What's Affecting Markets Today

Asia-Pacific markets advanced on Tuesday, tracking overnight gains on Wall Street, where U.S. retail sales data eased recession concerns.

Hong Kong’s Hang Seng Index led regional gains, rising 1.93%, driven by a 9.83% surge in Baidu and strong performance in tech stocks. China’s CSI 300 edged 0.15% higher, rebounding from the previous session’s losses.

Investors are closely watching Japan’s markets as the Bank of Japan (BOJ) begins its two-day policy meeting. The central bank is widely expected to hold rates steady at 0.5%, aligning with the U.S. Federal Reserve, which is also anticipated to maintain its current stance.

Japan’s Nikkei 225 rallied 1.43%, with the broader Topix index up 1.41%. South Korea’s Kospi rose 0.17%, while the small-cap Kosdaq saw a modest 0.11% gain amid choppy trading.

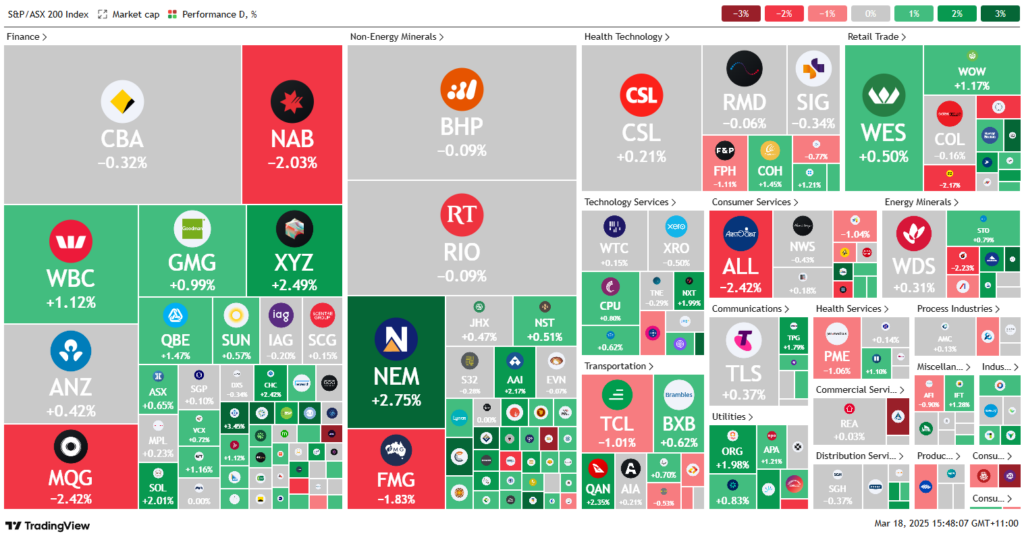

In Australia, the S&P/ASX 200 was flat after trimming earlier gains.

India’s Nifty 50 and BSE Sensex opened higher, gaining 0.45% and 0.43%, respectively.

ASX Stocks

ASX 200 - 7,858.1 (+0.10%)

The Australian sharemarket reversed earlier gains in the afternoon session as US futures turned lower, signaling potential weakness in the Wall Street rebound. The S&P/ASX 200 Index fluctuated before closing 0.1% higher at 7,865.1, while the All Ordinaries rose 0.2%. Gains in utilities helped offset losses in other sectors.

Initial optimism followed US retail sales data, but sentiment weakened after Israel launched airstrikes on Gaza, pushing gold prices to a new record of $US3,020 an ounce. Gold miners Newmont (+2.5%), Northern Star, and Evolution Mining climbed.

Banking stocks lost ground, with Commonwealth Bank (-0.6%), National Australia Bank, and Macquarie retreating, while Westpac and ANZ held gains. Consumer discretionary stocks underperformed, with Aristocrat Leisure (-1.9%) and JB Hi-Fi (-2.3%) falling.

New Hope surged 8.8% after strong earnings, a higher dividend, and a $100 million buyback. Woolworths (+1.1%) gained on a Macquarie upgrade, while Endeavour (-1.6%) fell after Goldman Sachs’ downgrade. Austal (+8.6%) jumped on Hanwha’s $180 million stake acquisition.

Leaders

CU6 – Clarity Pharmaceuticals Ltd (+11.02%)

NHC – New Hope Corporation Ltd (+8.65%)

ASB – Austal Ltd (+7.83%)

CSC – Capstone Copper Corp (+5.67%)

CGF – Challenger Ltd (+4.52%)

Laggards

DRO – Droneshield Ltd (-5.51%)

ZIM – Zimplats Holdings Ltd (-4.96%)

SPK – Spark New Zealand Ltd (-3.46%)

ADT – Adriatic Metals Plc (-3.46%)

CU6 – Clarity Pharmaceuticals Ltd (-3.23%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!