What's Affecting Markets Today

Asia-Pacific markets traded mostly higher on Monday, with investors weighing the impact of the looming April 2 U.S. tariff deadline set by President Donald Trump.

Australia’s S&P/ASX 200 slipped 0.07%, while South Korea’s Kospi rose 0.13% and the Kosdaq gained 0.74%. Sentiment in Korea improved after the Constitutional Court dismissed Prime Minister Han Duck-soo’s impeachment case. In Japan, the Nikkei 225 added 0.14%, although the broader Topix dipped 0.24%.

Hong Kong’s Hang Seng Index edged up 0.10%, and China’s CSI 300 was flat after Premier Li Qiang warned of “rising instability” and urged countries to further open their markets and enterprises.

U.S. stock futures pointed to a stronger open following a modest rebound on Friday. President Trump hinted at some flexibility around upcoming tariffs, lifting market sentiment but reaffirmed the April 2 implementation deadline.

The S&P 500 gained 0.08% to 5,667.56, snapping a four-week losing streak. The Nasdaq Composite rose 0.52% to 17,784.05, and the Dow Jones Industrial Average climbed 32.03 points, or 0.08%, to close at 41,985.35.

ASX Stocks

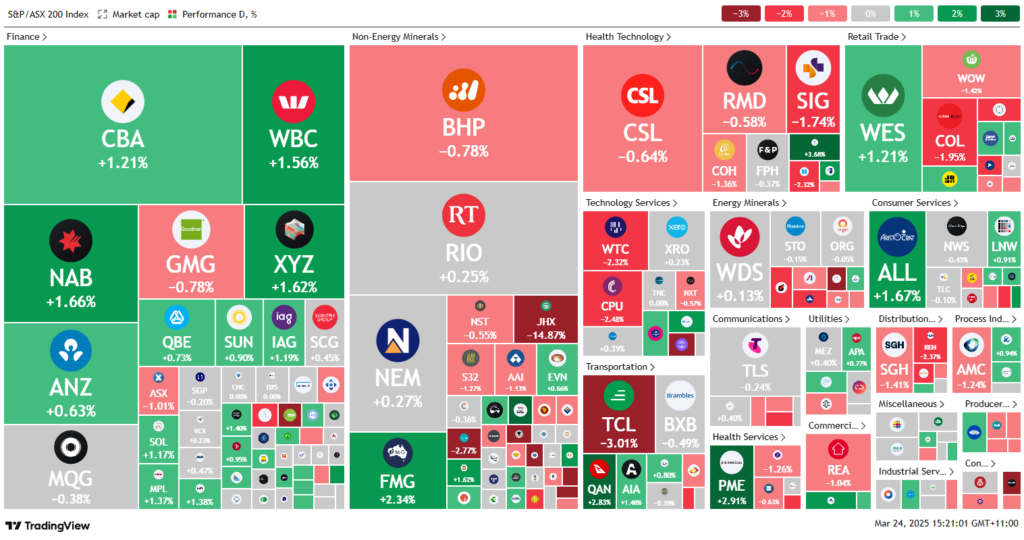

ASX 200 - 7,929.3 (-0.01%)

The ASX traded sideways on Monday afternoon, with the S&P/ASX 200 Index briefly rising before dipping 3.3 points, or 0.04%, to 7927.9 mid afternoon. The All Ordinaries fell 7 points, with only three of the index’s 11 sectors in positive territory.

Losses were led by James Hardie Industries, which dropped 12.9% after announcing a $US8.8 billion merger with NYSE-listed AZEK, giving AZEK shareholders a 26% stake in the combined group. Broader market sentiment remained cautious ahead of potential new US tariffs on April 2, despite some softening rhetoric from President Trump.

Computershare and Transurban fell 1.9% and 2.9% respectively, while Woolworths and Coles eased 1.1% and 1.6% after investors booked profits following Friday’s ACCC report.

Financial and consumer discretionary stocks provided some support, with Wesfarmers and Aristocrat Leisure up 1.2% and 1.4%, and major banks posting gains.

In company news, Helia plunged 26.2% on CBA contract concerns, while Mineral Resources rallied 4.5% after reopening its haul road. Fortescue rose 1.9% on a UBS upgrade, while Synlait Milk and South32 fell 8.2% and 1.7%, respectively.

Leaders

MIN – Mineral Resources Ltd (+5.27%)

ZIM – Zimplats Holdings Ltd (+3.89%)

TLX – TELIX Pharmaceuticals Ltd (+3.36%)

PME – Pro Medicus Ltd (+3.24%)

CQE – Charter Hall Social REIT (+2.96%)

Laggards

HLI – Helia Group Ltd (-26.29%)

RPL – Regal Partners Ltd (-15.37%)

JHX – James Hardie Industries Plc (-14.00%)

BGL – Bellevue Gold Ltd (-10.38%)

CU6 – Clarity Pharma (-8.99%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!