What's Affecting Markets Today

Metals Drop as Trump Plans Tariffs

Base metals weakened as U.S. President Donald Trump announced potential tariffs on Mexico and Canada, causing market concerns. Trump hinted at import tariffs of up to 25% on neighboring countries, boosting the U.S. dollar and making metals costlier for buyers globally. While he refrained from imposing levies on China, fears of escalating trade conflicts and China’s fragile economy continued to pressure the metals market. Copper prices fell 11% last quarter, reflecting broader market unease. On the London Metal Exchange, lead dropped 1%, zinc declined 0.2%, and aluminum remained steady at $2,691.50 per tonne during Shanghai trading hours.

Liontown Resources’ Output Triples

Liontown Resources reported a threefold increase in spodumene concentrate production in the December quarter, positioning itself as a significant lithium sector player. Production reached 88,683 dry metric tonnes, a substantial rise from 28,171 tonnes in the previous quarter. Total shipments since production began have surpassed 116,854 tonnes, highlighting the company’s rapid growth. Cost guidance for the latter half of FY2025 remains steady at $775 to $855 per tonne sold. This growth underscores Liontown’s commitment to becoming a world-class producer in the lithium industry, bolstered by strong demand for lithium batteries.

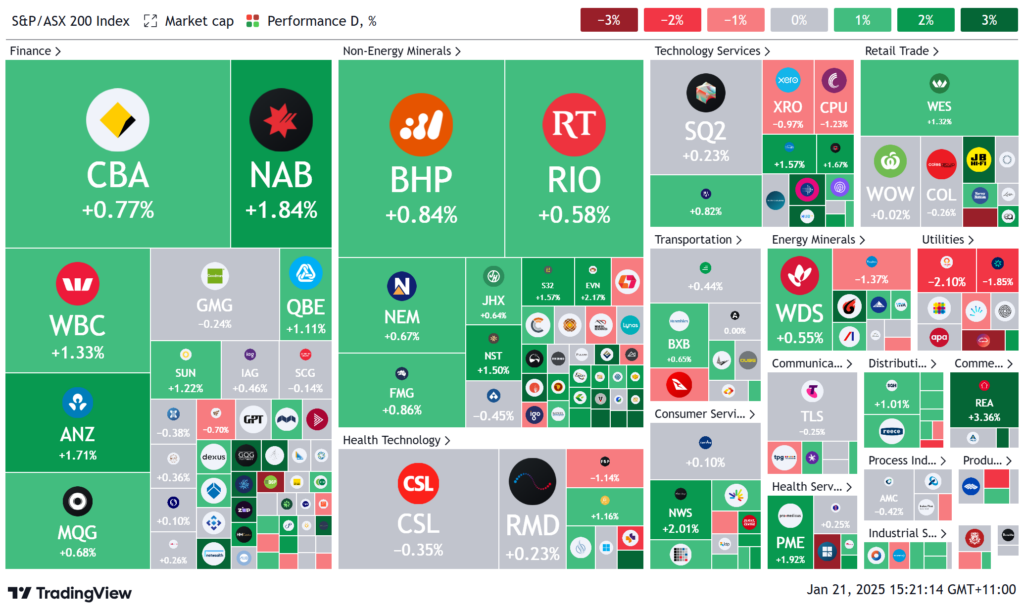

ASX Stocks

ASX 200 - 8,404.4 (+0.7%)

Key Highlights:

The Australian sharemarket recovered losses on Tuesday afternoon, with the S&P/ASX 200 Index rising 0.7% by 2:23 pm, reversing a morning dip spurred by U.S. President Donald Trump’s tariff plans. Trump’s proposal to impose 25% tariffs on Mexico and Canada by February 1 caused the Australian dollar to drop 0.7% to US62.48¢. Four of 11 ASX sectors declined despite a strong morning for banks. Commonwealth Bank gained 1%, while National Australia Bank and ANZ rose 2.1% and 1.8%, respectively, after a Macquarie upgrade.

Liontown Resources surged 12.7% on a tripling of quarterly output, and Yancoal advanced 5.5% after meeting 2024 guidance. However, Santos fell 1.7% after delaying a $2 billion joint venture in Western Australia, dragging Carnarvon Energy down 22.6%. Hub24 led gains, soaring 11.2% on record net inflows, while Novonix fell 6.2% as its CEO stepped down. Utilities faced the steepest decline, with Origin Energy dropping 2.3% following a Jarden downgrade. Bravura Solutions slipped 5.3% after going ex-dividend, highlighting mixed sector performances across the ASX.

Leaders

LTR – Liontown Resources Ltd (+13.89%)

HUB – HUB24 Ltd (+11.77%)

KGN – Kogan.com Ltd (+7.13%)

SGR – The Star Entertainment Group Ltd (+6.52%)

SYA – Sayona Mining Ltd (+6.52%)

Laggards

CVN – Carnarvon Energy Ltd (-24.19%)

ERA – Energy Resources of Australia Ltd (-16.67%)

SKO – Serko Ltd (-10.42%)

OBL – Omni Bridgeway Ltd (-8.74%)

LRV – Larvotto Resources Ltd (-8.58%)