What's Affecting Markets Today

Asian Markets weaker

Asia-Pacific markets declined on Friday following Japan’s May core inflation data, which came in slightly cooler than anticipated. Japan’s core inflation rate, excluding fresh food prices, was 2.5%, below the 2.6% expected by economists in a Reuters poll, and compared to April’s 2.2%. The “core-core” inflation, excluding both fresh food and energy prices, fell to 2.1% from April’s 2.4%. Japan’s headline inflation rate rose to 2.8%, up from 2.5% in April.

The Nikkei 225 dipped marginally, while the Topix index gained 0.26%. The yen weakened for the seventh consecutive day to 158.95 against the U.S. dollar. Chief currency diplomat Masato Kanda indicated the government’s readiness to act against currency volatility. The U.S. Treasury placed Japan on its currency “Monitoring List” without designating it a manipulator.

South Korea’s Kospi fell 0.73%, and the Kosdaq lost 0.27%. Mainland China’s CSI 300 and Hong Kong’s Hang Seng index also dipped.

ASX Stocks

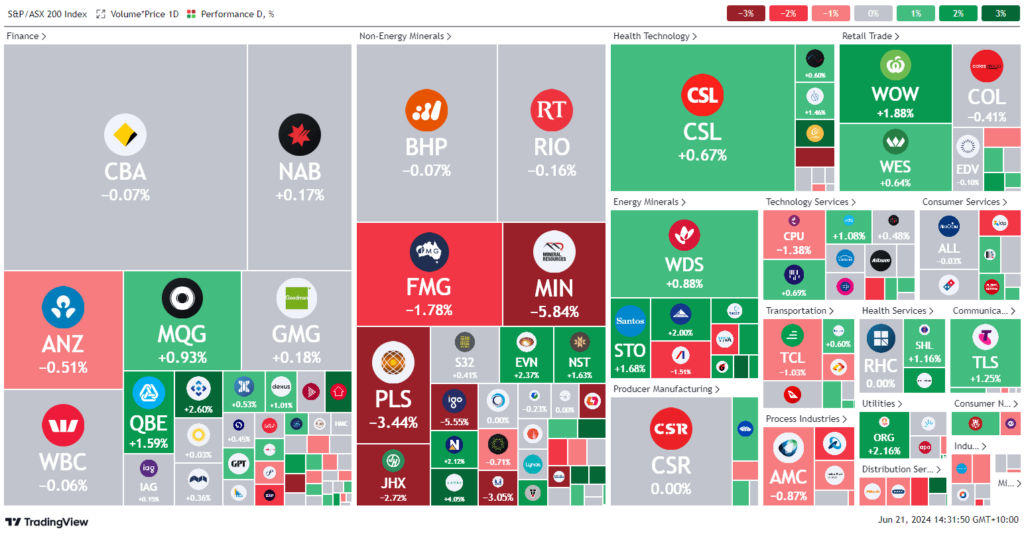

ASX 200 - 7,784.2 (+0.2%)

Key Highlights:

Australian shares rose 0.2% in the afternoon as Wall Street closed mixed. Guzman y Gomez, the burrito chain, saw its shares increase 0.5% to $30.15 before plunging 10% to $27 as investors took profits following a 36% surge on its first trading day.

Commonwealth Bank reached a record high, nearing BHP Group as Australia’s most valuable public company. Mineral Resources dropped 5.8%, down nearly 30% since May 20, with a net debt of $3.55 billion as of end-2023. The company is focusing on asset sales to alleviate debt pressures.

Kathmandu, an apparel and camping retailer, warned of declining sales in 2024 due to rising living costs, causing an 8% drop to 36¢. Mosaic Brands, a women’s fashion group, also forecasted a loss this financial year, citing weak sales and logistical issues, with shares falling 9% in early trade and down 41% over the past year.

Pilbara Minerals updated production guidance for its West Australian lithium mining operations.

Leaders

WGX Westgold Resources Ltd 4.13%

SMR Stanmore Resources Ltd 3.98%

MGH Maas Group Holdings Ltd 3.93%

HSN Hansen Technologies Ltd 3.81%

TPW Temple & Webster Group Ltd 3.67%

Laggards

CU6 Clarity Pharmaceuticals Ltd -9.28%

WA1 WA1 Resources Ltd -7.60%

RPL Regal Partners Ltd -6.82%

VUL Vulcan Energy Resources Ltd -6.33%

MIN Mineral Resources Ltd -6.30%