What's Affecting Markets Today

Asia-Pacific markets declined on Friday, mirroring Wall Street losses as investors remained unconvinced by U.S. President Trump’s tariff concessions. Japan’s Nikkei 225 fell 1.82%, while the Topix dropped 1.24%. South Korea’s Kospi and Kosdaq decreased by 0.30% and 0.25% respectively. Hong Kong’s Hang Seng index opened 0.31% lower, and mainland China’s CSI 300 index dipped 0.22%.

Yields on long-term Japanese government bonds reached levels unseen since the 2008 financial crisis. Investors await China’s combined January-February trade data, with economists projecting exports growth to slow to 5% year-on-year and imports growth to remain steady at 1%.

U.S. economic indicators, including the Federal Reserve’s Beige Book and ISM’s manufacturing reading, raised concerns about rising input costs due to tariffs. Challenger, Gray & Christmas reported layoff announcements reaching 2020 highs, attributed to efforts by Trump and Elon Musk to reduce the federal workforce.

These factors collectively contributed to the bearish sentiment across Asian markets, reflecting ongoing economic uncertainties and trade tensions.

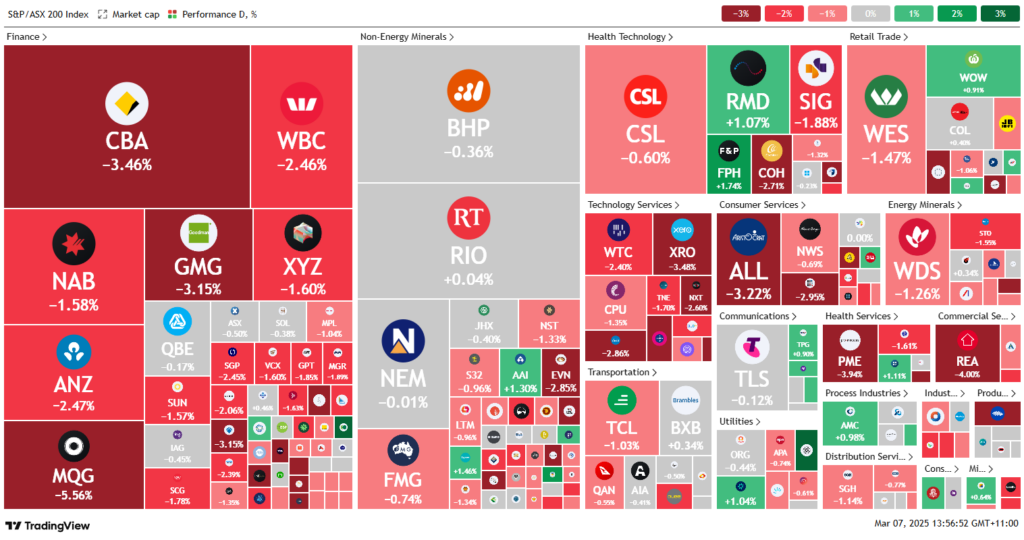

ASX Stocks

ASX 200 - 8,191.5 (-0.60%)

The Australian sharemarket dipped below 8000 on Friday, with the S&P/ASX 200 Index falling 1.3% to 7991.1 points by midday. This decline was driven by investor concerns over Washington’s shifting tariff policies and a significant drop in Commonwealth Bank shares.

Key developments:

CBA shares fell 3.4%

WiseTech declined 1.5%

Westpac retreated 2.4% following executive departure

Goodman Group slumped 3.4% to an 11-month low

The ASX technology sector mirrored Wall Street’s downturn, while the financial sector is heading for a 5% weekly loss. This follows ex-dividend trading and disappointing interim earnings.

The market’s decline reflects broader global trends, with US equities experiencing volatility due to inconsistent trade policies. The S&P 500 dropped 1.8% overnight, erasing post-election gains, while the Nasdaq is now 10% below its December peak.

Analysts are now questioning where the market might find support, as the breach of the 8000 threshold could potentially trigger a more significant sell-off.

Leaders

IFL Insignia Financial Ltd (+10.45%)

VUL Vulcan Energy Resources Ltd (+5.21%)

LFG Liberty Financial Group (+3.99%)

MCY Mercury NZ Ltd (+3.63%)

ELD Elders Ltd (+3.18%)

Laggards

PDI Predictive Discovery Ltd (-10.71%)

PNV Polynovo Ltd (-9.06%)

PGC Paragon Care Ltd (-7.61%)

ZIP ZIP Co Ltd (-6.74%)

CU6 Clarity Pharma (-5.85%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!