What's Affecting Markets Today

Asia-Pacific Markets Mixed as Investors Weigh China’s Growth Outlook and Trade Tensions

Asia-Pacific equities were mostly higher on Wednesday as investors evaluated China’s growth and inflation targets, while escalating U.S. tariffs and global trade tensions dampened sentiment.

Australia’s S&P/ASX 200 fell 0.92%, despite the economy expanding 1.3% year-on-year in Q4, surpassing the 1.2% forecast by economists polled by Reuters.

Japan’s Nikkei 225 edged 0.16% lower, while the Topix declined 0.15%. South Korea’s Kospi climbed 1.09%, with the small-cap Kosdaq up 1.26%.

In China, markets saw modest gains. Hong Kong’s Hang Seng Index added 0.35%, while the CSI 300 rose 0.13% as Beijing commenced its “Two Sessions” annual parliamentary meetings.

China set its 2025 GDP growth target at approximately 5% and adjusted its inflation expectation to around 2%, signaling a cautious economic outlook. Investors are closely watching for further policy measures to support growth amid trade tensions and ongoing economic challenges.

ASX Stocks

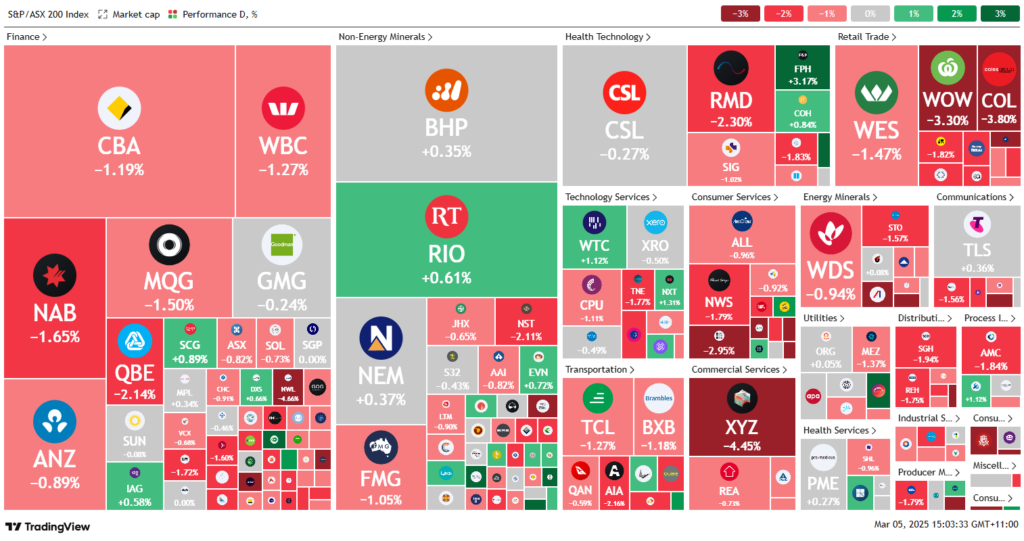

ASX 200 - 8,128.0 (-0.90%)

ASX Declines Amid Trade War Concerns, China Stimulus Measures

The S&P/ASX 200 fell 0.9% (-71 points) to 8,127.10, while the All Ordinaries also lost 0.9%, as global trade tensions and China’s latest stimulus measures weighed on sentiment. Ten of eleven sectors declined, led by consumer staples.

Australian shares tracked Wall Street losses, with investors reassessing Donald Trump’s tariffs on Mexico, China, and Canada. A late rebound in US equities followed comments from Commerce Secretary Howard Lutnick, suggesting possible relief for Canada and Mexico.

Energy stocks dropped as oil hit a year-to-date low of $US70 per barrel on concerns tariffs could weaken demand. Banks fell over 1%, while Woolworths (-3.5%) and Coles (-4%) dragged down consumer staples, despite bullish ratings from RBC Capital Markets.

Mining stocks gained after China pledged aggressive stimulus, with BHP (+0.5%), Rio Tinto (+0.6%), and Newmont (+0.2%) rising.

Among corporate moves, WiseTech (+1.2%) expects a new director appointment soon. Mineral Resources (-2.3%) slid after a Fitch downgrade, while Data#3 (-1.2%) saw a board departure. Suncorp and QBE fell on cyclone risks, while IAG (+0.2%) reassured investors on reinsurance coverage.

Leaders

OPT – Opthea Ltd (-12.14%)

IPX – Iperionx Ltd (-9.52%)

WA1 – WA1 Resources Ltd (-6.37%)

MAD – Mader Group Ltd (-4.82%)

NWL – Netwealth Group Ltd (-4.79%)

Laggards

RSG – Resolute Mining Ltd (+6.76%)

CEN – Contact Energy Ltd (+5.84%)

LTR – Liontown Resources Ltd (+4.80%)

CU6 – Clarity Pharmaceuticals Ltd (+4.71%)

CBO – Cobram Estate Olives Ltd (+4.57%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!