What's Affecting Markets Today

Asia-Pacific markets advanced on Monday as investors closely monitored Chinese equities following Beijing’s latest economic measures.

Mainland China’s CSI 300 traded flat amid choppy movements, while Hong Kong’s Hang Seng Index surged 1.37% after the Chinese government unveiled a “Special Action Plan to Boost Consumption” aimed at increasing incomes and stabilizing the stock and real estate markets. Authorities also introduced measures to address the declining birth rate.

China’s retail sales grew 4.0% year-on-year for the January-February period, meeting Reuters’ forecasts and improving from 3.7% in December. Meanwhile, urban investment rose 4.1%, exceeding expectations of 3.6%.

Across the region, Japan’s Nikkei 225 gained 1.14%, with the Topix up 1.17%, as investor sentiment remained strong. In South Korea, the Kospi climbed 1.46%, while the Kosdaq edged up 0.33%.

Markets reacted positively to signs of policy support from Beijing, with optimism extending across the region’s equity benchmarks, particularly in Hong Kong, Japan, and South Korea.

ASX Stocks

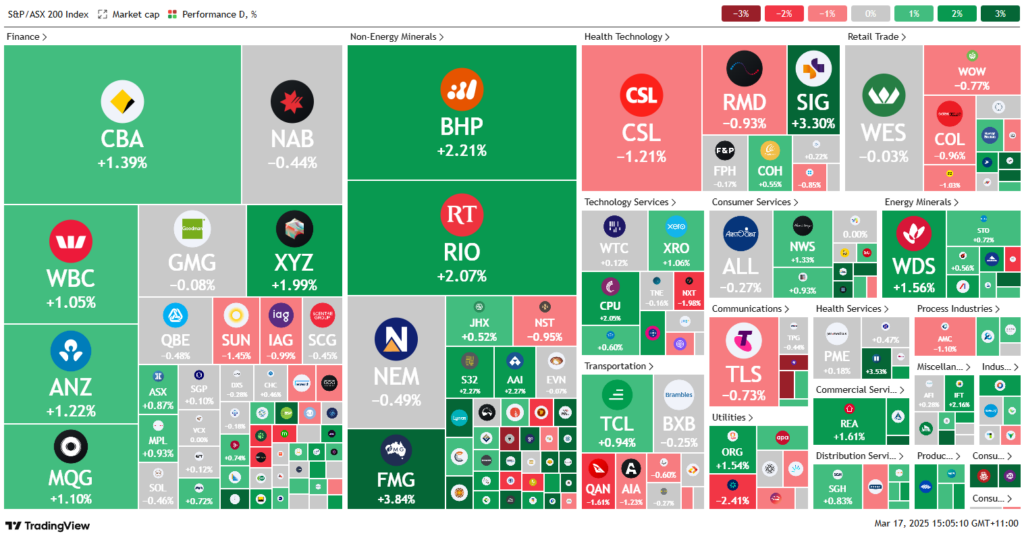

ASX 200 - 7,837.5 (+0.60%)

The Australian sharemarket started the week on a strong note, buoyed by risk-on sentiment following China’s pledge to boost consumption and a rally on Wall Street. By early afternoon, the S&P/ASX 200 rose 0.6% to 7835.3, with the All Ordinaries up a similar margin. Eight of the 11 sectors advanced, led by energy stocks.

Wall Street gained after the US averted a government shutdown, with the S&P 500 surging 2.1% last week. However, ASX technology stocks pared early gains as US futures opened lower. WiseTech added 0.3%, while Xero rose 1%.

Miners surged on China’s stimulus announcement, with Rio Tinto up 2.2%, Fortescue 3.6%, and BHP 1.5%. Mineral Resources jumped 8.3% following a UBS upgrade to “buy”. Energy stocks climbed as oil prices held above $US71 a barrel.

Among key movers, Smartpay soared 49% on takeover talks, Spartan Resources rose 8.9% post-merger confirmation, and Navigator Global gained 1.4% on a $111 million US private equity stake acquisition.

Leaders

MIN – Mineral Resources Ltd (+9.43%)

SPR – Spartan Resources Ltd (+8.91%)

BOT – Botanix Pharmaceuticals Ltd (+8.43%)

LTR – Liontown Resources Ltd (+6.59%)

IPX – Iperionx Ltd (+6.29%)

Laggards

DRO – Droneshield Ltd (-5.51%)

ZIM – Zimplats Holdings Ltd (-4.96%)

SPK – Spark New Zealand Ltd (-3.46%)

ADT – Adriatic Metals Plc (-3.46%)

CU6 – Clarity Pharmaceuticals Ltd (-3.23%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!