What's Affecting Markets Today

Asia-Pacific Markets Climb Despite Wall Street Sell-Off on Fed, Nvidia Drag

Asia-Pacific markets largely advanced on Thursday, diverging from Wall Street’s sharp overnight decline after U.S. Federal Reserve Chair Jerome Powell warned that escalating trade tensions could hinder progress on inflation and employment goals.

Australia’s S&P/ASX 200 rose 0.57%, while Japan’s Nikkei 225 gained 0.85% and the broader Topix index added 0.83%. South Korea’s Kospi advanced 0.68% and the Kosdaq outperformed with a 1.52% gain following the Bank of Korea’s decision to hold rates steady at 2.75%, in line with expectations.

In China, Hong Kong’s Hang Seng Index climbed 1.65%, while the mainland’s CSI 300 was little changed amid choppy trading. In India, the Nifty 50 slipped 0.49% and the BSE Sensex fell 0.1%.

Wall Street tumbled overnight as Powell’s hawkish comments spooked investors, compounded by a 6.9% plunge in Nvidia shares. The Dow Jones fell 699.57 points (-1.73%) to 39,669.39, the S&P 500 dropped 2.24% to 5,275.70, and the Nasdaq Composite slumped 3.07% to 16,307.16—bringing it within 19% of bear market territory.

ASX Stocks

ASX 200 - 7,800.50 (+0.50%)

ASX Rises on Energy and Gold Rally, Employment Data Supports Rates Outlook

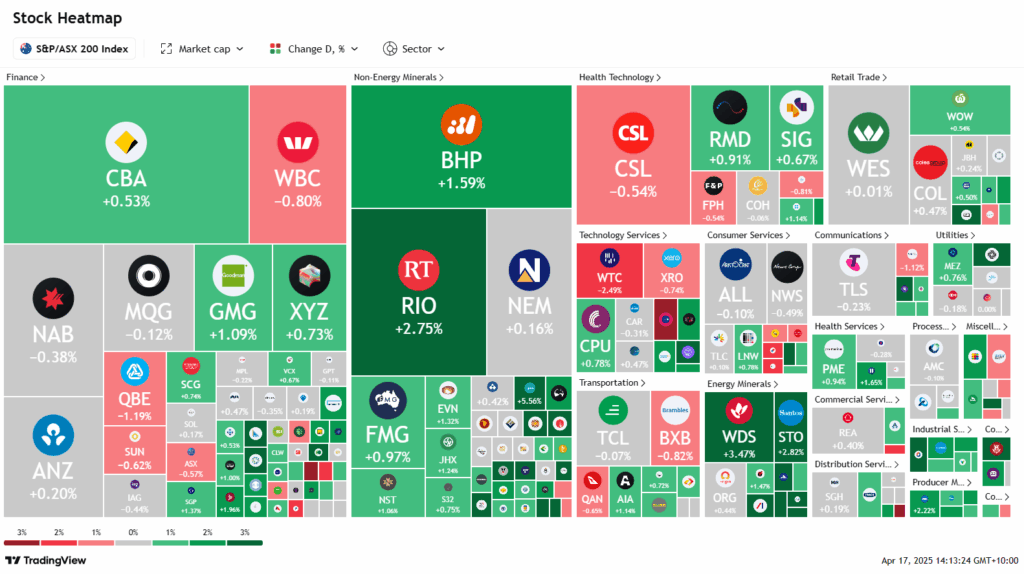

The Australian sharemarket extended its advance on Wednesday, with the S&P/ASX 200 Index up 0.5% to 7800.3 by 2pm AEDT, supported by gains in energy and gold stocks.

Gold producers rallied after bullion surged to a record above US$3300/oz on haven demand. Bellevue Gold rose 3.1%, Evolution Mining added 1.4%, and Ramelius Resources gained 1.1%. The energy sector climbed 3.4% as oil prices strengthened, led by Woodside (+3.4%), Ampol (+6.8%), and Santos (+2.6%), which reported a production increase to 21.9 million BOE.

March jobs data showed a 32,200 employment gain, keeping unemployment at 4.1%. The stronger-than-expected figures tempered expectations for a sharp rate cut in May.

Challenger surged 7.5% after narrowing FY25 profit guidance to $450–$465 million. AMP rose 1.8% on stronger net cash flows, despite a dip in AUM. BHP gained 1.5% despite weaker iron ore shipments. Insignia Financial rose 3.2% after extending due diligence talks with Bain and CC Capital. Pilbara Minerals rebounded 4% despite reporting cyclone-related disruptions.

Leaders

IPX Iperionx Ltd (+8.87%)

CGF Challenger Ltd (+7.78%)

ALD Ampol Ltd (+7.09%)

MYR Myer Holdings Ltd (+6.75%)

NXG Nexgen Energy(+6.66%)

Laggards

RIC Ridley Corporation Ltd (-9.43%)

NAN Nanosonics Ltd (-7.11%)

ZIP ZIP Co Ltd (-3.49%)

RDX REDOX Ltd (-3.19%)

AAC Australian Ag Co(-3.13%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!