What's Affecting Markets Today

Investors Bet That Nvidia Will Leave Magnificent Seven Rivals Behind

Nvidia has solidified its dominance among Wall Street’s elite after its latest earnings exceeded analyst expectations, suggesting it has outpaced its magnificent seven peers. The company announced bullish forecasts, reinforcing its position as the leading beneficiary of AI spending, with tech giants like Microsoft and Google increasingly relying on its AI accelerators. CEO Jensen Huang declared that “the next industrial revolution has begun.” Nvidia’s stellar first-quarter results justified the bullish investor sentiment, which had already driven the stock up 92% this year. The rapid profit acceleration pushed its shares 6% higher in after-hours trading.

Japan’s Inflation Cools as BoJ Waits for Wage Gains to Kick In

Japan’s inflation cooled for a second month but remained above the Bank of Japan’s (BoJ) 2% target due to the yen’s depreciation. Consumer prices, excluding fresh food, rose 2.2% in April from a year earlier, matching analysts’ estimates. The primary factors were a slowdown in processed food price gains and lodging costs. A deeper inflation measure excluding fresh food and energy prices also cooled to 2.4%. Despite these results, the BoJ may continue its easy policy settings, as the yen stays near a 34-year low. However, upcoming wage increases, which exceed 5%, may spur future spending and prices.

US Bond Yields Rise as Rate Cuts Seen Delayed

US Treasury yields surged as data showing strong US business activity and a tight labor market led traders to delay expectations for Federal Reserve rate cuts until the end of the year. The two-year yield, sensitive to Fed policy, rose over 8 basis points to 4.955%, its highest since May 2. Yields across maturities increased, causing the yield curve to flatten. Data showed US business activity accelerated at the fastest pace in two years, and initial unemployment benefit applications fell. This led to the expectation of a full quarter-point rate cut in December, with fewer cuts in 2024 compared to earlier predictions.

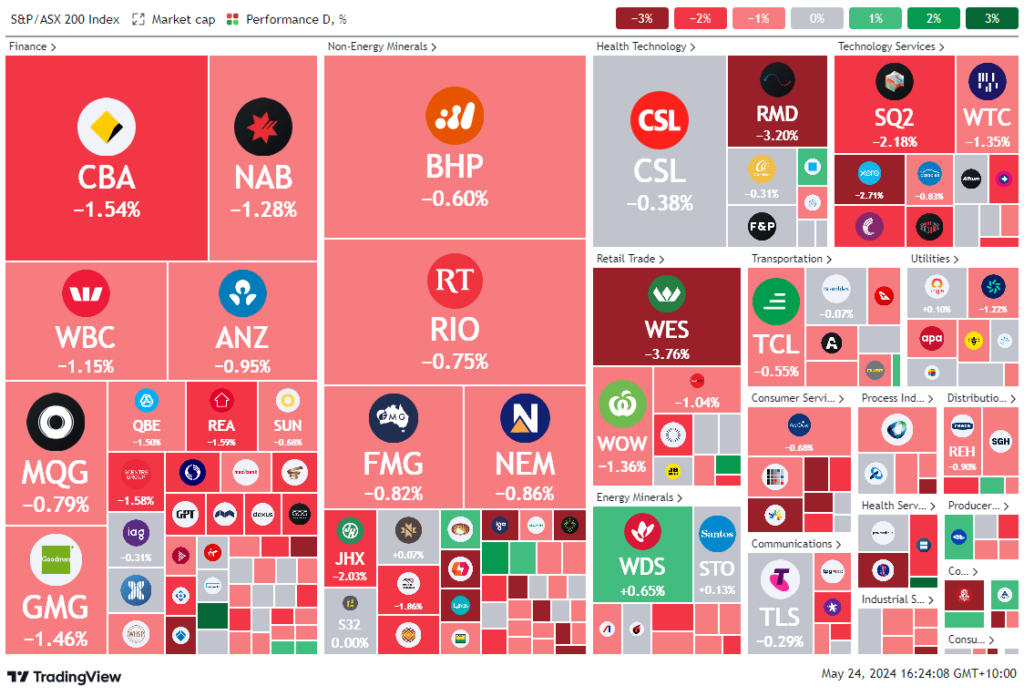

ASX Stocks

ASX 200 - 7,808.3 (-0.5%)

Key Highlights:

A Wall Street sell-off impacted Australian capital markets on Friday, leading to a decline in shares across technology, retail, and banking sectors due to rising bond yields and reduced rate cut expectations. Australian shares dropped 1.1% by early afternoon, with commodities also weakening. Iron ore fell below $US119 a tonne and gold slipped below $US2340 an ounce. The yield on the 10-year Australian government bond rose by 8 basis points to 4.35%, further dragging down interest rate-sensitive stocks. Major banks like CBA and NAB fell 2% and 1.8%, respectively. Miners were also affected, with BHP dropping 0.5% and Mineral Resources down 2.5%.

The sell-off in US markets was driven by stronger-than-expected purchasing manager (PMI) data, suggesting the Federal Reserve might maintain higher interest rates for longer. The S&P 500, Nasdaq Composite, and Dow closed down 0.7%, 0.4%, and 1.5%, respectively. Nvidia, however, surged 9.3%, lifting its market cap to $US2.55 trillion.

In focus, Perpetual increased its stake in Star Entertainment after takeover interest emerged, while Appen shares rose 6.8% following optimistic financial forecasts. Gold miners, including Newmont, retreated as gold prices eased. Analysts speculate BHP’s bid for Anglo American might succeed, pending negotiations.

Leaders

PLY – Playside Studios Ltd (+6.32%)

AX1 – Accent Group Ltd (+5.71%)

SKC – Skycity Ent. Group Ltd (+5.26%)

CXL – CALIX Ltd (+4.94%)

SVM – Sovereign Metals Ltd (+4.59%)

Laggards

A1M – Aic Mines Ltd (-9.32%)

FBU – Fletcher Building Ltd (-5.59%)

BDM – Burgundy Diamond Mines Ltd (-5.56%)

AIS – Aeris Resources Ltd (-5.09%)

QAL – Qualitas Ltd (-4.53%)