What's Affecting Markets Today

Asia-Pacific markets traded mixed on Wednesday, tracking Wall Street’s tech-led decline. Japan remained in focus as the Bank of Japan held rates at 0.5%, aligning with expectations amid concerns over U.S. trade policies. The Nikkei 225 gained 0.69%, while the Topix rose 1.05%.

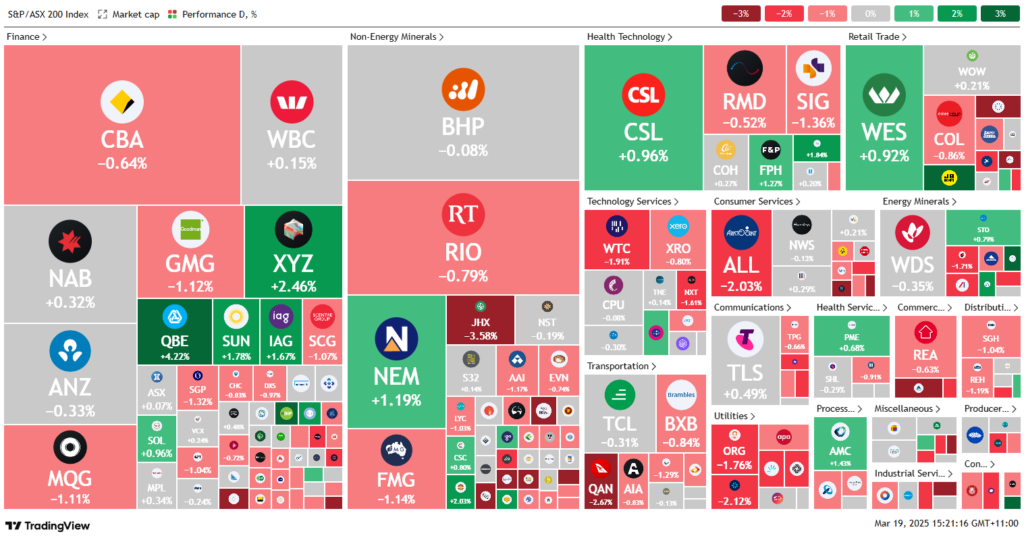

In South Korea, the Kospi climbed 0.84%, but the Kosdaq dipped 0.58%. China’s CSI 300 slipped 0.10%, and Hong Kong’s Hang Seng Index traded flat. Australia’s S&P/ASX 200 declined 0.17%.

U.S. futures edged higher as investors awaited the Federal Reserve’s rate decision. However, Wall Street’s rally stalled, with all three benchmarks reversing gains. The Dow Jones fell 260.32 points (-0.62%) to 41,581.31. The S&P 500 lost 1.07%, closing at 5,614.66, nearing correction territory, while the Nasdaq Composite slid 1.71% to 17,504.12.

Tech stocks remained under pressure. Tesla fell 5% after RBC Capital cut its price target. Palantir and Nvidia lost nearly 4% and 3%, respectively, while the XLK ETF dropped over 1%.

ASX Stocks

ASX 200 - 7,837.9 (-0.30%)

The ASX retreated on Wednesday, snapping a three-day rally as risk-off sentiment returned to global markets. The S&P/ASX 200 declined 0.2% to 7,846.6 points, mirroring Wall Street’s tech-led sell-off. The All Ordinaries also fell 0.2%, despite eight of eleven sectors trading higher.

US futures suggested a rebound after Tesla’s 5.3% drop and a 5.8% jump in the VIX index signaled increased investor caution. Gold surged to a record $US3,038.33/oz as traders rotated into safe-haven assets. Market focus remains on the US Federal Reserve’s upcoming policy decision, with concerns over inflation and trade tensions persisting.

Australian tech stocks tracked Nasdaq losses, with NextDC down 1.5%. Utilities also softened, with Origin Energy falling 1.9%. Mineral Resources tumbled 5.1% after suspending haulage on its Onslow iron haul road.

In corporate moves, WiseTech slipped 0.2% amid a board review. Myer lost 2.4% after flat sales and a 40% profit slump. Dicker Data declined 1.1% after its CEO sold shares to fund a divorce settlement. Capricorn Metals fell 3.6%, despite closing its hedge contracts.

Leaders

DRO – Droneshield Ltd (+9.09%)

VUL – Vulcan Energy Resources Ltd (+7.25%)

CDA – Codan Ltd (+6.28%)

DYL – Deep Yellow Ltd (+5.47%)

NHC – New Hope Corporation Ltd (+4.22%)

Laggards

HLI – Helia Group Ltd (-15.58%)

MIN – Mineral Resources Ltd (-5.71%)

IPX – Iperionx Ltd (-4.93%)

CU6 – Clarity Pharmaceuticals Ltd (-4.63%)

CRN – Coronado Global Resources Inc (-4.55%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!