What's Affecting Markets Today

Bond yields jump on rising rate increase bets

Australian bond yields surged on Thursday as traders anticipated the Reserve Bank might raise interest rates in August following hotter-than-expected inflation data on Wednesday. Money market traders estimate a 40% chance of a 0.25% rate hike in August, increasing to 60% by September. The yield on one-year Australian government bonds rose by 9 basis points to 4.53%, now 18 basis points above the central bank’s overnight cash rate of 4.35%. Additionally, the yield on 10-year government bonds climbed 14 basis points to 4.46%.

Yen’s free fall exposes the Fed’s grip on markets

Japanese authorities are facing the harsh reality that the yen’s plummet will not halt until the US Federal Reserve changes its stance on maintaining higher interest rates for an extended period. This sentiment is echoed by global investors, who see the strong dollar as a consequence of high US borrowing costs, impacting global markets. In the $11.3 trillion global currency market, the yen’s decline highlights the US’s financial dominance. Andrew Brenner of NatAlliance Securities explains that the Fed’s high rates attract money to the US, keeping the dollar strong, which poses significant problems for Japan.

ASX Stocks

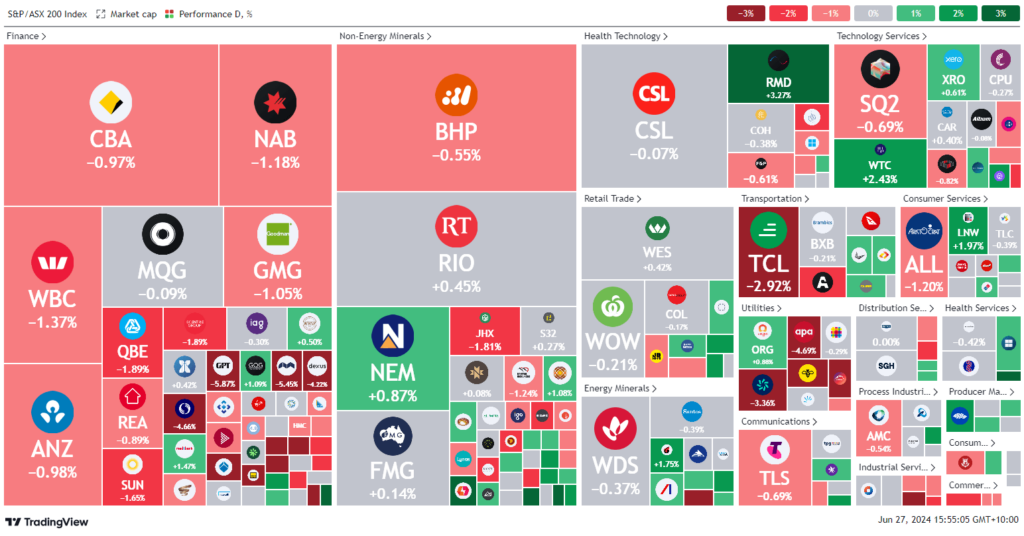

ASX 200 - 7,739.2.0 (-0.60%)

Key Highlights:

Australian shares fell 1.1% by midday following higher-than-expected inflation data for May, which showed a 4% annual increase. The real estate sector, the worst performer, dropped 2.4% as traders anticipated a possible rate hike by the Reserve Bank in August. Financials, led by major banks, declined by 1.5%, with Commonwealth Bank falling 1.6% to $124.92. NAB’s economics team now expects the RBA to delay the first rate cut until May 2025, forecasting a steady rate reduction to 3.10% by mid-2026.

On Wall Street, tech stocks surged, driven by Apple, Amazon, and Tesla, while Micron Technology fell nearly 6% after disappointing sales forecasts. The Federal Reserve announced that all 31 US banks passed the annual stress test, indicating their readiness to withstand a severe recession.

In focus, Baby Bunting’s shares soared 23% to $1.52 after reporting improved sales and a positive profit forecast despite ongoing challenges like the rental crisis and declining birth rates. Southern Cross Media rejected a takeover bid from Australian Community Media for some of its broadcast assets, citing misalignment with its audio strategy. Additionally, Qatar is in talks to acquire up to a 20% stake in Virgin Australia, amidst a stalled ASX float process.

Leaders

ENR – Encounter Resources Ltd (+11.61%)

MAU – Magnetic Resources NL (+7.35%)

SYA – Sayona Mining Ltd (+7.14%)

SGR – The Star Enter. Group Ltd (+6.45%)

CTT – Cettire Ltd (+6.40%)

Laggards

IMM – Immutep Ltd (-24.14%)

JDO – Judo Capital Holdings Ltd (-7.84%)

DXB – Dimerix Ltd (-6.42%)

KSC – K & S Corporation Ltd (-6.25%)

GOZ – Growthpoint Properties AU (-6.03%)