What's Affecting Markets Today

Asia-Pacific markets advanced on Tuesday, recovering from recent declines as investors awaited further details on U.S. President Donald Trump’s proposed tariffs. Japan’s Nikkei 225 rose 0.73%, while the broader Topix gained 0.91%, after the Nikkei entered correction territory on Monday with a sharp 4.05% drop to a six-month low.

South Korea’s Kospi index climbed 1.44% and the small-cap Kosdaq surged 2.48%, reflecting broad-based optimism. In China, the CSI 300 edged 0.01% higher, while Hong Kong’s Hang Seng Index rose 0.66%. Economic data also supported sentiment, with China’s Caixin manufacturing PMI for March coming in at 51.2, ahead of expectations and up from 50.8 in February.

Australia’s S&P/ASX 200 pared earlier gains but still closed up 0.42%. Meanwhile, U.S. equity futures slipped as markets remained cautious ahead of Trump’s tariff announcement.

Overnight on Wall Street, the S&P 500 rebounded 0.55% to close at 5,611.85 after falling as much as 1.65% intraday. The Dow Jones Industrial Average gained 417.86 points, or 1%, to 42,001.76. The Nasdaq Composite dipped slightly, down 0.14% to 17,299.29.

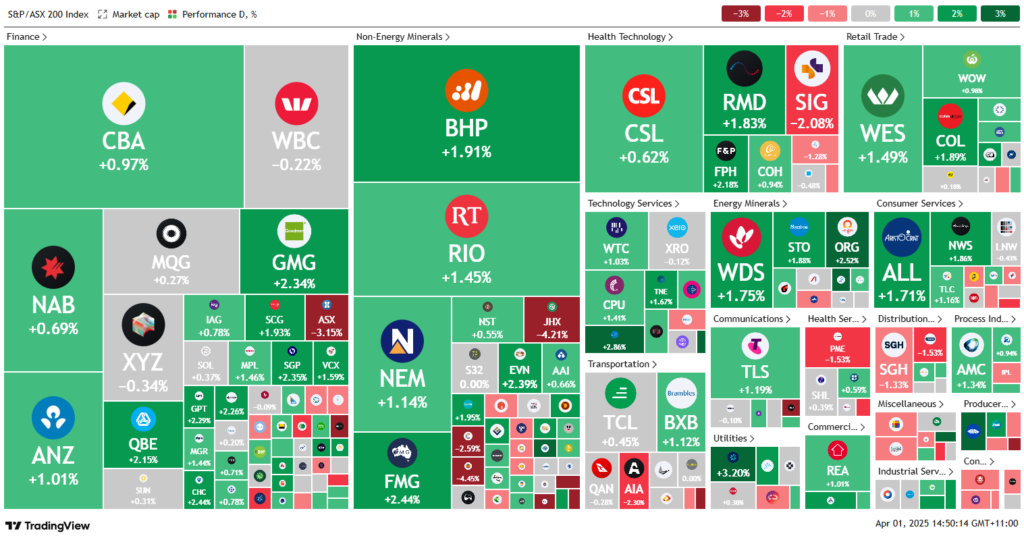

ASX Stocks

ASX 200 - 7,915.9 (+0.90%)

Australian shares are rebounding, tracking gains on Wall Street ahead of US President Donald Trump’s anticipated announcement of reciprocal tariffs. By 2:30pm, the S&P/ASX 200 was up 0.8% or 61.2 points at 7904.6, while the All Ordinaries gained 0.6%. All 11 sectors were in positive territory, led by real estate and utilities.

Overnight, the S&P 500 reversed a 2% intraday decline to close up 0.6%, though US futures are now pointing lower. Local investors are closely watching the Reserve Bank for signs of a policy shift, with markets pricing a 70% chance of a rate cut in May.

Tech stocks lagged, with SiteMinder down 2.2% and Gentrack falling 4.1%, though WiseTech rose 0.9% following an RBC upgrade. Utilities outperformed, with Origin Energy up 2.3% and AGL Energy gaining 2%.

Goodman Group rose 2.4% amid renewed rate cut expectations. AVJennings jumped 7.4% on a takeover bid from Proprium Capital and Avid Property. Southern Cross Electrical Engineering surged 10.3%, while Tower fell 10.7% after a discounted Bain Capital selldown. SSR Mining dropped 6.7% despite improved production forecasts.

Leaders

HLI – Helia Group Ltd (+4.39%)

DRR – Deterra Royalties Ltd (+3.89%)

ZIM – Zimplats Holdings Ltd (+3.69%)

SGM – Sims Ltd (+2.87%)

BSL – Bluescope Steel Ltd (+2.82%)

Laggards

DYL – Deep Yellow Ltd (-6.60%)

PDN – Paladin Energy Ltd (-5.28%)

CAT – Catapult Group International Ltd (-5.06%)

PLS – Pilbara Minerals Ltd (-4.75%)

JHX – James Hardie Industries Plc (-4.47%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!