What's Affecting Markets Today

Copper Surges Above $US11,000 for First Time

Copper prices soared above $US11,000 a tonne for the first time as futures on the London Metal Exchange surged over 4%. This price rally positively impacted ASX-listed copper miners, with Sandfire Resources rising 3.8% to $10.02 and BHP increasing by 2.1% to $45.85. ING’s head of commodities strategy, Warren Patterson, noted the bullish sentiment driven by speculative buying, though he cautioned about short-term concerns, particularly regarding high copper stock levels on the Shanghai Futures Exchange, which are at their highest for this time of year in over 15 years.

Gold Miners Rally on Record Prices

ASX-listed gold miners experienced significant gains as gold prices reached a new record high. Bullion climbed 1.1% to $US2440.59 an ounce in early Asian trading hours, surpassing a previous high from April. This surge occurred as traders speculated that the US Federal Reserve might cut interest rates by September, putting pressure on the US dollar. Evolution Mining rose 5.8% to $4.08, Gold Road Resources increased by 5.4% to $1.66, and Regis Resources advanced 4.7% to $2.12.

Panicked Traders Position for Mega-Rally as Metal Prices Hit Record

Traders are aggressively betting on industrial and precious metals due to an intensifying supply squeeze, causing a significant rise in metal prices and forcing bearish investors to cover short positions. Copper prices reached new highs on the London Metal Exchange, mirroring records in New York and Shanghai. LME nickel also spiked nearly 8%. Precious metals saw a similar trend, with gold peaking and silver reaching $US30 an ounce, its highest since 2013. This surge propelled the Bloomberg Commodity Total Return Index, tracking 24 major futures contracts, to its highest level in over a year.

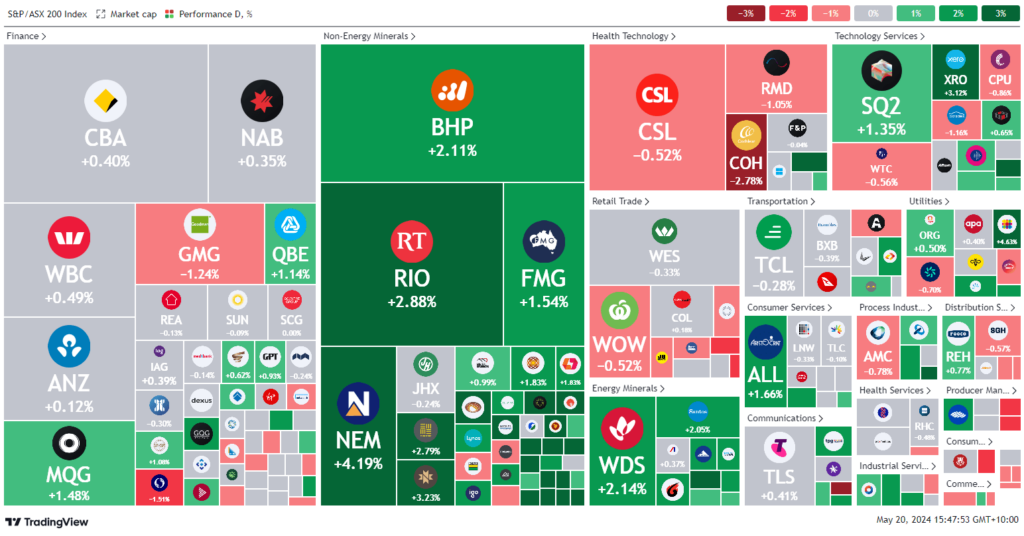

ASX Stocks

ASX 200 - 7,814.4 (-0.80%)

Key Highlights:

The Australian sharemarket edged closer to its record high, driven by robust gains in the mining sector, including major players BHP and Rio Tinto. The S&P/ASX 200 index climbed 56.5 points, or 0.7%, to 7870.9, just 26 points shy of its peak. Materials led the surge, rising 2%, with copper hitting a record high in Asian trading, and gold and iron ore prices also strengthening. Nickel miners benefited from a price surge following riots in New Caledonia, with South32 up 1.6% and Nickel Industries rising 3.1%. The People’s Bank of China maintained its 1- and 5-year rates at 3.45% and 3.95%, respectively.

Notable stock movements included Star Entertainment, which soared 22% after confirming acquisition interest from Hard Rock Hotels and Casinos. Michael Hill plummeted nearly 20% after reporting a decline in sales. Elders cut its dividend by 22% following a 76% drop in first-half profits, leading to a 1.8% fall in its share price. Nuix surged 16.8% on positive revenue growth projections, while PointsBet’s upgraded earnings guidance for FY24 drove its shares up by 16.5%. Core Lithium fell 1.8% following the appointment of Paul Brown as its new CEO.

Leaders

NXL – NUIX Ltd (+23.95%)

GTK – Gentrack Group Ltd (+20.94%)

SGR – The Star Ent. Group Ltd (+18.33%)

SVL – Silver Mines Ltd (+11.84%)

ANG – Austin Engineering Ltd (+7.84%)

Laggards

VUL – Vulcan Energy Resources Ltd (-11.81%)

MYX – Mayne Pharma Group Ltd (-10.52%)

BRN – Brainchip Holdings Ltd (-7.55%)

SYA – Sayona Mining Ltd (-7.55%)

WTN – Winton Land Ltd (-6.25%)