What's Affecting Markets Today

Australian bond yields surged to three-month highs as solid U.S. economic data led to a rally in U.S. markets, influencing expectations that the Federal Reserve will not rush to cut rates. Australia’s three-year yield rose to 3.9%, while the 10-year yield reached 4.4%. Money markets have shifted their expectations for the Reserve Bank of Australia’s (RBA) first rate cut to May 2024, pushing it back from April. There remains a slim one-in-four chance of a rate cut before the end of 2023.

In other news, the Pharmacy Guild has raised concerns about the proposed $8.8 billion merger between Sigma Healthcare and Chemist Warehouse, claiming the concessions offered are insufficient to address competitive concerns. The Guild argues that the merger would give the combined entity control over half the pharmacy sector’s revenue. The Australian Competition and Consumer Commission (ACCC) is currently reviewing the deal, having already delayed its decision twice. Sigma has offered concessions, including allowing franchisees to cancel contracts without penalty, in an effort to gain regulatory approval for the merger. The ACCC’s decision is expected next month.

ASX Stocks

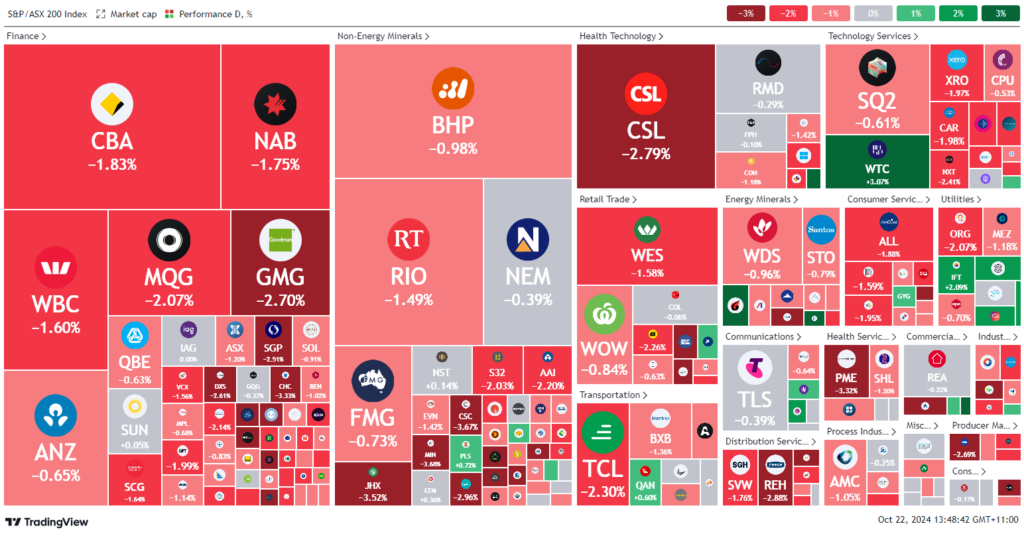

ASX 200 - 8,221.7 (-1.50%)

Key Highlights:

The Australian sharemarket tumbled on Tuesday, with the S&P/ASX 200 Index falling 1.4%, or 226.4 points, to 8228 by midday, following a sell-off across all sectors. The drop mirrored Wall Street, where the Dow Jones lost 0.8% and the S&P 500 declined 0.2%. Investors took profits after recent ASX highs, influenced by rising bond yields and expectations of a “higher-for-longer” interest rate environment. Bond traders pushed back the expected timing of the Reserve Bank of Australia’s first rate cut to May next year.

Rate-sensitive sectors were hit hardest, with property stocks falling more than 2%, led by a 2.4% drop in Goodman Group. The banking sector also struggled, with Commonwealth Bank down 1.5%.

Mineral Resources lost 4.2%, extending its losses after a tax evasion investigation involving its managing director. Transurban fell 2%, despite reaffirming its FY25 distribution guidance. Viva Energy dropped 5.3%, citing weaker retail conditions. Audinate Group plummeted 8%, warning it would miss its gross profit target due to ongoing headwinds. Suncorp, Magellan, and Transurban are set to hold annual general meetings (AGMs) today.

Leaders

PPS – Praemium Ltd (+7.56%)

SMR – Stanmore Resources Ltd (+4.30%)

CU6 – Clarity Pharmaceuticals Ltd (+4.27%)

INR – Ioneer Ltd (+3.64%)

TBN – Tamboran Resources Corporation (+3.57%)

Laggards

HTA – Hutchison Teleco. (Australia) Ltd (-11.11%)

OPT – Opthea Ltd (-7.97%)

AD8 – Audinate Group Ltd (-7.23%)

IPX – Iperionx Ltd (-7.06%)

CXO – Core Lithium Ltd (-6.25%)