What's Affecting Markets Today

Asian Markets mostly lower

Asia-Pacific markets mostly declined on Thursday as China maintained its one- and five-year loan prime rates at 3.45% and 3.95%, respectively. The People’s Bank of China also kept the one-year medium-term lending facility rate steady at 2.5% earlier this week.

Mainland China’s CSI 300 dropped 0.49%, and Hong Kong’s Hang Seng index fell 0.48%. Hong Kong’s notable losers included Haidilao, which plunged 6.13%, Shenzhou International Group, down 4.31%, and Budweiser Brewing Company APAC, losing 3.73%.

South Korea’s Kospi rose 0.42%, while the Kosdaq slipped 0.41%, with shares of HMM, the largest container ship company, climbing over 3%. Japan’s Nikkei 225 decreased by 0.15%, and the Topix fell 0.36%.

The Taiwan Weighted Index hit new highs for the third consecutive day, rising 0.43%. In New Zealand, the economy grew 0.2% quarter-on-quarter in Q1, surpassing Reuters poll expectations of 0.1% growth, indicating an exit from a technical recession.

ASX Stocks

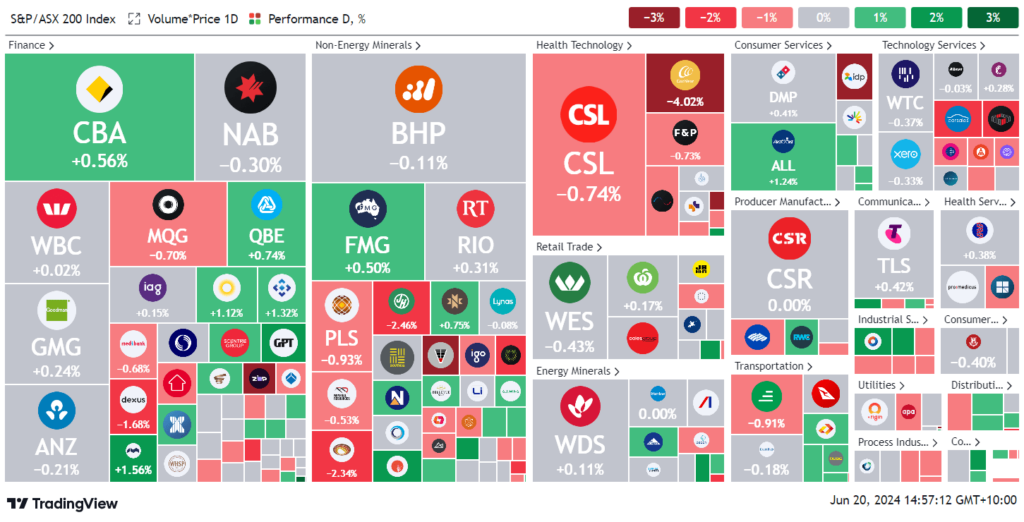

ASX 200 - 7,761.6 (-0.1%)

Key Highlights:

The local sharemarket dipped 0.1% by Wednesday lunchtime despite Guzman y Gomez surging 36.2% on its ASX debut, boosting its market cap to over $3 billion. The group aims to expand its Australian store count from 185 to over 1000 if demand remains strong.

The S&P/ASX 200’s top sector was energy, up 0.2%, while materials fell 0.2% and have dropped 10.1% over the past month due to weaker commodity prices. Mortgage broker Helia Group led individual stocks, rising 14% to $3.84 on news of a potential deal with Commonwealth Bank.

European markets declined, and Wall Street was closed for a federal holiday. Van Eck’s ASX-listed bitcoin fund is set to trade, joining existing bitcoin ETFs on the Cboe exchange. Central banks in Norway and Switzerland will announce policy decisions.

The Australian dollar trades at US66.72¢. Dexus shares fell 1.4% to $6.45 after announcing a 11.4% reduction in office property valuations. Bigtincan shares are halted after rejecting a 19¢ per share takeover bid. Mineral Resources, down 0.6% to $60.22, will shut iron ore mines, affecting 1000 jobs.

Leaders

HLI Helia Group Ltd 15.57%

DRO Droneshield Ltd 7.05%

MAF MA Financial Group Ltd 5.90%

REG Regis Healthcare Ltd 4.19%

RSG Resolute Mining Ltd 4.00%

Laggards

SNZ Summerset Group Holdings Ltd -10.68%

WA1 WA1 Resources Ltd -7.49%

RED RED 5 Ltd -6.74%

MAD Mader Group Ltd -5.38%

MEZ Meridian Energy Ltd -4.86%