What's Affecting Markets Today

Telix Raises $650 Million at 2.375% Interest

Biotech sensation Telix Pharmaceuticals has successfully raised $650 million through convertible debt, offering an interest rate of 2.375%. This move comes after the company decided not to list on the Nasdaq exchange. Telix, a pioneer in the radiopharmaceuticals field, utilizes isotopes to diagnose and treat cancers. The convertible bonds can be turned into shares if they reach a conversion price of $24.78, representing a 32.5% premium over the reference price of $18.70 and a notable premium to the last ASX price of $20.31. Proceeds from the notes will support Telix’s clinical development programs and provide funds for mergers and acquisitions.

Iron Ore Buckles Below $US100 a Tonne

Iron ore prices fell below $US100 a tonne on Tuesday, influenced by a disappointing policy meeting in China that failed to deliver significant stimulus. The material dropped by as much as 3.5% to $US99.85 in Singapore, marking the third consecutive day of losses. The Third Plenum, a bi-decade conclave of Communist Party officials, did not meet investor expectations, providing little to boost metals demand or address the property crisis. Additionally, increased supply from Brazil, the world’s second-largest iron ore exporter, contributed to the decline. The global seaborne market surplus and weak steel-product demand have caused iron ore to drop by more than a quarter this year, making it one of the worst-performing commodities.

New Government Bond Sale Gets $55.5 Billion in Orders

A new Australian government bond, maturing in December 2035, has garnered over $55.5 billion in orders, including $2.2 billion from joint lead managers. According to the terms sheet, the bond issue is expected to raise between $11 billion and $12 billion at a yield of 4.42%. The order books closed at 9 am, with Westpac serving as both the bookrunner and risk manager. This strong interest underscores the demand for government debt amidst a volatile economic environment. The substantial oversubscription highlights investor confidence in the Australian government’s creditworthiness and the appeal of fixed-income securities in the current market.

ASX Stocks

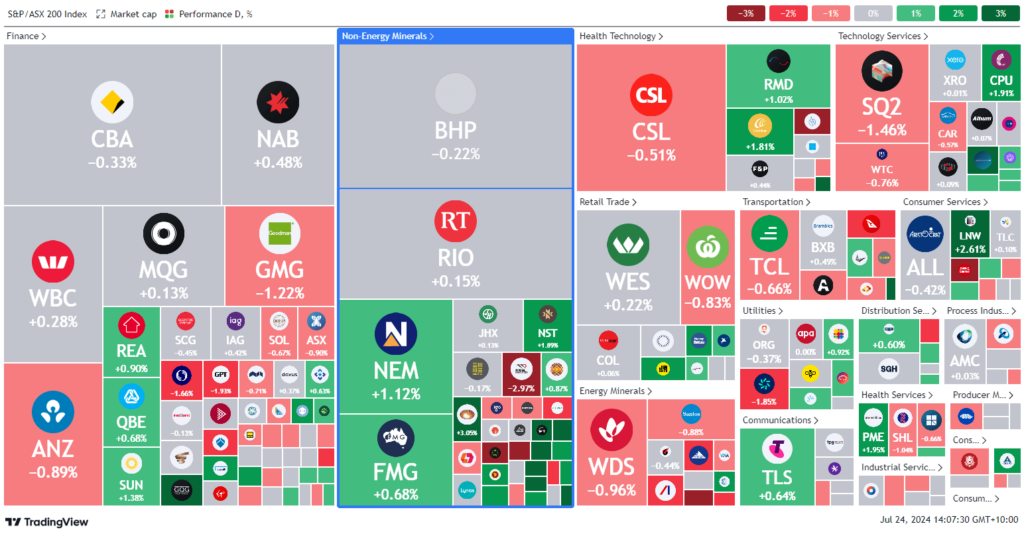

ASX 200 - 7963.5 (-0.1%)

Key Highlights:

The Australian share market remained flat at midday, with the S&P/ASX 200 Index steady at 7969.8, following a weak lead from Wall Street. U.S. stocks had edged lower, with the Dow and Nasdaq slipping 0.1%, and the S&P down 0.2%, influenced by mixed quarterly results from Tesla and Alphabet. Tesla reported a fourth consecutive profit miss, while Alphabet’s slightly better-than-expected results still led to a retreat in after-hours trading.

In the ASX, the energy sector was the worst performer despite oil prices rising above $US81 a barrel. Key stocks like Woodside Energy, Viva Energy, and Beach Energy saw declines. Miners also edged lower, with BHP down 0.3% as iron ore traded near $US100 a tonne.

Flight Centre dropped 4.2% after revising its profit guidance and closing its Discova Central Americas business. Perpetual fell 1.2% due to a decline in assets under management. Pilbara Minerals slipped 0.3% after a recent revenue jump.

Telix Pharmaceuticals plunged 5.5% after raising $650 million via convertible debt. In contrast, Platinum Capital rose 3.9% following its announcement to convert its Platinum International Fund to an open-ended fund from a closed-end fund.

Leaders

CYL – Catalyst Metals Ltd (+8.48%)

VUL – Vulcan Energy Ltd (+8.14%)

SXG – Southern Cross Gold Ltd (+7.80%)

SPR – Spartan Resources Ltd (+7.11%)

OBM – Ora Banda Mining Ltd (+6.88%)

Laggards

AVR – Anteris Technologies Ltd (-8.68%)

INR – Ioneer Ltd (-6.90%)

IMU – Imugene Ltd (-6.67%)

TLX – Telix Pharmaceuticals Ltd (-5.96%)

ILU – Iluka Resources Ltd (-4.60%)