What's Affecting Markets Today

Asia-Pacific markets traded mixed on Thursday after China’s central bank held interest rates steady, following the U.S. Federal Reserve’s decision to maintain its benchmark rate.

Australia’s S&P/ASX 200 rose 1.02%, while South Korea’s Kospi gained 0.28% and the Kosdaq climbed 0.55%. However, Hong Kong’s Hang Seng Index fell 1.36%, and China’s CSI 300 edged 0.17% lower after the People’s Bank of China (PBoC) kept its 1-year loan prime rate at 3.1% and 5-year LPR at 3.6%, unchanged since October. Japan’s markets were closed for a holiday.

In the U.S., the Federal Reserve held rates at 4.25%-4.5%, reaffirming expectations for two rate cuts in 2025, despite signaling higher inflation and slower growth. Fed Chair Jerome Powell downplayed recession risks but acknowledged ongoing trade tensions.

U.S. equities rallied, with the Dow Jones Industrial Average adding 383.32 points (+0.92%) to 41,964.63, the S&P 500 climbing 1.08% to 5,675.29, and the Nasdaq Composite gaining 1.41% to 17,750.79. Stock futures remained steady following the rally.

ASX Stocks

ASX 200 - 7,918.9 (+1.20%)

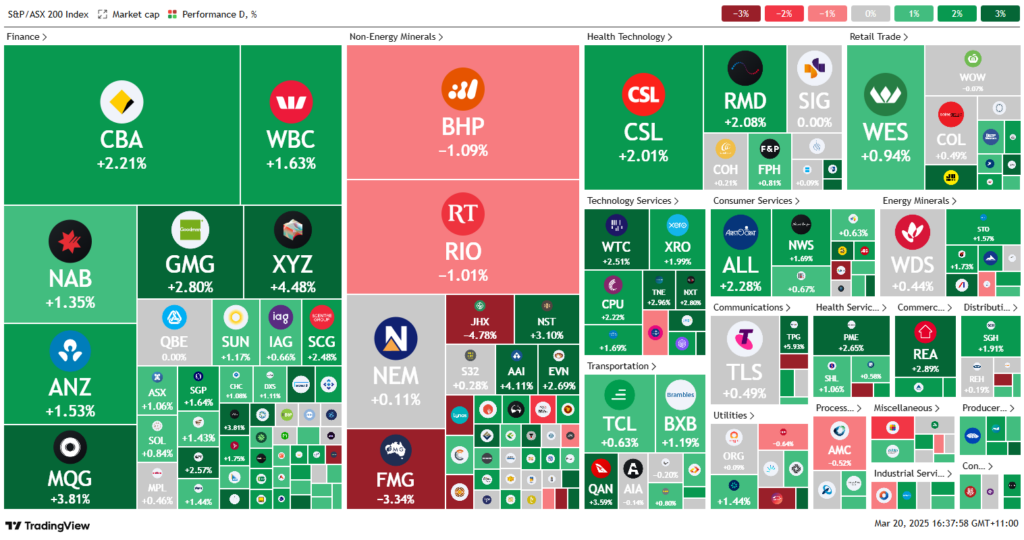

The Australian sharemarket was poised for its strongest session in six weeks, driven by gains in banks, technology, and consumer stocks following a Wall Street rally. The S&P/ASX 200 climbed 1.2% to 7920.7, with the All Ordinaries also up 1.2%.

Markets responded positively to a surprise decline in Australian employment, fueling expectations of a May rate cut by the Reserve Bank. Money markets now assign a 78% probability to a reduction, up from 66%, after February saw a loss of 52,800 jobs while unemployment remained steady.

Financials and technology stocks led gains. WiseTech and TechnologyOne advanced over 2%, while Macquarie surged 3.5%. Commonwealth Bank and ANZ both added more than 2%. Goodman Group and Scentre lifted 2.6%.

In corporate news, Nanosonics soared 12.4% on US regulatory approval for its infection control device. Arafura Rare Earths jumped 9.2% on a supply agreement with Traxys. TPG Telecom gained 4.3% as its $5.25 billion fibre sale received regulatory approval. Cleanaway and NRW Holdings also posted strong gains.

Leaders

NAN – Nanosonics Ltd (+13.96%)

BOE – Boss Energy Ltd (+8.43%)

MSB – Mesoblast Ltd (+6.80%)

CU6 – Clarity Pharmaceuticals Ltd (+6.79%)

TPG – TPG Telecom Ltd (+5.93%)

Laggards

SNZ – Summerset Group Holdings Ltd (-8.02%)

JDO – Judo Capital Holdings Ltd (-6.20%)

MYR – Myer Holdings Ltd (-5.33%)

SPK – Spark New Zealand Ltd (-4.99%)

JHX – James Hardie Industries Plc (-4.78%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!