What's Affecting Markets Today

Asian Stocks Rally Amid Positive Trump-Xi Talks

Asian equities rallied on Monday as U.S. President-elect Donald Trump and Chinese leader Xi Jinping discussed trade and other issues. The conversation, described by Trump as “very good,” lifted investor sentiment, with markets in Australia, Japan, and South Korea posting gains. U.S.-listed Chinese shares surged 3.2% on Friday, while TikTok resumed operations in the U.S. following Trump’s temporary pause on enforcement of a divestment order. Analysts noted that the discussion provided short-term optimism amid ongoing geopolitical tensions. Traders remain cautious as Trump prepares executive orders on immigration and energy policies, signaling a dynamic start to his second term.

Bitcoin Experiences Significant Volatility

Bitcoin reversed earlier gains, dropping to $100,268.20 after briefly rallying above $106,000 overnight. The cryptocurrency’s sharp movements come as markets anticipate President-elect Trump’s inauguration and its implications for global markets. Previously, Trump’s pro-crypto stance had driven Bitcoin to an all-time high of over $108,000, fueled by optimism within the industry. However, volatility increased following Trump’s announcement of a new token on his social media accounts, raising concerns about potential conflicts of interest despite massive trading volumes. Traders remain watchful of Bitcoin’s unpredictable swings amid broader economic and political uncertainties.

ASX Stocks

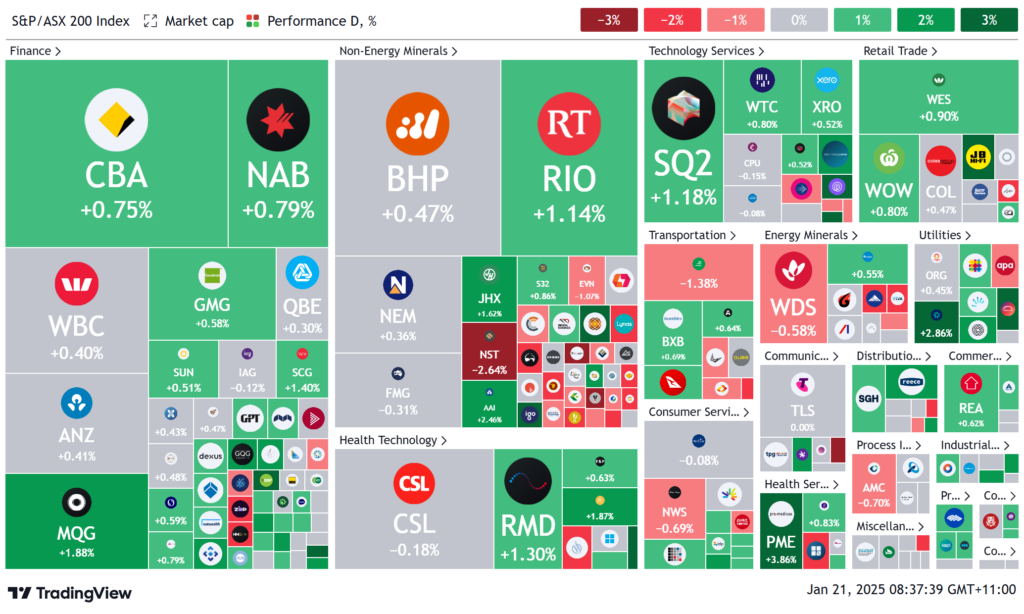

ASX 200 - 8,347.4 (+0.45%)

Key Highlights:

The ASX rose on Monday as investors anticipated Donald Trump’s inauguration as the 47th U.S. president. The S&P/ASX 200 gained 0.5%, closing at 8347.4, while the All Ordinaries rose 0.4%. Nine out of 11 sectors advanced, although communications and energy stocks ended in the red. Technology stocks led gains, with WiseTech up 0.8% to $118.01, TechnologyOne rising 1.7% to $29.17, and Xero increasing 0.5% to $168.67. Banking stocks also performed well, with Commonwealth Bank and National Australia Bank both climbing 0.8%.

Investors are closely watching Trump’s tariff policies and their implications for Australia’s currency and trade with China. The Australian dollar rose 0.3% to US62.11¢. Gold edged up 0.2% to $US2707.50 an ounce, and Bitcoin rebounded to $US102,478.40 after reaching $US106,000 overnight.

Notable market moves included Ioneer’s 20.6% surge after securing a $1.6 billion U.S. Department of Energy loan. Meanwhile, Nanosonics led the ASX 200, climbing 6.3%. Conversely, Star Entertainment plunged 17.9% to 12¢ amid financial concerns, and gold miners saw profit-taking losses, with Northern Star Resources down 2.6%.

Leaders

INR – Ioneer Ltd: $0.205 (+20.59%)

CAY – Canyon Resources Ltd: $0.21 (+10.53%)

CEN – Contact Energy Ltd: $8.85 (+9.26%)

SPZ – Smart Parking Ltd: $0.95 (+7.95%)

VSL – Vulcan Steel Ltd: $7.50 (+7.91%)

Laggards

SGR – The Star Entertainment Group Ltd: $0.115 (-17.86%)

DXB – Dimerix Ltd: $0.49 (-8.41%)

PNR – Pantoro Ltd: $0.097 (-7.62%)

TCG – Turaco Gold Ltd: $0.275 (-6.78%)

4DX – 4DMEDICAL Ltd: $0.565 (-6.61%)