluminum and nickel also experiencing declines.

Bitcoin’s $100,000 Milestone Slips Away

In the cryptocurrency market, Bitcoin’s attempt to reach the $100,000 milestone has been thwarted, marking its longest losing streak since Trump’s election victory. The digital asset completed a three-day drop of approximately 6% through Monday, settling at $94,245. This cooling of enthusiasm comes despite the crypto market’s overall $1 trillion gain since election day on November 5. Trump’s recent posts about additional tariffs have contributed to a bout of risk aversion in the crypto market, with US equity futures falling and the dollar strengthening. Despite this setback, some industry experts remain optimistic about the bullish market sentiment continuing into 2025, viewing the current situation as a temporary profit-taking opportunity rather than a long-term trend reversal.

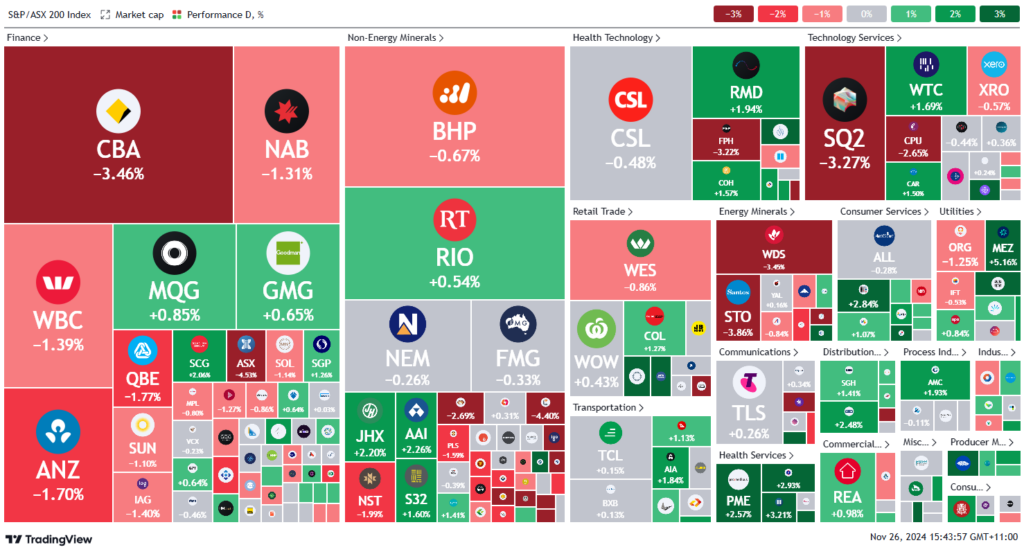

ASX Stocks

ASX 200 - 8,367.6 (-0.6%)

Key Highlights:

The Australian sharemarket retreated on November 26, 2024, with the S&P/ASX 200 Index falling 0.4% to 8485 points, pulled back from Monday’s record close. The decline was primarily triggered by President-elect Donald Trump’s announcement of new tariffs on Chinese, Canadian, and Mexican goods. This news led to a sell-off in energy stocks and banks, with the financial sector dropping 1.5%. The Australian dollar hit a four-month low as the US dollar strengthened.

Despite the overall downturn, some stocks benefited from the tariff news. BlueScope Steel, a US supplier, surged 6.7% to $22.71, while technology stocks gained 1%. Notable individual performances included EML Payments soaring 25% on strong earnings, ASX Ltd falling 3.2% after delaying a system upgrade, and Ramsay Healthcare rising 4% on a positive outlook. The market’s reaction reflected investor caution in response to potential trade tensions and global economic uncertainties.

Leaders

EML – EML Payments Ltd (+27.01%)

ERA – Energy Resources of Australia Ltd (+25.00%)

GTK – Gentrack Group Ltd (+24.57%)

MCY – Mercury NZ Ltd (+9.43%)

360 – LIFE360 Inc (+6.67%)

Laggards

SPR – Spartan Resources Ltd (-6.41%)

OBM – Ora Banda Mining Ltd (-6.29%)

SKC – Skycity Entertainment Group Ltd (-6.16%)

WBT – Weebit Nano Ltd (-6.10%)