What's Affecting Markets Today

James Hardie in $2.5b Wipeout on Weaker Housing Outlook

James Hardie, a leading building products group, anticipates a 5% drop in volumes in the Australian market over the next year due to high house prices dampening demand. This grim outlook led to a significant 11% slump in its share price, falling to $48.70. The company forecasted a decline in annual profits across its global operations amid uncertain market conditions, causing its market value to plummet by over $2.5 billion in early trading on the ASX.

Star Confirms ‘Incomplete’ Proposal from Hard Rock Pacific Consortium

Star Entertainment has confirmed receiving a proposal from a consortium including Hard Rock Hotels & Resorts (Pacific). However, Hard Rock International denied any involvement, stating it had not licensed its name for any proposal and threatened legal action against unauthorized use of its brand. The confusion arose after The Australian Financial Review reported that a consortium involving Hard Rock was considering a bid for Star. Star’s announcement emphasized that the proposal was incomplete and indicative, with multiple parties showing interest in potential transactions.

Sonic Issues Profit Warning Due to Inflation

Sonic Healthcare, a major diagnostics company, has warned of lower-than-expected profits due to inflation and currency exchange challenges. It revised its EBITDA forecast for fiscal 2024 to $1.6 billion on revenue of $8.9 billion. For 2025, Sonic anticipates earnings between $1.7 billion and $1.75 billion, factoring in potential negative impacts from the USA PAMA fee cut, initial losses from the UK Hertfordshire & West Essex NHS contract, and an equity accounted loss for Franklin.ai.

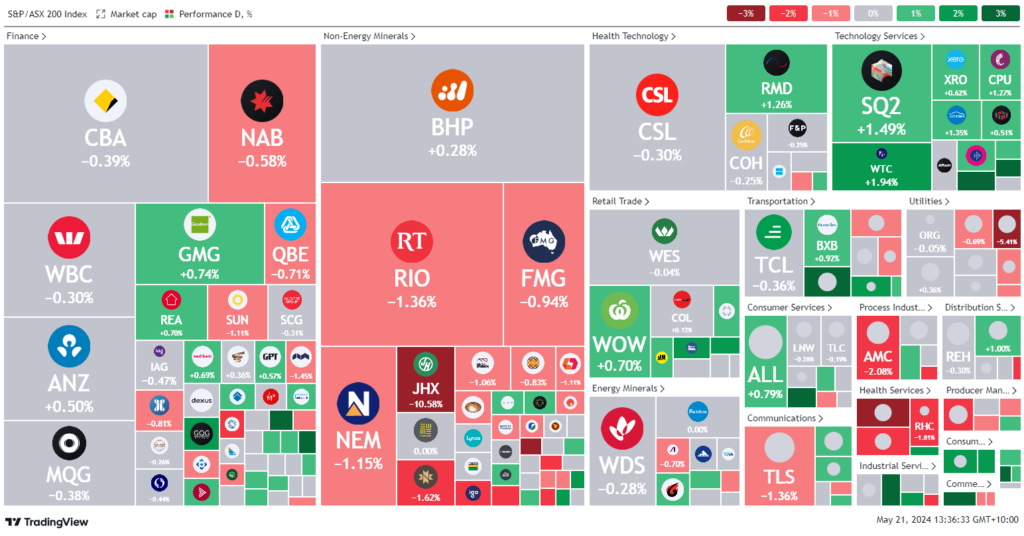

ASX Stocks

ASX 200 - 7,846.9 (-0.2%)

Key Highlights:

Australian shares dipped midday Tuesday as declines in James Hardie and Sonic Healthcare offset a tech rally following a record high for the Nasdaq. The S&P/ASX 200 fell 0.2%, or 15.5 points, to 7848.2, close to the record high of 7896.4. Six out of eleven sectors were down, led by communications services. Telstra dropped 2.7% to $3.57 after announcing up to 2800 job cuts. James Hardie was the biggest laggard, falling 10% due to disappointing 2025 net income guidance. Sonic Healthcare fell over 8% amid profit warnings. Star Entertainment dropped 2.3% as investors considered a consortium bid involving Hard Rock Hotels & Resorts (Pacific), despite Hard Rock denying involvement. Mining giants slipped despite higher iron ore prices. Rio fell 1.3% due to gas shortages in Queensland, BHP was flat, and Fortescue dropped 1.1%. Gold producers like St Barbara and Bellevue Gold rose due to record gold prices. Ethereum surged nearly 20%, and Bitcoin rose 2.2% amid SEC speculation. Minutes from the Reserve Bank’s May meeting showed considerations for a cash rate hike, though the policy remained unchanged. The Australian dollar slipped 0.2% to US66.53¢, with a 50% chance of an interest rate cut this year. ALS rallied 5.4%, TechOne jumped 4.2%, Alumina advanced 2%, SkyCity rose 2.6%, while Mineral Resources fell 0.6%.

Leaders

OFX – OFX Group Ltd (+12.09%)

VUL – Vulcan Energy Resources Ltd (+7.68%)

INR – Ioneer Ltd (+7.61%)

BRN – Brainchip Holdings Ltd (+7.00%)

29M – 29METALS Ltd (+6.48%)

Laggards

JMS – Jupiter Mines Ltd (-11.97%)

JHX – James Hardie Industries Plc (-10.44%)

SYA – Sayona Mining Ltd (-10.20%)

SGR – The Star Ent. Group Ltd (-6.94%)

SHL – Sonic Healthcare Ltd (-6.52%)