What's Affecting Markets Today

Asian Markets mostly weaker

Asia-Pacific markets mostly declined on Monday as investors anticipated upcoming inflation data from Australia and Japan.

Japan’s Nikkei 225 and Topix were exceptions, rising by 0.24% and 0.26%, respectively. The Bank of Japan disclosed discussions about raising interest rates during its June meeting, emphasizing that any policy change should be contingent upon clear signs of rebounding CPI inflation and increased medium to long-term inflation expectations. BOJ Governor Kazuo Ueda hinted that a rate hike could occur as early as July.

Conversely, Hong Kong’s Hang Seng index fell 1.1%, and mainland China’s CSI 300 declined by 0.5%. China reported a 2.8% year-on-year decline in fiscal revenue for the first five months of 2024, with May’s revenue down 3.2% year-on-year.

South Korea’s Kospi dropped 0.82%, while the small-cap Kosdaq decreased by 1.08%.

ASX Stocks

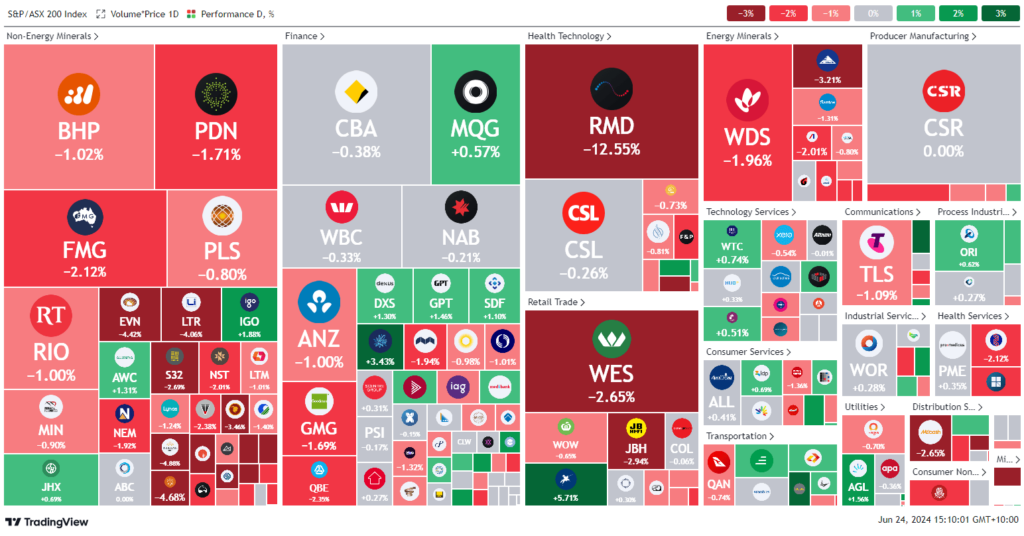

ASX 200 - 7,741.3 (-0.7%)

Key Highlights:

The Australian sharemarket continued its decline at midday, with the S&P/ASX 200 Index falling 0.6% (43.8 points) to 7752.2. Nine of the 11 sectors were in the red, led by healthcare and consumer discretionary stocks.

Healthcare was down 1.5%, driven by ResMed’s 14% tumble after weight-loss drug trial results resurfaced market doubts. Sonic Healthcare and Fisher and Paykel fell 1.4% and 1.7%, respectively.

Consumer discretionary stocks plummeted 1.9%, with Wesfarmers and JB Hi-Fi losing 3.4% and 3.2%. Star Entertainment shares dropped 6.2% following a profit warning and the departure of interim CEO David Foster. Cettire shares plunged 46.3% due to a downturn in the online luxury market.

Upcoming forecasts for May’s consumer price index suggest an acceleration to 3.8% annual inflation, raising concerns for the RBA. George Boubouras of K2 Asset Management noted the challenges posed by strong fiscal stimulus, a tight labor market, and resilient consumption.

In commodities, Singapore iron ore futures fell 1.3% to $US103.70/tonne, impacting BHP shares, which edged down 0.6%.

Leaders

PMV Premier Investments Ltd 5.21%

MAQ Macquarie Technology Group Ltd 3.58%

AMP AMP Ltd 3.47%

FPR Fleetpartners Group Ltd 3.11%

AAC Australian Agricultural Company Ltd 2.90%

Laggards

CTT Cettire Ltd -48.55%

RMD Resmed Inc -12.84%

DRO Droneshield Ltd -10.52%

WA1 WA1 Resources Ltd -6.60%

DYL Deep Yellow Ltd -5.82%