What's Affecting Markets Today

Asia-Pacific markets traded higher on Wednesday, mirroring gains on Wall Street amid expectations that upcoming U.S. tariffs under President Donald Trump may be narrower in scope than previously feared.

Australia’s S&P/ASX 200 opened 0.71% higher. Japan’s Nikkei 225 rose 0.63%, while the broader Topix gained 0.39%. South Korea’s Kospi added 0.38%, although the tech-focused Kosdaq slipped 0.28%. Thailand’s SET Index climbed 0.4% following Prime Minister Paetongtarn Shinawatra’s successful no-confidence vote.

Hong Kong’s Hang Seng Index rose 0.75%, while the Hang Seng Tech Index advanced 0.84%, hovering near correction territory. China’s CSI 300 traded flat.

Market sentiment was supported by reports from The Wall Street Journal and Bloomberg, indicating the White House’s April 2 tariffs may be limited, with Trump hinting at potential “flexibility” for trade partners. However, Morning Consult warned that U.S. consumer confidence is weakening, with rising inflation and labor market concerns expected to dampen spending across income levels.

On Wall Street, all three major U.S. indices extended gains. The S&P 500 rose 0.16%, the Nasdaq gained 0.46%, and the Dow edged up just 0.01%.

ASX Stocks

ASX 200 - 8,0002.5 (+0.80%)

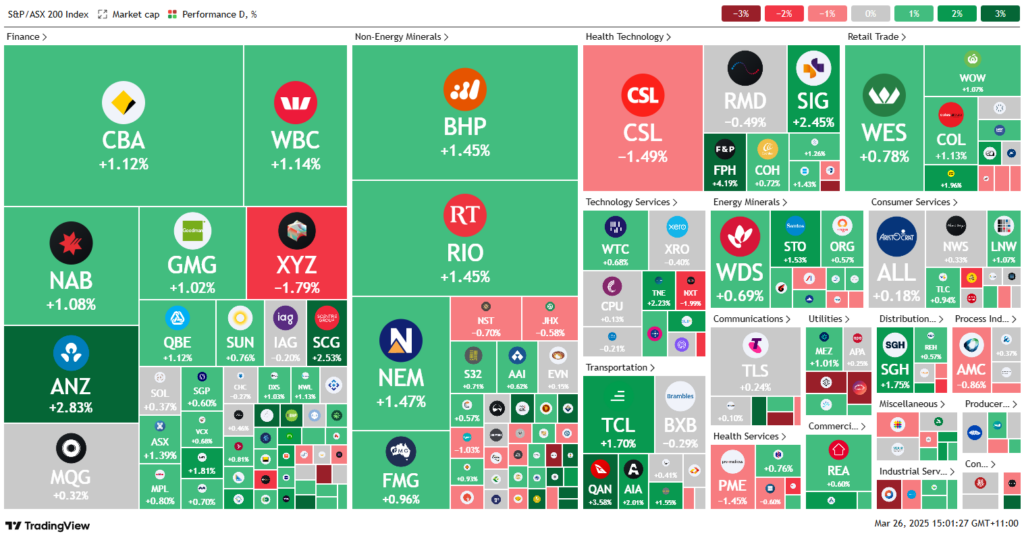

The ASX advanced on Wednesday, driven by a risk-on rally in banks and miners. The S&P/ASX 200 rose 0.9% (68.8 points) to 8011.3 by 2pm, breaking above 8000 for the first time in two weeks. The All Ordinaries climbed 0.8%, with eight of 11 sectors in positive territory, led by financials.

Investor sentiment improved following gains on Wall Street, where the S&P 500 added 0.2%, supported by Apple and Tesla. Locally, optimism was reinforced by the federal budget, which major banks said would not disrupt the RBA’s potential easing cycle.

Bank stocks surged on a combination of falling CPI, upbeat economic outlook, and positive momentum from US peers. ANZ rose 3.2%, and Commonwealth Bank gained 1.6%. CPI for February eased to 2.4% annually, below expectations.

Miners also rallied, with BHP and Rio Tinto up 1.5% and 1.7%, respectively. Energy producers rose on stronger oil prices, with Brent crude surpassing US$73. Woodside and Santos added over 1% each.

Key movers included Vulcan Energy (+11%), Paladin Energy (-11.4%), and Tuas (-18.3%).

Leaders

VUL Vulcan Energy (+11.16%)

RMS Ramelius Resources Ltd (+5.81%)

WA1 WA1 Resources Ltd (+5.45%)

SPR Spartan Resources Ltd (+4.65%)

FPH Fisher & Paykel (+4.47%)

Laggards

TUA Tuas Ltd (-12.44%)

PDN Paladin Energy Ltd (-11.19%)

MCY Mercury NZ Ltd (-5.39%)

NEU Neuren Pharmaceuticals Ltd (-4.83%)

DGT Digico Infrastructure REIT (-4.00%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!