What's Affecting Markets Today

Asian Markets Rebound

Asia-Pacific markets mostly rebounded Friday after Thursday’s sell-off hit regional indexes hard. In Asia, traders evaluated July inflation data from Tokyo, a key indicator of nationwide trends. Tokyo’s headline inflation eased slightly to 2.2% in July from 2.3% in May, while core inflation, excluding fresh food prices, remained steady at 2.2%. The “core-core” inflation rate, excluding fresh food and energy, fell to 1.5% from 1.8%, watched closely by the Bank of Japan.

The yen strengthened against the dollar, trading at 153.79. Japan’s Nikkei 225 remained flat, while the Topix rose 0.2%. Renesas Electronics led losses, plunging over 8% after a 29% drop in net profit for H1 2024, attributed to misjudged industrial equipment demand.

Nissan fell 4.04% following dismal Q1 results, with operating profit down over 99% and net profit down 72.9%. Conversely, Honda gained 1.58% after announcing plans to shutter a factory in China and shift to electric vehicle production.

ASX Stocks

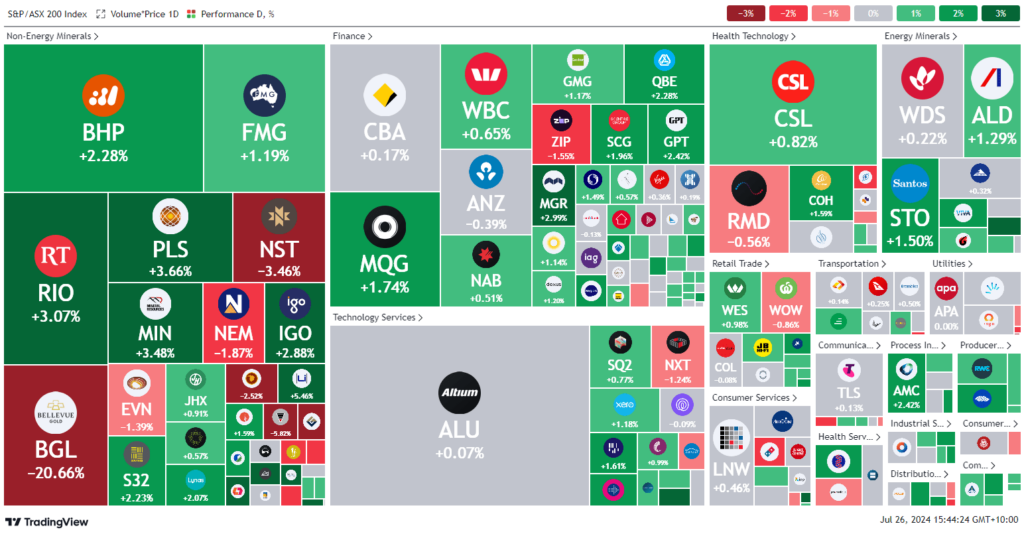

ASX 200 - 7,923.7 (+0.8%)

Key Highlights:

The Australian sharemarket advanced at midday, recovering some earlier losses. The S&P/ASX 200 Index rose 0.9%, or 69.4 points, to 7930.6, with nine of the 11 sectors trading in the green. The Australian dollar steadied at US65.5¢ after a week of selling.

This follows a 1% slump on Thursday, the largest in six weeks, driven by lower commodity prices and heavy selling on Wall Street.

The materials sector performed strongly, rising 1.8%. BHP gained 2.4% and Fortescue Metals increased 1.7%, supported by a 1.9% rise in iron ore futures to $US101.55 a tonne.

Mineral Resources jumped 6.1% after confirming it was on track to meet its FY24 production guidance, with volumes up 9% year-on-year to 269 metric tons.

Energy stocks also rose, with Ampol up 1.9% and Santos gaining 1.8% as oil prices increased for a third session.

Conversely, Nine shares dipped as publishing staff voted to strike. Bellevue Gold shares plunged 23% following a $150 million institutional placement at a 15.3% discount.

Leaders

SNL: Supply Network Ltd (+7.45%)

KAR: Karoon Energy Ltd (+5.75%)

LTR: Liontown Resources Ltd (+5.46%)

CRN: Coronado Global Inc (+5.32%)

SGR: The Star Ent Group Ltd (+5.05%)

Laggards

BGL: Bellevue Gold Ltd (-20.90%)

RED: RED 5 Ltd (-6.33%)

DRO: Droneshield Ltd (-4.53%)

AIZ: Air New Zealand Ltd (-3.67%)

NST: Northern Star Resources Ltd (-3.39%)