What's Affecting Markets Today

Asian Markets continue slide

Japan’s Nikkei 225 extended its six-day losing streak, plummeting 3% and leading losses among Asian indexes following a broad sell-off triggered by Wall Street’s overnight tumble. Key index member SoftBank Group dropped 7%, while Renesas Electronics led losses, falling over 14%. The broader Topix decreased by 2.24%. The yen strengthened for the fourth consecutive day, reaching an 11-week low of 152.28 against the U.S. dollar.

Reuters reported that the Bank of Japan might discuss a rate hike and plans to halve its bond buying at its monetary policy meeting on July 30-31. Additionally, a Japanese government panel agreed to raise the average minimum hourly wage by 5% to 1,054 yen ($6.90), providing more room for a rate increase amid rising wages.

South Korea’s Kospi dropped 1.8%, with the Kosdaq down 2.32%. SK Hynix fell 6% despite reporting record Q2 revenue and profits. Hong Kong’s Hang Seng index fell 1.65%, and China’s CSI 300 declined 0.98%. China’s central bank cut the medium-term facility lending rate to 2.3% from 2.5% to stimulate the economy.

ASX Stocks

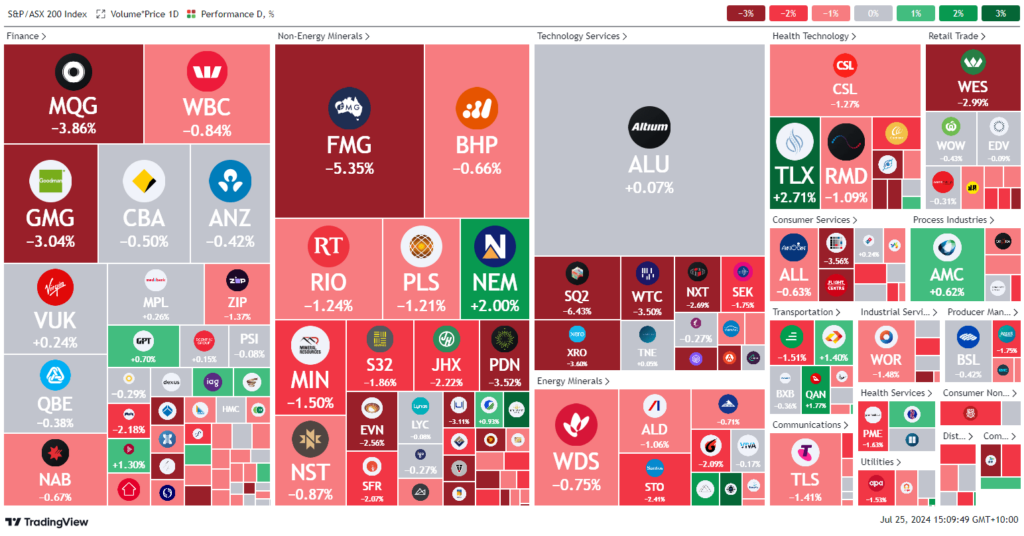

ASX 200 - 7,871.3 (-1.2%)

Key Highlights:

Australian shares fell by 1 per cent at midday, with losses across all sectors. Mining stocks continued to decline due to concerns over China’s economy.

Macquarie Group reported that weak performance in its investment banking division led to a lower-than-expected quarterly earnings result. The financial services giant maintained a cautious outlook, and its stock dropped 3.5 per cent to $201.48. “The update appears worse than anticipated, with implied NPAT performance down year-on-year,” Macquarie commented.

The technology sector was the worst performer, declining 2.7 per cent, with Block, the owner of Afterpay, plunging 6 per cent.

ANZ Bank provided an update on investigations into its data reporting processes, a 2023 bond transaction, and conduct issues in its Sydney dealing room.

Seek wrote down the value of its Chinese marketplace Zhaopin by $141 million, attributing it to China’s weak economy. Shares fell 3 per cent to $19.92. Fortescue Metals lost 3.6 per cent to $20.55, while Newmont rose 1.3 per cent to $72.31.

Leaders

CRN: Coronado Global Res (+6.00%)

TLX: TELIX Pharmaceuticals Ltd (+3.00%)

NEM: Newmont Corporation (+2.20%)

GNE: Genesis Energy Ltd (+2.00%)

PGF: PM Capital Global Opp (+1.75%)

Laggards

RRL: Regis Resources Ltd (-9.16%)

MSB: Mesoblast Ltd (-8.17%)

WA1: WA1 Resources Ltd (-7.11%)

SQ2: Block Inc (-6.48%)

FMG: Fortescue Ltd (-5.37%)