What's Affecting Markets Today

Asian markets declined sharply on Tuesday, led by a 2.43% drop in Japan’s Nikkei 225, after U.S. President Donald Trump confirmed tariffs on Mexico and Canada would proceed as planned. The broader Topix index also lost 1.48%.

Japan’s January unemployment rate rose slightly to 2.5%, exceeding Reuters’ 2.4% forecast.

In South Korea, the Kospi slipped 0.13%, while the Kosdaq fell 1.42%. January retail sales declined 0.6%, following a revised 0.2% increase in December.

Hong Kong’s Hang Seng opened 1.58% lower, while Mainland China’s CSI 300 dipped 0.59% ahead of the “Two Sessions”, China’s annual parliamentary gathering.

Australia’s S&P/ASX 200 was down 1.07%, mirroring regional weakness. The country’s January retail sales rose 0.3%, in line with expectations, rebounding from a 0.1% decline in December.

Investors remain cautious amid escalating trade tensions, with markets reacting to potential economic disruptions from higher tariffs and weak retail data across key economies.

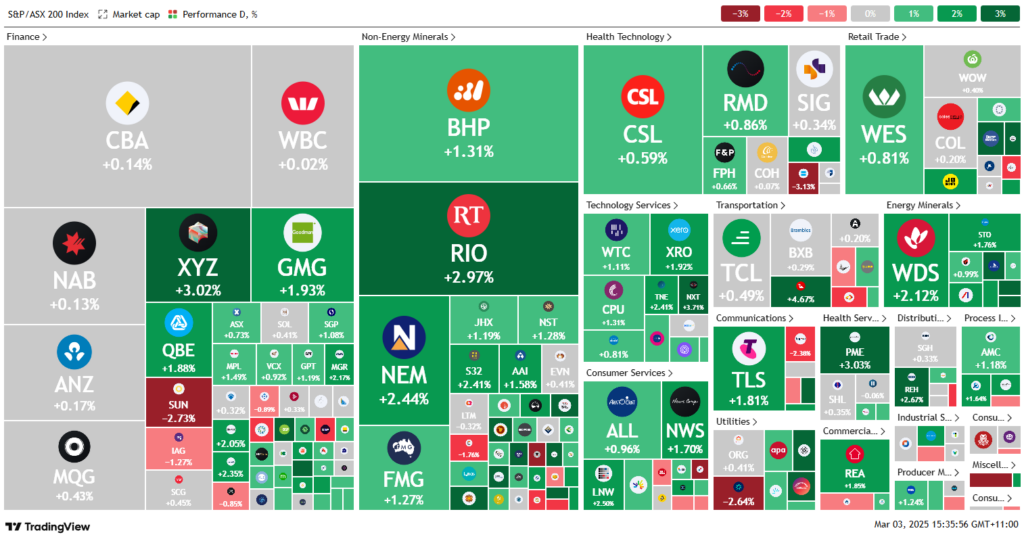

ASX Stocks

ASX 200 - 8,189.1 (-0.70%)

The Australian sharemarket fell on Tuesday after US President Donald Trump confirmed plans to proceed with higher tariffs on key trading partners, denting hopes of a reprieve.

By midday, the S&P/ASX 200 was down 0.8% to 8,181.30, while the All Ordinaries dropped 0.9%. Ten of eleven sectors declined, led by utilities as Origin Energy traded ex-dividend.

The downturn followed sharp losses on Wall Street, where Trump ruled out negotiations before imposing 25% tariffs on Mexico and Canada, alongside a 10% levy on China. Canada retaliated with its own tariffs, weighing on Chinese and Hong Kong stocks.

Miners fell as iron ore briefly dipped below $US100. Fortescue lost 3.9%, BHP fell 0.6%, and Mineral Resources slumped 9.1%. Brent crude dropped toward $US71, driving Woodside (-2.6%), Santos (-3.2%), and Ampol (-1.9%) lower.

Among individual movers, Suncorp (-1.6%) slid on cyclone concerns, while Insignia (-5%) rejected NAB’s $200m loan redemption request, raising coupon payments. HealthCo REIT (-8.1%) fell after Healthscope missed rent payments.

Leaders

SPR – Spartan Resources Ltd (+5.41%)

LYC – Lynas Rare Earths Ltd (+2.62%)

BFL – BSP Financial Group Ltd (+2.39%)

DEG – De Grey Mining Ltd (+2.25%)

TLC – The Lottery Corp (+2.09%)

Laggards

MIN – Mineral Resources Ltd (-9.32%)

OPT – Opthea Ltd (-8.33%)

BOE – Boss Energy Ltd (-8.14%)

ZIP – ZIP Co Ltd (-6.43%)

MSB – Mesoblast Ltd (-6.18%)

Join our JTrader Daily Newsletter! Share Trading Made Simple. Rule #1 : Buy stocks that are going UP!

Get our 5 best Stocks that are going Up, sent to your inbox before every trading day!