What's Affecting Markets Today

Asia-Pacific Markets Mostly Higher as U.S. Tariff Delay Lifts Sentiment

Asia-Pacific markets were largely positive on Thursday, buoyed by Wall Street’s rebound after U.S. President Donald Trump postponed auto tariffs on certain manufacturers.

Japan’s Nikkei 225 gained 1%, while the Topix climbed 1.3%. Meanwhile, Japanese government bond yields surged, with the 10-year JGB yield reaching its highest level since 2009, according to LSEG data.

South Korea’s Kospi advanced 0.9%, though the Kosdaq slipped 0.75%. Inflation in South Korea rose 2% year-on-year in February, slightly above Reuters estimates of 1.95%, but easing from 2.2% in January.

China’s markets reacted positively to Beijing’s fiscal policy shift. Hong Kong’s Hang Seng Index jumped 2.47% at the open, while the CSI 300 added 0.6% after the government announced plans to raise its fiscal deficit target to 4% of GDP.

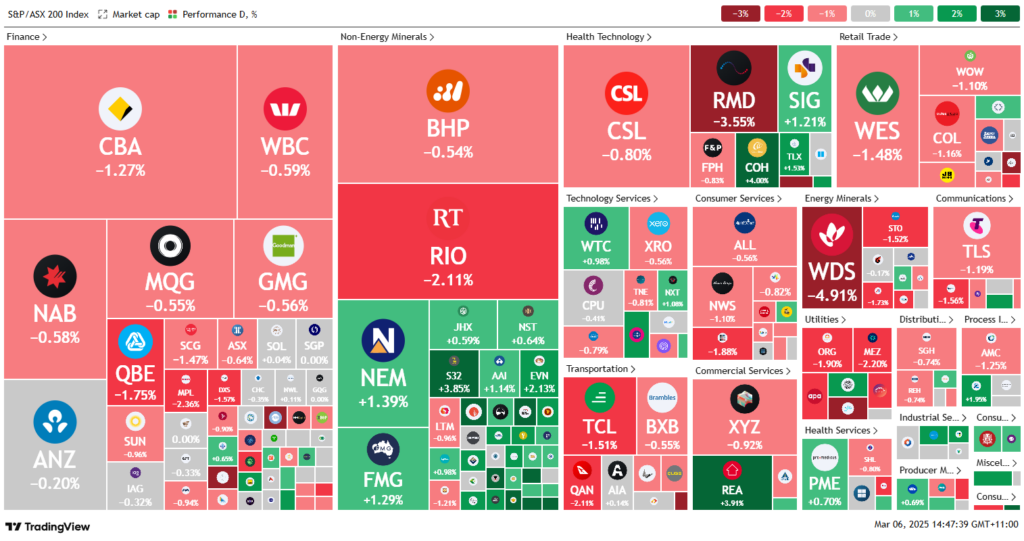

Australia’s S&P/ASX 200 fell 0.6%.

In the U.S., the Dow Jones rebounded 485.60 points (1.14%) to 43,006.59, while the S&P 500 and Nasdaq Composite gained 1.12% and 1.46%, respectively.

ASX Stocks

ASX 200 - 8,191.5 (-0.60%)

Energy Stocks Drag ASX Lower Amid Tariff Concerns

The S&P/ASX 200 fell 0.7% (57.2 points) to 8,083.90 on Thursday, as energy stocks weighed on the market following concerns over U.S. crude oil import tariffs. The All Ordinaries declined 0.6%, with all 11 sectors closing in the red.

Despite a Wall Street rally—spurred by U.S. President Donald Trump’s decision to pause auto sector tariffs for a month—Australian equities slumped as the White House maintained a hard stance on 25% tariffs on other Canadian and Mexican imports. The U.S. dollar weakened, while the Australian dollar rose above US63¢.

A global bond sell-off pushed Australia’s 10-year yield to 4.47%, triggered by German fiscal policy uncertainties. Meanwhile, Brent crude slipped below $US70 per barrel, hitting a three-year low amid weakening demand and OPEC+ supply concerns.

Energy stocks tumbled: Woodside (-5.1%) traded ex-dividend, while Santos (-1.8%) and Ampol (-2.0%) declined. Gold miners rallied, with South32 (+3.9%), Bellevue Gold (+6.9%), and West African Resources (+11.4%) gaining.

In corporate news, Myer surged 5.3% after Morgan Stanley projected strong upside potential. Star Entertainment neared a deal to offload its Brisbane casino to avoid administration.

Leaders

WAF West African Resources Ltd (+11.67%)

RSG Resolute Mining Ltd (+7.60%)

PNR Pantoro Ltd (+7.41%)

BGL Bellevue Gold Ltd (+6.94%)

WA1 WA1 Resources Ltd (+6.06%)

Laggards

VUL Vulcan Energy Resources Ltd (-8.76%)

MSB Mesoblast Ltd (-7.71%)

SIQ Smartgroup Corporation Ltd (-5.10%)

WDS Woodside Energy Group Ltd (-4.91%)

AGL AGL Energy Ltd (-4.03%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!