What's Affecting Markets Today

Asia-Pacific markets tumbled Monday as investors braced for a new wave of U.S. tariffs expected later this week from President Donald Trump. Japan’s Nikkei 225 led regional losses, falling 3.67% after an earlier drop of over 4%, while the Topix declined 2.33%. South Korea’s Kospi fell 2.29% and the Kosdaq lost 1.55%.

Australia’s S&P/ASX 200 dropped 1.62%, and Hong Kong’s Hang Seng Index declined 0.78%. In mainland China, the CSI 300 opened 0.28% lower. Meanwhile, China’s March NBS Manufacturing PMI printed at 50.5, slightly above February’s 50.2 and in line with economists’ expectations.

U.S. futures edged lower as markets await further details on the scope and timing of Trump’s tariff measures.

Friday’s session saw a steep sell-off on Wall Street amid increasing uncertainty over U.S. trade policy and persistent inflation concerns. The Dow Jones Industrial Average lost 715.80 points, or 1.69%, to close at 41,583.90. The S&P 500 fell 1.97% and the Nasdaq Composite slumped 2.7%, weighed down by losses in tech. Alphabet dropped 4.9%, while Meta and Amazon both declined 4.3%.

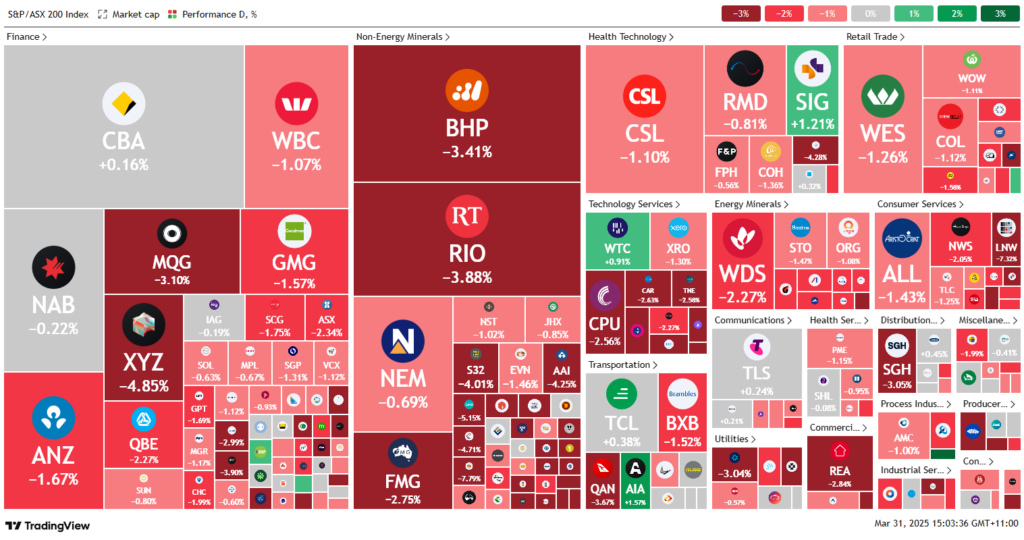

ASX Stocks

ASX 200 - 7,860.7 (-1.50%)

The Australian sharemarket is tracking toward its third-largest daily decline of 2025, amid fears that a new wave of US tariffs could spark a global economic downturn. The S&P/ASX 200 fell 1.6% (125 points) to 7857, wiping out approximately $35 billion in market value. The All Ordinaries dropped 1.5%, with all 11 sectors in the red—led by heavy losses in the mining sector.

Investor sentiment has weakened ahead of the US’s largest round of reciprocal tariffs, expected Wednesday. With few details released, markets remain cautious amid rising bearish forecasts. The ASX 200 is now down 3.2% for the quarter, on track for its worst quarterly performance since June 2022.

Miners bore the brunt: BHP and Rio Tinto dropped over 3%, Pilbara Minerals plunged 7.6%, and Coronado and Champion Iron also declined. Technology and financials fell broadly. Notably, gold stocks retreated despite bullion surpassing US$3100/oz.

Among individual movers, Orora rose 4% on a French regulatory update. Qantas fell 3.7% on board changes. HMC Capital dropped 4% following a bid for Healthscope.

Leaders

CYL Catalyst Metals Ltd (+5.81%)

ORA Orora Ltd (+3.89%)

VGL Vista Group International Ltd (+2.71%)

CMW Cromwell Property Group (+2.06%)

HSN Hansen Technologies Ltd (+1.62%)

Laggards

ADT Adriatic Metals Plc (-9.31%)

LNW Light & Wonder Inc (-7.64%)

PLS Pilbara Minerals Ltd (-7.63%)

ZIP ZIP Co Ltd (-7.45%)

WA1 WA1 Resources Ltd (-6.79%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!