What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday, as investor sentiment improved following Wall Street’s rally and growing optimism around a potential de-escalation in U.S.-China trade tensions.

Japan’s Nikkei 225 led regional gains, rising over 1% to extend Wednesday’s advance, while the broader Topix gained 0.81%. Australia’s S&P/ASX 200 also climbed 0.56%. In contrast, South Korea’s Kospi slipped 0.47% and the Kosdaq shed 0.15% after data showed the country’s GDP unexpectedly contracted 0.1% in Q1 2025, missing consensus estimates for a 0.1% expansion.

Hong Kong’s Hang Seng Index declined 0.29%, and China’s CSI 300 ended flat, reflecting cautious investor positioning amid mixed global cues.

U.S. futures were muted after two consecutive sessions of strong gains. S&P 500 and Nasdaq 100 futures were up 0.1%, while Dow Jones futures dipped 0.1%.

Overnight, all three major U.S. benchmarks advanced, driven by hopes of easing trade hostilities and stability at the Federal Reserve. The Dow rose 1.07% to 39,606.57, the S&P 500 added 1.67%, and the Nasdaq surged 2.50% to 16,708.05.

ASX Stocks

ASX 200 - 7,975.7 (+0.70%)

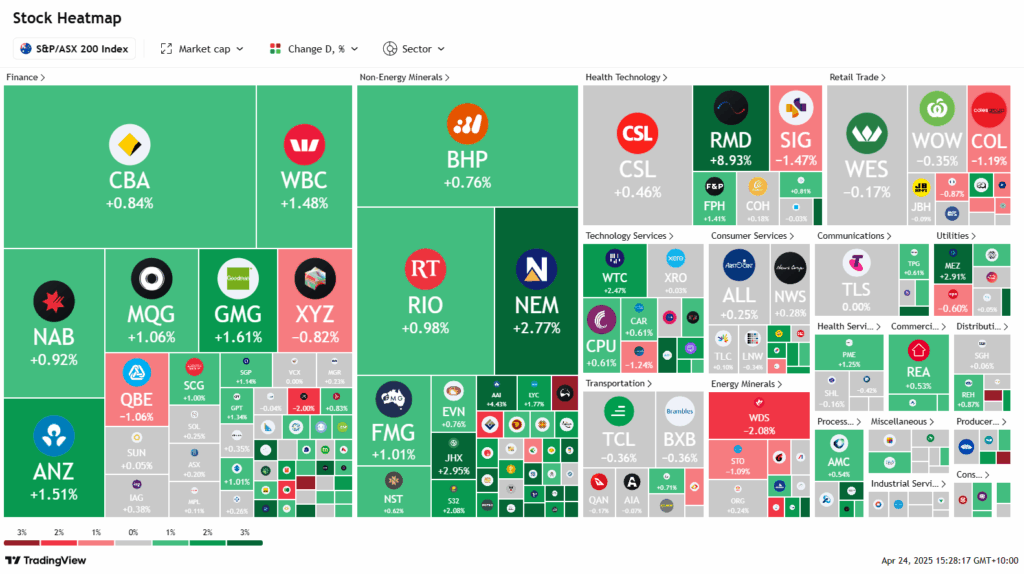

The Australian sharemarket edged higher on Thursday, buoyed by easing global trade tensions and a strong lead from Wall Street. The S&P/ASX 200 Index rose 0.6% or 51 points to 7971.5 by 2pm AEST, with the All Ordinaries up 0.7%. Gains were broad-based, with eight of 11 sectors in the green, led by mining and banking stocks.

Market sentiment was lifted by speculation that the Trump administration may scale back tariffs on Chinese imports, with reports suggesting levies could be reduced to between 50% and 65%. However, US Treasury Secretary Scott Bessent tempered expectations, stating no unilateral action had been taken.

Gold miners gained as prices rebounded, with Emerald Resources up 4.2% and Newmont rising 2.3%. Iron ore stocks tracked firmer commodity prices, while banks extended gains, led by Westpac and ANZ.

In corporate news, ResMed jumped 8.2% on tariff exemption news. Generation Development tumbled 15.1% despite higher AUM, while PWR Holdings slid 6% after CEO Kees Weel took medical leave. James Hardie climbed 3.1% amid governance developments.

Leaders

PDN Paladin Energy Ltd (+24.50%)

DYL Deep Yellow Ltd (+11.98%)

TLX TELIX Pharmaceuticals Ltd (+11.60%)

BOE Boss Energy Ltd (+8.82%)

A4N Alpha Hpa Ltd (+8.73%)

Laggards

GDG Generation Development (-15.36%)

ADT Adriatic Metals Plc (-3.63%)

VGL Vista Group Int (-2.99%)

ASB Austal Ltd (-2.76%)

DBI Dalrymple Bay (-2.70%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!