What's Affecting Markets Today

Major Lithium Miners Push for a More Reliable Spot Price

Australia’s leading lithium miners are advocating for a “coalition of the willing” to establish a trading exchange aimed at reducing price volatility and making the commodity more appealing for commercial bank financing. The surging demand from batteries and electric vehicles has energized the Australian lithium industry. However, the market structure, where investors often send mine output to refineries, results in minimal spot market trading. Consequently, prices for lithium spodumene concentrate, primarily mined in Australia and processed in China, experience significant fluctuations based on single trades and limited price disclosure.

Investors Bet That Nvidia Will Leave Magnificent Seven Rivals Behind

Nvidia has solidified its position among Wall Street’s elite after exceeding analyst expectations with its latest earnings report, indicating the US chipmaker has outpaced its magnificent seven peers. The company unveiled optimistic forecasts, reinforcing its status as the primary beneficiary of artificial intelligence spending, with tech giants like Microsoft and Google increasingly relying on its AI accelerators. Nvidia’s stellar first-quarter results have justified bullish investor sentiment, driving the stock up 92% this year. Rapidly accelerating profits pushed Nvidia shares 6% higher in after-hours trading, as investors remain confident in the stock’s continued meteoric rise.

Gold Stocks Drop as Price Falls

Gold miners on the ASX are experiencing significant losses, with three of the five worst-performing stocks on the S&P/ASX 200 being gold producers. Regis Resources fell 7.1% to $1.97, Bellevue Gold dropped 5.8% to $1.90, and Emerald Resources decreased by 5.9% to $3.69. This decline follows spot gold’s largest one-day drop since April, falling 1.7% to approximately $US2379 after the US Federal Reserve’s meeting minutes suggested that rate cuts may be delayed. Meanwhile, copper prices steadied after reaching record highs earlier in the week.

ASX Stocks

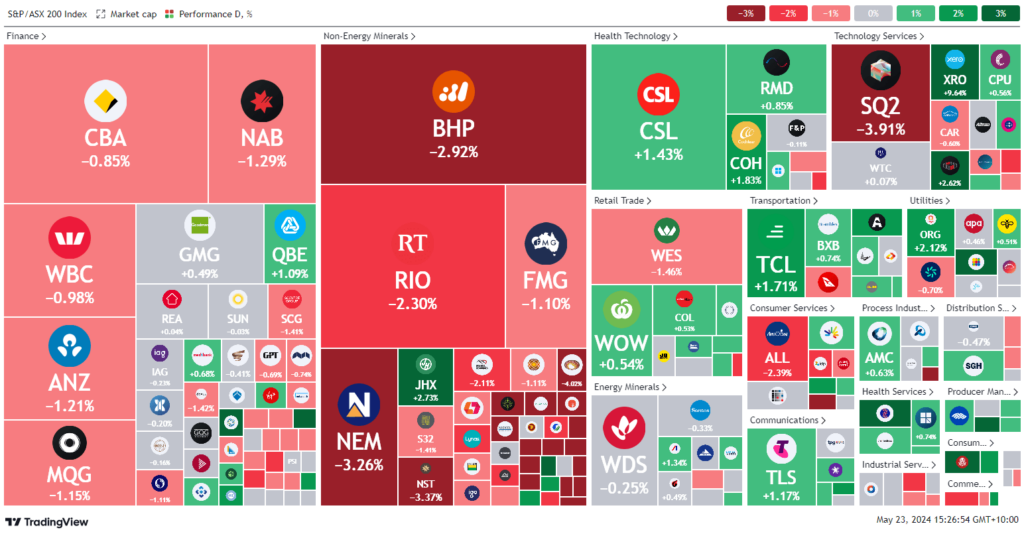

ASX 200 - 7,808.3 (-0.5%)

Key Highlights:

Australian shares trimmed earlier losses, trading around 0.4% lower as trading entered its final hours. This follows Wall Street’s decline after the latest US Federal Reserve policy meeting minutes indicated concern about slow inflation progress. The S&P/ASX 200 was 41 points lower at 7807, after falling as much as 1% earlier, tracking the US benchmark S&P 500’s 0.3% slip. The Fed minutes revealed a potential for further policy tightening if necessary, which was more hawkish than expected.

Metals prices dropped, affecting the materials sector, which fell 2.6%. BHP declined 2.5% to $45.00 after its latest bid was rejected by Anglo American, leading to profit-taking from speculators. Copper miner Sandfire Resources fell 6.7% to $9.14, and gold producer Regis Resources dropped 6.4% to $1.99.

Notable stock movements included Origin Energy rising 1% to $10.26 after delaying the Eraring power station closure. Nufarm dropped 5.1% to $4.83 due to challenging conditions impacting profits. Xero surged 9.1% to $135.31 on a 22% revenue increase. The Reject Shop fell 7% to $3.43 following a steep earnings warning. Inghams bounced 4% to $3.75 despite bird flu concerns. Australian Vintage and Neuren Pharmaceuticals halted trading pending updates.

Leaders

AFP – Aft Pharmaceuticals Ltd (+14.23%)

XRO – Xero Ltd (+9.56%)

CXL – CALIX Ltd (+9.43%)

SMP – Smartpay Holdings Ltd (+9.01%)

FBU – Fletcher Building Ltd (+7.72%)

Laggards

SKO – Serko Ltd (-7.33%)

LRS – Latin Resources Ltd (-7.14%)

RRL – Regis Resources Ltd (-6.96%)

PEN – Peninsula Energy Ltd (-6.25%)

SFR – Sandfire Resources Ltd (-6.17%)