What's Affecting Markets Today

Asia-Pacific markets were mixed on Friday amid persistent uncertainty over the U.S. economic outlook, with Hong Kong equities leading regional declines.

The Hang Seng Index fell 1.9%, pressured by losses in healthcare and consumer cyclical stocks, while China’s CSI 300 dropped 1.1%. In contrast, Japan’s Nikkei 225 advanced 0.36%, and the broader Topix index gained 0.7%, reaching its highest level since July 2023. South Korea’s Kospi added 0.14%, while the Kosdaq slipped 0.38%. Australia’s S&P/ASX 200 rose 0.37%.

Japan’s annual headline inflation came in at 3.7% in February, easing from January’s two-year high of 4%, offering a potential reprieve for the Bank of Japan as it weighs its policy trajectory.

U.S. stock futures hovered near the flatline after the Federal Reserve-induced rally on Wednesday lost momentum. Overnight, the S&P 500 dipped 0.22% to 5,662.89, while the Nasdaq Composite fell 0.33% to 17,691.63, dragged lower by Apple and Alphabet. The Dow Jones Industrial Average edged down 11.31 points, or 0.03%, to close at 41,953.32.

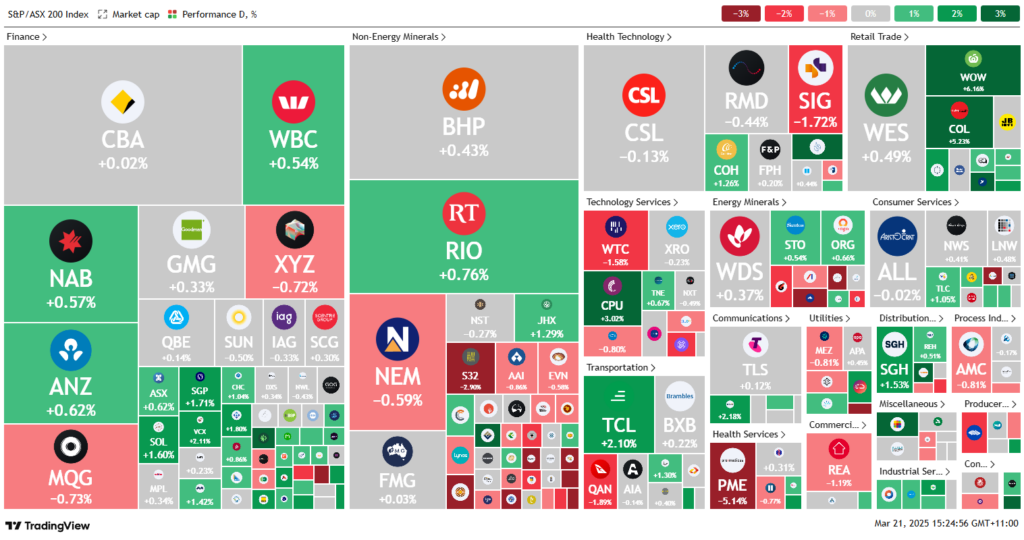

ASX Stocks

ASX 200 - 7,944.8 (+0.30%)

The Australian sharemarket is poised to record its strongest weekly gain of the year, with supermarket stocks lifting the ASX on Friday despite persistent global economic uncertainty.

By mid afternoon, the S&P/ASX 200 rose 0.5% or 36.9 points to 7955.8, with the All Ordinaries up 0.4%. Gains across seven of 11 sectors helped the market move higher.

Woolworths surged 5.7% and Coles rose 4.3% after the ACCC’s long-awaited report noted both companies were among the world’s most profitable supermarkets but found minimal evidence of price gouging.

Commodity stocks weighed on the index as investors reacted to US President Donald Trump’s move to invoke emergency powers aimed at ramping up domestic production of critical minerals. Iron ore slipped below US$100 a tonne. Yancoal and Whitehaven Coal fell 1.7% and 2.8% respectively, while South32 dropped 3.2%. Liontown and Pilbara Minerals declined 5.7% and 4.3%.

Healthcare and tech stocks also lagged, with CSL down 0.3%, ResMed off 1.2% and WiseTech retreating 1.6%.

Among notable movers, Premier Investments added 4.1%, while Paladin Energy and Emerald Resources dropped 4% and 4.6% respectively.

Leaders

BOE Boss Energy Ltd (+7.04%)

WOW Woolworths Group Ltd (+6.22%)

PDI Predictive Discovery Ltd (+5.41%)

VUL Vulcan Energy Resources Ltd (+5.35%)

COL Coles Group Ltd (+5.23%)

Laggards

OBM Ora Banda Mining Ltd (-6.95%)

LTR Liontown Resources Ltd (-5.71%)

PME Pro Medicus Ltd (-5.09%)

EMR Emerald Resources NL (-5.05%)

GNE Genesis Energy Ltd (-4.61%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!